National Grid 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Electricity Transmission plc Annual Report and Accounts 2006/07

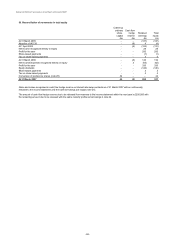

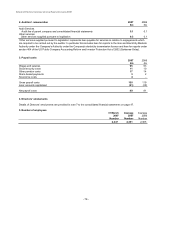

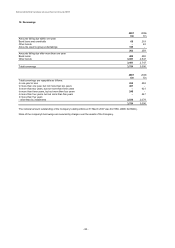

13. Provisions for liabilities and charges

Deferred

taxation

Environmental

Other

Total

£m

£m

£m

£m

At 31 March 2006 820 8 12 840

Charged to profit and loss account 9- - 9

Charged to equity 4- - 4

Utilised -(4) (1) (5)

Transfers to group undertakings (27) - - (27)

At 31 March 2007

806

4

11

821

Details of provisions for liabilities and charges are shown in note 27 to the consolidated financial statements shown on page 64.

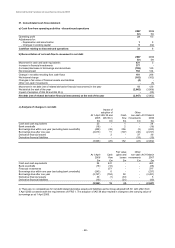

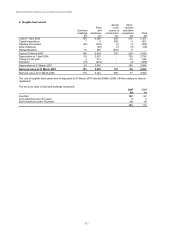

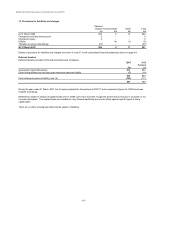

Deferred taxation

Deferred taxation provided in the financial statements comprises:

2007

2006

Restated

£m

£m

Accelerated capital allowances

813

834

Other timing differences excluding post-retirement pensions liability

(7)

(14)

806

820

Post-retirement pensions liability (note 14)

(139)

(111)

667

709

During the year ended 31 March 2007, the Company adopted the Amendment to FRS 17 and comparative figures for 2006 have been

restated accordingly.

Deferred tax assets in respect of capital losses of £1m (2006: £2m) have not been recognised as their future recovery is uncertain or not

currently anticipated. The capital losses are available to carry forward indefinitely and can be offset against specific types of future

capital gains.

There are no other unrecognised deferred tax assets or liabilities.

- 81 -