Motorola 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

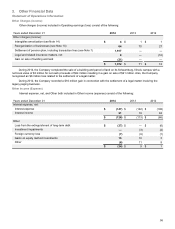

Consolidated Statements of Stockholders’ Equity

(In millions, except per share amounts) Shares

Common

Stock and

Additional Paid-in

Capital

Accumulated Other

Comprehensive

Income (Loss) Retained

Earnings Noncontrolling

Interests

Balance as of January 1, 2012 320 $ 7,074 $ (2,876) $ 1,016 $ 60

Net earnings 881 —

Net unrealized gain on securities, net of tax of $1 1

Foreign currency translation adjustments, net of tax benefit of

$(4) 14

Amortization of retirement benefit adjustments, net of tax of $99 177

Remeasurement of retirement benefits, net of tax of $52 87

Year-end and other retirement adjustments, net of tax of $(419) (707)

Issuance of common stock and stock options exercised 6.9 80

Share repurchase program (49.6) (2,438)

Excess tax benefit from share-based compensation 20

Share-based compensation expense 184

Net gain on derivative hedging instruments, net of tax of $(1) 4

Acquisition of noncontrolling interest from Japanese subsidiary 20 (35)

Dividends declared (272)

Balance as of December 31, 2012 277.3 $4,940 $ (3,300) $ 1,625 $ 25

Net earnings 1,099 6

Net unrealized loss on securities, net of tax of $1 (4)

Foreign currency translation adjustments, net of tax of $(7) (4)

Amortization of retirement benefit adjustments, net of tax of $40 70

Year-end and other retirement adjustments, net of tax of $571 953

Issuance of common stock and stock options exercised 6.8 100

Share repurchase program (28.6) (1,694)

Excess tax benefit from share-based compensation 25

Share-based compensation expense 153

Net loss on derivative hedging instruments, net of tax of $1 (2)

Purchase of noncontrolling interest in subsidiary (3) (1)

Dividends declared (299)

Balance as of December 31, 2013 255.5 $3,521 $ (2,287) $ 2,425 $ 30

Net earnings 1,299 1

Net unrealized gain on securities, net of tax of $26 46

Foreign currency translation adjustments, net of tax of $(9) (49)

Mid-year remeasurement of retirement benefits, net of tax of

$(294) (353)

Pension settlement adjustment, net of tax of $715 1,168

Amortization of retirement benefit adjustments, net of tax of $17 44

Year-end retirement adjustments, net of tax of $(153) (365)

Issuance of common stock and stock options exercised 4.4 86

Share repurchase program (39.4) (2,546)

Excess tax benefit from share-based compensation 5

Share-based compensation expense 114

Net gain on derivative hedging instruments, net of tax of $- 1

Dividends declared (314)

Disposition of the Enterprise business, net of tax of ($16) (60)

Balance as of December 31, 2014 220.5 $1,180 $ (1,855) $ 3,410 $ 31

See accompanying notes to consolidated financial statements.