Mercury Insurance 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 Annual Report

Moving Forward Together

Table of contents

-

Page 1

Moving Forward Together 2013 Annual Report -

Page 2

... half century, Mercury has been home to the best and brightest the industry has to offer. The efforts and ingenuity of our team have fueled Mercury's long tenure of success. Today, we have approximately 4,500 reasons to be thankful. As a token of appreciation, this year's annual report is dedicated... -

Page 3

... have introduced improved pricing strategies, launched new commercial and private passenger auto products in selected markets, made investments in technology, increased relationships with qualified agents and, introduced a new program enabling customers to purchase a policy online. We will continue... -

Page 4

...in premiums written for the year ended December 31, 2013, Mercury is one of the most trusted insurance companies in the nation. 1.7 96% Mercury has earned solid customer loyalty by providing quality plans at affordable prices, with 96% of California private passenger automobile customers choosing... -

Page 5

... dividend. The company has increased its dividend every year since. California is Mercury's largest market and where it all began more than half a century ago. Today, Mercury is the 5th largest writer of private passenger automobile insurance in the state. 5 th 4,500 The number one reason for... -

Page 6

... market, a lower interest rate environment and our operating results outside of California. However, 2013 was a step in the right direction. Our 2013 operating earnings were $2.18 cents per share compared to $1.34 cents per share in 2012, a 62.7% improvement. Premiums written for the year increased... -

Page 7

... as rate increases affected our retention levels and impacted our ability to generate new business. To improve our cost structure outside of California, last year we consolidated our claims and underwriting operations located outside of California into hub locations in Florida, New Jersey and Texas... -

Page 8

...' relationship with the Company; • Focusing on increasing our agents quote volume; • Introducing a paperless solution for underwriting and claims for various business lines; • Introducing an improved homeowners product in California; • Expanding to eight additional states; • Continuing to... -

Page 9

... on the dividend. We hope you will be able to attend our annual meeting on May 14, 2014. Sincerely, Dividends Per Share (in dollars) 2.50 George Joseph Chairman of the Board 2.40 2.30 2.20 2.10 Gabriel Tirador 2.00 09 10 11 12 13 President and Chief Executive Officer 2013 ANNUAL REPORT 7 -

Page 10

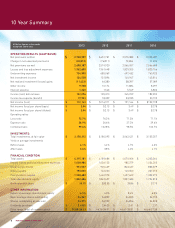

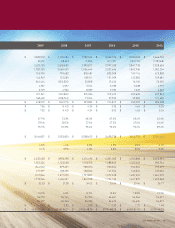

... Summary All dollar figures in thousands, except per share data 2013 2012 2011 2010 OPERATING RESULTS (GAAP BASIS): Net premiums written Change in net unearned premiums Net premiums earned Losses and loss adjustment expenses Underwriting expenses Net investment income Net realized investment... -

Page 11

... 1.92 59.90-48.75 $ $ 15.8% 54,566 54,605 1.72 60.45-51.16 $ $ 19.9% 54,471 54,515 1.48 60.26-46.29 2013 ANNUAL REPORT 9 -

Page 12

... Committee This Annual Report document includes Mercury General Corporation's financial statements and supporting data, management's discussion and analysis of financial condition and results of operations and quantitative and qualitative disclosures about market risks from the Company's Form 10... -

Page 13

...) _____ California (State or other jurisdiction of incorporation or organization) 95-2211612 (I.R.S. Employer Identification No.) 4484 Wilshire Boulevard, Los Angeles, California (Address of principal executive offices) 90010 (Zip Code) _____ Registrant's telephone number, including area code... -

Page 14

... at June 28, 2013 was $1,181,485,005 (which represents 26,876,365 shares of common equity held by non-affiliates multiplied by $43.96, the closing sales price on the New York Stock Exchange for such date, as reported by the Wall Street Journal). At February 3, 2014, the Registrant had issued... -

Page 15

... Website Access to Information Organization Production and Servicing of Business Underwriting Claims Losses and Loss Adjustment Expenses Reserves and Reserve Development Statutory Accounting Principles Investments Competitive Conditions Reinsurance Regulation Executive Officers of the Company Risk... -

Page 16

... "Insurance Companies") in 13 states, principally California. The Company also writes homeowners, commercial automobile, commercial property, mechanical breakdown, and umbrella insurance. The direct premiums written for the years ended December 31, 2013, 2012, and 2011 by state and line of business... -

Page 17

... executive offices of Mercury General are located in Los Angeles, California. The home office of the Insurance Companies and the information technology center are located in Brea, California. The Company also owns office buildings in Rancho Cucamonga and Folsom, California, which are used to support... -

Page 18

... offers homeowners insurance in 11 states, commercial automobile insurance in 10 states, and mechanical breakdown insurance in most states. The Company completed its exit from the Florida homeowners market in 2012. In California, "good drivers," as defined by the California Insurance Code, accounted... -

Page 19

basis of historical information by line of insurance. Inflation is reflected in the reserving process through analysis of cost trends and review of historical reserve settlement. The Company's ultimate liability may be greater or less than management estimates of reported losses and loss adjustment ... -

Page 20

...$3 million on the 2012 and prior accident years' loss and loss adjustment expense reserves due primarily to Florida claims that were re-opened from prior years due to a state supreme court ruling that was adverse to the insurance industry. See "Critical Accounting Policies and Estimates-Reserves" in... -

Page 21

... for the California BI coverage as well as increases in the provision for BI and PIP losses in New Jersey and Florida. For 2004, the unfavorable development related to an increase in the Company's prior accident years' loss estimates for personal automobile insurance in Florida and New Jersey. In... -

Page 22

..., Aggregates & Averages (2010 through 2013), for all property and casualty insurance companies (private passenger automobile line only, after policyholder dividends). Source: A.M. Best, "Best's Special Report U.S. Property/Casualty-Review & Preview, February 4, 2014." Premiums to Surplus Ratio The... -

Page 23

... Consolidated Financial Statements. At December 31, 2013, 70.6% of the Company's total investment portfolio at fair value and 87.1% of its total fixed maturity investments at fair value were invested in tax-exempt state and municipal bonds. For more detailed information including credit ratings, see... -

Page 24

...of $530,000 per person and has no maximum limit. Michigan law provides for unlimited lifetime coverage for medical costs caused by automobile accidents. For California homeowners policies, the Company has reduced its catastrophe exposure from earthquakes by placing earthquake risks directly with the... -

Page 25

... was minimal during 2013, it may increase the cost of parts for auto repairs in the future. Insurance rates in Georgia, New York, New Jersey, Pennsylvania, and Nevada require prior approval from the state DOI, while insurance rates in Illinois, Texas, Virginia, Arizona, and Michigan must only be... -

Page 26

... coverage to California homeowners. The Company places all new and renewal earthquake coverage offered with its homeowner policy directly with the CEA. The Company receives a small fee for placing business with the CEA, which is recorded as other revenue in the consolidated statements of operations... -

Page 27

... Company Act. Assigned Risks Automobile liability insurers in California are required to sell BI liability, property damage liability, medical expense, and uninsured motorist coverage to a proportionate number (based on the insurer's share of the California automobile casualty insurance market... -

Page 28

... in 1991, and named Chief Underwriting Officer in January 2010. Mr. Minnich, Vice President-Marketing, joined the Company as an underwriter in 1989. In 2007, he joined Superior Access Insurance Services as Director of Agency Operations and rejoined the Company as an Assistant Product Manager in 2008... -

Page 29

... by the Company from time to time. Risks Related to the Company's Business The Company remains highly dependent upon California and several other key states to produce revenues and operating profits. For the year ended December 31, 2013, the Company generated 79.9% of its direct automobile insurance... -

Page 30

... those which may be related to climate change; losses from sinkhole claims; unexpected medical inflation; and unanticipated inflation in auto repair costs, auto parts prices, and used car prices. Such risks may result in the Company's pricing being based on outdated, inadequate or inaccurate... -

Page 31

... time the Company seeks additional financing. In addition, financial strength and claims-paying ability ratings have become an increasingly important factor in the Company's ability to access capital markets. Rating agencies assign ratings based upon an evaluation of an insurance company's ability... -

Page 32

... business and financial position could be harmed. The process of establishing property and liability loss reserves is inherently uncertain due to a number of factors, including underwriting quality, the frequency and amount of covered losses, variations in claims settlement practices, the costs and... -

Page 33

... prompt reporting of claims and the Company's right to decline coverage in the event of a violation of that condition. While the Company's insurance product exclusions and limitations reduce the Company's loss exposure and help eliminate known exposures to certain risks, it is possible that a court... -

Page 34

...identifiable information, for business purposes including underwriting, claims and billing purposes, and relies upon the various information technology systems that enter, process, summarize and report such data. The Company also maintains personally identifiable information about its employees. The... -

Page 35

... the necessary employees for the operation and expansion of the Company's business could hinder its ability to conduct its business activities successfully, develop new products and attract customers. The Company's success also depends upon the continued contributions of its executive officers, both... -

Page 36

... Company, which could adversely affect premium revenue. The Company's business is vulnerable to significant losses related to sinkhole claims, which could have an adverse effect on its results of operations. In 2011, the Company began its withdrawal from the Florida homeowners market due to the high... -

Page 37

...Company operates have laws and regulations that limit its ability to exit a market. For example, these states may limit a private passenger auto insurer's ability to cancel and non-renew policies or they may prohibit the Company from withdrawing one or more lines of insurance business from the state... -

Page 38

... to provide compensation to injured employees for aggravation of a prior condition or injury which are funded by either assessments based on paid losses or premium surcharge mechanisms. In addition, as a condition to the ability to conduct business in various states, the Insurance Companies must... -

Page 39

...new claim, coverage, and business practice issues could adversely affect the Company's business by changing the way policies are priced, extending coverage beyond its underwriting intent, or increasing the size of claims. Risks Related to the Company's Stock The Company is controlled by small number... -

Page 40

... occupied by the Company at December 31, 2013 Location Purpose Brea, CA Folsom, CA Los Angeles, CA Rancho Cucamonga, CA Clearwater, FL Oklahoma City, OK Home office and I.T. facilities (2 buildings) Administrative and Data Center Executive offices Administrative Administrative Administrative... -

Page 41

... to notify the California DOI of any dividend after declaration, but prior to payment. There are similar limitations imposed by other states on the Insurance Companies' ability to pay dividends. As of December 31, 2013, the Insurance Companies are permitted to pay in 2014, without obtaining DOI... -

Page 42

...each of the Company's Common Stock, the S&P 500 Index and the industry peer group and the reinvestment of all dividends. Comparative Five-Year Cumulative Total Returns Stock Price Plus Reinvested Dividends 2008 2009 2010 2011 2012 2013 Mercury General Industry Peer Group S&P 500 Index $ 100... -

Page 43

...31, 2013 2012 2011 2010 2009 (Amounts in thousands, except per share data) Income Data: Net premiums earned Net investment income Net realized investment (losses) gains Other Total revenues Losses and loss adjustment expenses Policy acquisition costs Other operating expenses Interest Total expenses... -

Page 44

... courts, regulators and governmental bodies, particularly in California; the Company's ability to obtain and the timing of required regulatory approvals of premium rate changes for insurance policies issued in states where the Company operates; the Company's reliance on independent agents to market... -

Page 45

... agents in thirteen states: Arizona, California, Florida, Georgia, Illinois, Michigan, Nevada, New Jersey, New York, Oklahoma, Pennsylvania, Texas, and Virginia. The Company also offers homeowners, commercial automobile, commercial property, mechanical breakdown, fire, and umbrella insurance... -

Page 46

..., the Company plans to implement Guidewire for California homeowners and private passenger automobile claims processing. B. Regulatory and Legal Matters The process for implementing rate changes varies by state. Insurance rates in California, Georgia, New York, New Jersey, Pennsylvania, and Nevada... -

Page 47

... new ruling was minimal during 2013, it may increase the cost of parts for auto repairs in the future. In April 2010, the California DOI issued a Notice of Non-Compliance ("2010 NNC") to MIC, MCC, and CAIC based on a Report of Examination of the Rating and Underwriting Practices of these companies... -

Page 48

... losses, particularly in the Company's larger, more established lines of business which have a long operating history. The average severity method analyzes historical loss payments and/or incurred losses divided by closed claims and/ or total claims to calculate an estimated average cost per claim... -

Page 49

... motorists. BI payments are primarily for medical costs and general damages. The following table presents the typical closure patterns of BI claims in the California automobile insurance coverage: % of Total Claims Closed Dollars Paid BI claims closed in the accident year reported BI claims... -

Page 50

California Bodily Injury Inflation Reserve Sensitivity Analysis (B) Pro-forma severity if actual severity is higher by 10% for 2013, 5% for 2012, and 3% for 2011 Accident Year Number of Claims Expected Actual Recorded Severity at 12/31/13 Implied Inflation Rate (1) Recorded (A) Pro-forma ... -

Page 51

... accident years' losses and loss adjustment expense reserves, which at December 31, 2012 totaled approximately $1,036 million. The unfavorable development in 2013 is largely from Florida claims that were re-opened from prior years due to a state supreme court ruling that was adverse to the insurance... -

Page 52

... uncertainties. The effective tax rate was 15.1% for 2013, compared to 13.6% for 2012. The increase in the effective tax rate is mainly due to an increase in taxable income relative to tax exempt investment income and an increase in the provision for the Company's state income tax uncertainties. The... -

Page 53

...sum of policy acquisition costs plus other operating expenses by net premiums earned and did not materially change in 2013 compared to 2012. The 2013 expense ratio was affected by the consolidation of claims and underwriting operations located outside of California into hub locations, which resulted... -

Page 54

... gains of $45.5 million in 2013 and 2012, respectively, due to changes in the fair value of total investments pursuant to application of the fair value accounting option. The net losses during 2013 arise from a $100.7 million market value decrease in the Company's fixed maturity securities offset by... -

Page 55

... automobile line of business. The 2011 loss ratio was negatively impacted by a total of $18 million of catastrophe losses due to California winter storms, Hurricane Irene, and Georgia tornadoes during 2011. The improvement in the expense ratio in 2012 was mainly due to ongoing cost reduction... -

Page 56

... cash provided by operating activities in 2013 was $209.8 million, an increase of $61.7 million compared to 2012. The increase was primarily due to increased premiums collected and reduced operating expenses, offset by an increase in paid losses and loss adjustment expenses. The Company utilized the... -

Page 57

... in the gains and losses were $100.7 million in losses and $56.8 million in gains due to changes in the fair value of the Company's fixed maturity and equity security portfolio, respectively, as a result of applying the fair value accounting option. During 2012, the Company recognized $66.4 million... -

Page 58

...securities is credit risk, which is managed by maintaining a weighted-average portfolio credit quality rating of AA-, at fair value, consistent with the average rating at December 31, 2012. To calculate the weighted-average credit quality ratings as disclosed throughout this Annual Report on Form 10... -

Page 59

...Non-Rated/ Other Total (Amounts in thousands) U.S. government bonds and agencies: Treasuries Government Agency Total Municipal securities: Insured Uninsured Total Mortgage-backed securities: Commercial Agencies Non-agencies: Prime Alt-A Total Corporate securities: Communications Consumer-cyclical... -

Page 60

...due to high loan-to-value ratios or limited supporting documentation. The Company had holdings of $21.9 million and $4.3 million ($21.8 million and $4.2 million at amortized cost) in commercial mortgage-backed securities at December 31, 2013 and 2012, respectively. The weighted-average rating of the... -

Page 61

... 477,088 December 31, Lender Interest Rate Expiration 2013 2012 (Amounts in thousands) Secured credit facility Secured loan Unsecured credit facility Total Bank of America Union Bank Bank of America and Union Bank LIBOR plus 40 basis points LIBOR plus 40 basis points (1) July 31, 2016 January... -

Page 62

... to continue to operate in a strong and healthy manner. The ORSA will be used by the state insurance regulator to evaluate the risk exposure and quality of the risk management processes within the insurance companies to assist in conducting risk-focused financial examinations and for determining... -

Page 63

... after-tax yields, mitigate market risks, and optimize capital to improve profitability and returns. The Company manages exposures to market risk through the use of asset allocation, duration, and credit ratings. Asset allocation limits place restrictions on the total funds that may be invested... -

Page 64

... lower total amount invested in common stocks . Therefore, the impact that large market corrections could have on the equity portfolio was lower at December 31, 2013 than at December 31, 2012. Interest rate risk Interest rate risk is the risk that the Company will incur a loss due to adverse changes... -

Page 65

...Data INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Reports of Independent Registered Public Accounting Firm Consolidated Financial Statements: Consolidated Balance Sheets as of December 31, 2013 and 2012 Consolidated Statements of Operations and Consolidated Statements of Comprehensive Income for... -

Page 66

... also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Mercury General Corporation's internal control over financial reporting as of December 31, 2013, based on criteria established in Internal Control-Integrated Framework (1992) issued... -

Page 67

... the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Mercury General Corporation and subsidiaries as of December 31, 2013 and 2012, and the related consolidated statements of operations, comprehensive income, shareholders' equity, and... -

Page 68

...' EQUITY Losses and loss adjustment expenses Unearned premiums Notes payable Accounts payable and accrued expenses Current income taxes Deferred income taxes Other liabilities Total liabilities Commitments and contingencies Shareholders' equity: Common stock without par value or stated value... -

Page 69

MERCURY GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data) Year Ended December 31, 2013 2012 2011 Revenues: Net premiums earned Net investment income Net realized investment (losses) gains Other Total revenues Expenses: Losses and loss ... -

Page 70

... AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in thousands) Year Ended December 31, 2013 2012 2011 Common stock, beginning of year Proceeds of stock options exercised Share-based compensation expense Tax benefit on sales of incentive stock options Common stock, end of year... -

Page 71

... exercise of stock options Increase in premiums receivable Changes in current and deferred income taxes Increase in deferred policy acquisition costs Increase (decrease) in unpaid losses and loss adjustment expenses Increase in unearned premiums Increase (decrease) in accounts payable and accrued... -

Page 72

... Companies in 13 states, principally California. The Company also writes homeowners, commercial automobile, commercial property, mechanical breakdown, fire, and umbrella insurance. The private passenger automobile lines of insurance exceeded 79% of the Company's direct premiums written in 2013, 2012... -

Page 73

... loss. The Company, as writer of an option, bears the market risk of an unfavorable change in the price of the security underlying the written option. Liabilities for covered call options of $0.1 million and $0.2 million were included in other liabilities at December 31, 2013 and 2012, respectively... -

Page 74

..., and certain other underwriting costs that are incremental or directly related to the successful acquisition of new and renewal insurance contracts and are amortized over the life of the related policy in proportion to premiums earned. Deferred policy acquisition costs are limited to the amount... -

Page 75

.... Estimating loss reserves is a difficult process as many factors can ultimately affect the final settlement of a claim and, therefore, the reserve that is required. Changes in the regulatory and legal environment, results of litigation, medical costs, the cost of repair materials, and labor rates... -

Page 76

...reportable operating segments for the periods presented. The annual direct premiums written attributable to the Company's lines of insurance were as follows: Year Ended December 31, 2013 2012 (Amounts in thousands) 2011 Private passenger automobile Homeowners Commercial automobile Other lines Total... -

Page 77

... on the Company's cumulative underwriting income, annual underwriting income, and net premiums written growth. The fair value of each restricted stock unit grant was determined based on the market price on the date of grant. Compensation cost is recognized based on management's best estimate that... -

Page 78

... impact on the Company's consolidated financial statements. 2. Investments The following table presents (losses) gains due to changes in fair value of investments that are measured at fair value pursuant to application of the fair value option: Year Ended December 31, 2013 2012 (Amounts in thousands... -

Page 79

...of the reporting date. Pricing inputs are other than quoted prices in active markets, which are based on the following Level 3 Quoted prices for similar assets or liabilities in active markets; Quoted prices for identical or similar assets or liabilities in non-active markets; or Either directly or... -

Page 80

... services and closing exchange values are used as a comparison to ensure that reasonable fair values are used in pricing the investment portfolio. U.S. government bonds and agencies/Short-term bonds: Valued using unadjusted quoted market prices for identical assets in active markets. Common stock... -

Page 81

... utilities Banks, trusts and insurance companies Energy and other Non-redeemable preferred stock Partnership interest in a private credit fund Short-term bonds Money market instruments Total return swap Total assets at fair value Liabilities Equity contracts Total liabilities at fair value $ 16... -

Page 82

... Banks, trusts and insurance companies Energy and other Non-redeemable preferred stock Partnership interest in a private credit fund Short-term bonds Money market instruments Total assets at fair value Liabilities Equity contracts Interest rate swap agreements Total liabilities at fair value... -

Page 83

...190,000 $ $ 2012 120,000 20,000 0 140,000 (Amounts in thousands) Secured loan Union Bank Unsecured credit facility Bank of America and Union Bank Total _____ (1) On July 2, 2013, the Company entered into an unsecured $200 million five-year revolving credit facility. The interest rate on borrowings... -

Page 84

... Financial Instruments The Company is exposed to certain risks relating to its ongoing business operations. The primary risks managed by using derivative instruments are equity price risk and interest rate risk. Equity contracts on various equity securities are intended to manage the price risk... -

Page 85

... Recognized in Income Year Ended December 31, 2013 2012 (Amounts in thousands) 2011 Total return swap - Net realized investment (losses) gains Equity contracts-Net realized investment (losses) gains Interest rate contract - Other revenue Total $ $ 2,177 1,776 103 4,056 $ $ 0 2,680 567 3,247... -

Page 86

...,611 53,935 The income tax provision reflected in the consolidated statements of operations is reconciled to the federal income tax on income before income taxes based on a statutory rate of 35% as shown in the table below: Year Ended December 31, 2013 2012 (Amounts in thousands) 2011 Computed tax... -

Page 87

...during 2013. The increase was the result of tax positions taken regarding federal tax credit carryforwards and state tax apportionment issues based on management's best judgment given the facts, circumstances and information available at the reporting date. The Company does not expect any changes in... -

Page 88

... commercial taxi business and Florida homeowners business, both of which the Company ceased writing in 2011. 2012 accident year losses were also impacted by higher loss severity and frequency on the California private passenger automobile line of business. The increase in the provision for insured... -

Page 89

... as writers of similar lines where differences in risk may be related to corporate structure, investment policies, reinsurance arrangements, and a number of other factors. The Company periodically monitors the RBC level of each of the Insurance Companies. As of December 31, 2013, 2012, and 2011 each... -

Page 90

... option for employees to make salary deferrals under Section 401(k) of the Internal Revenue Code. The matching contributions, at a rate set by the Board of Directors, totaled $8.1 million, $7.2 million, and $7.2 million for 2013, 2012, and 2011, respectively. The Plan also includes an employee stock... -

Page 91

..., the Compensation Committee of the Company's Board of Directors granted performance vesting restricted stock units to the Company's senior management and key employees. See Note 1 for grants summary. A summary of the restricted stock unit activity as of December 31, 2013, 2012, and 2011 and changes... -

Page 92

...coverage to California homeowners. The Company places all new and renewal earthquake coverage offered with its homeowners policies directly with the CEA. The Company receives a small fee for placing business with the CEA, which is recorded as other income in the consolidated statements of operations... -

Page 93

..."2004 NNC") alleging that the Company charged rates in violation of the California Insurance Code, willfully permitted its agents to charge broker fees in violation of California law, and willfully misrepresented the actual price insurance consumers could expect to pay for insurance by the amount of... -

Page 94

... and if premium volumes decline, it could lead to higher expense ratios. The 2013 expense ratio was affected by the consolidation of claims and underwriting operations located outside of California into hub locations, which resulted in approximately $10 million of pre-tax office closure costs and... -

Page 95

... the participation of the Company's management, including its Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company's disclosure controls and procedures as of the end of the period covered by this Annual Report on Form 10-K. Based on the... -

Page 96

reporting. The Company's process for evaluating controls and procedures is continuous and encompasses constant improvement of the design and effectiveness of established controls and procedures and the remediation of any deficiencies which may be identified during this process. Item 9B. None Other ... -

Page 97

... Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accounting Fees and Services Information regarding executive officers of the Company... -

Page 98

.... Amendment 2013-1 to the Mercury General Corporation Profit Sharing Plan. Management Agreement effective January 1, 2001 between Mercury Insurance Services, LLC and Mercury Casualty Company, Mercury Insurance Company, California Automobile Insurance Company and California General Insurance Company... -

Page 99

... Mercury Insurance Services, LLC and Mercury Insurance Company of Florida and Mercury Indemnity Company of Florida. Management Agreement dated January 22, 1997 between Mercury County Mutual Insurance Company and Mercury Insurance Services, LLC. Director Compensation Arrangements. Mercury General... -

Page 100

.... This document was filed as an exhibit to Registrant's Registration Statement on Form S-1, File No. 33-899, and is incorporated herein by ... Registrant's Form 10-Q for the quarterly period ended June 30, 2013, and is incorporated herein by this reference. Denotes management contract or compensatory... -

Page 101

... GEORGE JOSEPH George Joseph Chairman of the Board President and Chief Executive Officer and Director (Principal Executive Officer) Senior Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) Director Director Director Director Director Director... -

Page 102

... considered in relation to the basic consolidated financial statements taken as a whole, present fairly, in all material respects, the information set forth therein. /s/ Los Angeles, California February 10, 2014 KPMG LLP See accompanying Report of Independent Registered Public Accounting Firm S-1 -

Page 103

... fixed maturity securities Equity securities: Common stock: Public utilities Banks, trust and insurance companies Energy and other Non-redeemable preferred stock Partnership interest in a private credit fund Total equity securities Short-term investments Total investments $ 15,994 2,201,047 37... -

Page 104

... fixed maturity securities Equity securities: Common stock: Public utilities Banks, trust and insurance companies Energy and other Non-redeemable preferred stock Partnership interest in a private credit fund Total equity securities Short-term investments Total investments $ 13,999 2,040,537 27... -

Page 105

... II MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT BALANCE SHEETS December 31, 2013 2012 (Amounts in thousands) ASSETS Investments, at fair value: Equity securities (cost $27,449; $31,178) Short-term investments (cost $11,089; $47,174) Investment in subsidiaries Total... -

Page 106

... MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF OPERATIONS Year Ended December 31, 2013 2012 (Amounts in thousands) 2011 Revenues: Net investment income Net realized investment gains (losses) Total revenues Expenses: Other operating expenses Interest Total... -

Page 107

SCHEDULE II, Continued MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF CASH FLOWS Year Ended December 31, 2013 2012 (Amounts in thousands) 2011 Cash flows from operating activities: Net cash used in operating activities Cash flows from investing activities: ... -

Page 108

... of America Mercury Select Management Company, Inc. Mercury Insurance Services LLC AIS Management LLC Auto Insurance Specialists LLC PoliSeek AIS Insurance Solutions, Inc. Animas Funding LLC The method of allocation between the companies is subject to an agreement approved by the Board of Directors... -

Page 109

SCHEDULE IV MERCURY GENERAL CORPORATION AND SUBSIDIARIES REINSURANCE THREE YEARS ENDED DECEMBER 31, Property and Liability Insurance Earned Premiums 2013 2012 (Amounts in thousands) 2011 Direct amounts Ceded to other companies Assumed Net amounts $ 2,704,401 $ 2,578,715 $ 2,569,661 (4,134) ... -

Page 110

... Company* Mercury Select Management Company, Inc. Auto Insurance Specialists LLC AIS Management LLC PoliSeek AIS Insurance Solutions, Inc. Animas Funding LLC TRANSFER AGENT & REGISTRAR Computershare Trust Company, N.A. 250 Royall Street Canton, MA 02021 Telephone number: (866) 214-7508 Website... -

Page 111

Environmental Benefits Statement To minimize our environmental impact, the Mercury General Corporation 2013 Annual Report was printed on paper containing fibers from environmentally appropriate, socially beneficial and economically viable forest resources.