Mercury Insurance 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

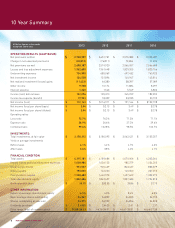

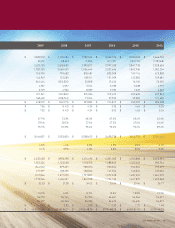

Our 2013 operating earnings were $2.18 cents per share compared to

$1.34 cents per share in 2012, a 62.7% improvement. Premiums written for

the year increased by 2.9%.

Premiums Written

(in millions)

3,500

3,000

2,000

1,500

1,000

0

94 95 96 97 98 99 00 01 02 03

2,500

500

04 05 06 07 08 09 10 11 12 13

Over the past few years our operating results

have not provided the returns we expect to

deliver and have historically provided to our

shareholders. Although our 2013 operating results

improved dramatically over 2012, we still have

much work to do to achieve an acceptable return

on shareholders’ equity. Many factors have made it

dicult to achieve higher returns these past few years,

including our diculty in obtaining approval of rate

increases in California, our largest market, a lower

interest rate environment and our operating results

outside of California. However, 2013 was a step in

the right direction.

Our 2013 operating earnings were $2.18 cents per

share compared to $1.34 cents per share in 2012,

a 62.7% improvement. Premiums written for the

year increased by 2.9%. The improvement in our

operating earnings was largely the result of improved

profitability in states outside of California due to rate,

underwriting and other operational actions taken

over the past few years, fewer catastrophe losses,

and less adverse development on prior period loss

reserves. For the full year, we recorded approximately

$3 million of adverse reserve development compared

to approximately $42 million in 2012.

Diculties in obtaining regulatory approval for rate

increases in California have had a negative impact on

our results. Consequently, for the past two years we

posted a combined ratio over 100% in our California

private passenger automobile line of business.

However, we recently have made significant progress

in obtaining rate approvals in California. In July 2013,

we implemented a 6.9% rate increase on our California

non-standard private passenger automobile business

Letter to Shareholders

4MERCURY GENERAL CORPORATION