Motorola 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

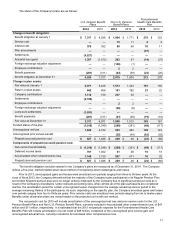

68

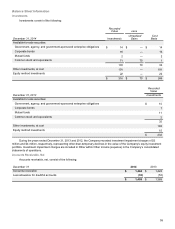

The IRS is currently examining the Company's 2012 and 2013 tax years. The Company also has several state and non-

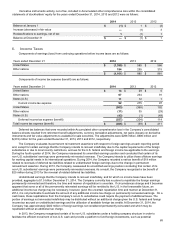

U.S. audits pending. A summary of open tax years by major jurisdiction is presented below:

Jurisdiction Tax Years

United States 2008-2014

China 2002-2014

France 2010-2014

Germany 2008-2014

India 1997-2014

Israel 2012-2014

Japan 2011-2014

Malaysia 2009-2014

Singapore 2010-2014

United Kingdom 2008-2014

Although the final resolution of the Company’s global tax disputes is uncertain, based on current information, in the opinion

of the Company’s management, the ultimate disposition of these matters will not have a material adverse effect on the

Company’s consolidated financial position, liquidity or results of operations. However, an unfavorable resolution of the

Company’s global tax disputes could have a material adverse effect on the Company’s consolidated financial position, liquidity or

results of operations in the periods in which the matters are ultimately resolved.

Based on the potential outcome of the Company’s global tax examinations, the expiration of the statute of limitations for

specific jurisdictions, or the continued ability to satisfy tax incentive obligations, it is reasonably possible that the unrecognized

tax benefits will change within the next twelve months. The associated net tax impact on the effective tax rate, exclusive of

valuation allowance changes, is estimated to be in the range of a $50 million tax charge to a $50 million tax benefit, with cash

payments not to exceed $25 million.

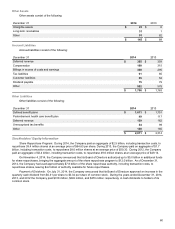

At December 31, 2014, the Company had $26 million accrued for interest and $26 million accrued for penalties on

unrecognized tax benefits. At December 31, 2013, the Company had $25 million and $27 million accrued for interest and

penalties, respectively, on unrecognized tax benefits.

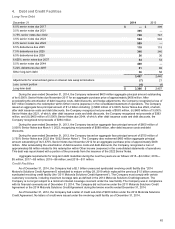

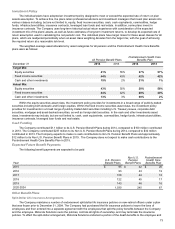

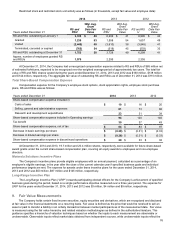

7. Retirement Benefits

Pension and Postretirement Health Care Benefits Plans

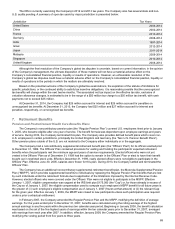

The Company’s noncontributory pension plan (the “Regular Pension Plan”) covered U.S. employees hired prior to January

1, 2005, who became eligible after one year of service. The benefit formula was dependent upon employee earnings and years

of service. During 2014, the Company terminated this plan. The Company also provides defined benefit plans which cover non-

U.S. employees in certain jurisdictions, principally the United Kingdom and Germany (the “Non U.S. Pension Benefit Plans”).

Other pension plans outside of the U.S. are not material to the Company either individually or in the aggregate.

The Company had a noncontributory supplemental retirement benefit plan (the “Officers’ Plan”) for its officers elected prior

to December 31, 1999. The Officers’ Plan contained provisions for vesting and funding the participants’ expected retirement

benefits when the participants met the minimum age and years of service requirements. Elected officers who were not yet

vested in the Officers’ Plan as of December 31, 1999 had the option to remain in the Officers’ Plan or elect to have their benefit

bought out in restricted stock units. Effective December 31, 1999, newly elected officers were not eligible to participate in the

Officers’ Plan. Effective June 30, 2005, salaries were frozen for this plan. During 2013, the Company settled and terminated the

Officers' Plan.

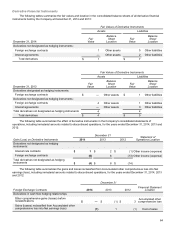

The Company has an additional noncontributory supplemental retirement benefit plan, the Motorola Supplemental Pension

Plan (“MSPP”), which provides supplemental benefits to individuals by replacing the Regular Pension Plan benefits that are lost

by such individuals under the retirement formula due to application of the limitations imposed by the Internal Revenue Code.

However, elected officers who were covered under the Officers’ Plan were not eligible to participate in the MSPP. Effective

January 1, 2007, eligible compensation was capped at the IRS limit plus $175,000 (the “Cap”) or, for those already in excess of

the Cap as of January 1, 2007, the eligible compensation used to compute such employee’s MSPP benefit for all future years is

the greater of: (i) such employee’s eligible compensation as of January 1, 2007 (frozen at that amount) or (ii) the relevant Cap

for the given year. Effective January 1, 2009, the MSPP was closed to new participants unless such participation was required

under a prior contractual entitlement.

In February 2007, the Company amended the Regular Pension Plan and the MSPP, modifying the definition of average

earnings. For the years ended prior to December 31, 2007, benefits were calculated using the rolling average of the highest

annual earnings in any five years within the previous ten calendar year period. Beginning in January 2008, the benefit calculation

was based on the set of the five highest years of earnings within the ten calendar years prior to December 31, 2007, averaged

with earnings from each year after 2007. In addition, effective January 2008, the Company amended the Regular Pension Plan,

modifying the vesting period from five years to three years.