Mercedes 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Mercedes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Answers for questions to come

Annual Report 2001

Table of contents

-

Page 1

Answers for questions to come Annual Report 2001 -

Page 2

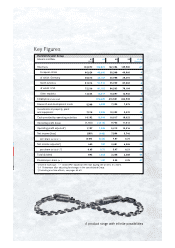

... in millions 01 US $1) 01 00 99 01:00 Change in % Revenues European Union of which: Germany North America of which: USA Other markets Employees (at year-end) Research and development costs Investments in property, plant and equipment Cash provided by operating activities Operating profit (loss... -

Page 3

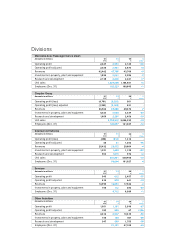

Divisions Mercedes-Benz Passenger Cars & smart Amounts in millions 01 US $ 01 â,¬ 00 â,¬ % change Operating profit Operating profit adjusted Revenues Investments in property, plant and equipment Research and development Unit sales Employees (Dec. 31) Chrysler Group Amounts in millions 2,627 2,... -

Page 4

Our Passenger Car Brands Our Commercial Vehicle Brands Our Alliance Partner Our Strategic Partner -

Page 5

... of Accident-Free Driving" Operating Activities Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Services Other Activities Research and Technology DaimlerChrysler and the Environment Global Procurement and Supply Human Resources The DaimlerChrysler Shares Analysis of... -

Page 6

... smart, however, 2001 was an excellent year with new records in revenue, sales and profit. With over 1.1 million vehicles sold, Mercedes-Benz is today the world's leading luxury car brand. The resounding success of the C-Class family and strong demand for the new SL were two of the factors driving... -

Page 7

... company's current financial year ending March 2002. For the rest of 2002, one will have to take into consideration the extremely difficult market conditions prevailing in Japan. Group outlook 2002. The global automotive business is currently experiencing the toughening markets the Chrysler Group... -

Page 8

...brands, creating efficient and effective market pull at the same time as they promote customer loyalty; A broad product range, serving all customer needs, exploring and profiting from new market niches or segments and allowing savings through significant economies of scale; and finally Leadership in... -

Page 9

...us through the challenges of 2002 and the years that follow. We continue to rate as one of the world's most respected employers. As a result the company attracts the best people who also understand and endorse DaimlerChrysler's powerful commitment to its shareholders. Cautious optimism. We emphasize... -

Page 10

... Manfred Gentz Age: 60 Finance & Controlling Appointed until 2003 Günther Fleig Age: 53 Human Resources & Labor Relations Director Appointed until 2004 Eckhard Cordes Age: 51 Commercial Vehicles Appointed until 2003 Jürgen Hubbert Age: 62 Mercedes-Benz Passenger Cars & smart Appointed until... -

Page 11

...Age: 59 Global Procurement & Supply Appointed until 2003 Dieter Zetsche Age: 48 Chrysler Group Appointed until 2003 Thomas W. Sidlik Age: 52 Procurement & Supply Chrysler Group Board Member Hyundai Motor Company Appointed until 2003 Wolfgang Bernhard Age: 41 Chief Operating Officer Chrysler Group... -

Page 12

...for the decline in earnings at Group level were the extremely competitive US market for passenger cars, minivans and light trucks, the dramatic contraction of demand for heavy trucks in North America, continued pressure on margins in the financial services business, and weakening demand in important... -

Page 13

... the same level as in 2000. Revenues In millions 2001 US $ Consolidated Revenues 2001 â,¬ 2000 â,¬ In billions of â,¬ 150 125 100 75 50 Other markets USA European Union 25 97 98 99 00 01 DaimlerChrysler Group Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Services Other... -

Page 14

... no longer consolidated from April and May 2001 respectively. While the Mercedes-Benz Passenger Cars & smart division was able to increase revenues by 9%, at Chrysler Group and the Commercial Vehicles division they were lower than in the prior year. Services' revenues also declined slightly, but on... -

Page 15

... FUSO light truck, Canter, in selected European markets. With Hyundai Motor Company (HMC) of South Korea, in which DaimlerChrysler holds a 10% equity interest, we agreed in June on the establishment of a joint venture for the production of medium-class commercial vehicle engines of the Mercedes-Benz... -

Page 16

... for Group strategy Further growth at Mercedes-Benz Passenger Cars & smart Turnaround measures reinforced at Chrysler Group and Freightliner Services division to continue focusing on automotive business Investment in products and innovation to secure competitiveness I I I I I Slow recovery of... -

Page 17

...should also help improve our cost position and margins, as well as the innovative potential of Chrysler Group. Revenues In billions Plan 2002 Target 2004 â,¬ â,¬ DaimlerChrysler Group Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Services Other Activities 142 46 56 28 16... -

Page 18

... the Group's various vehicle brands. Within the context of this strategy, in Germany from the middle of 2002, the DaimlerChrysler Bank will offer deposit and savings facilities, investment funds and customer credit cards, in addition to its existing products. We also intend to extend our activities... -

Page 19

... production of new passenger car and commercial vehicle models. In addition, we are planning significant spending on the modernization of manufacturing Research and Development Costs In billions Plan 2002 â,¬ 2002-2004 â,¬ DaimlerChrysler Group Mercedes-Benz Passenger Cars & smart Chrysler Group... -

Page 20

... they will be applied - Standardizing components - Steering the global production capacities of the DaimlerChrysler Group - Coordinating our global sales and marketing activities Quick and flexible decisions. The EAC meets at In some vehicle segments the foundations have already been laid for the... -

Page 21

... exchange of components is the Mercedes-Benz five-speed automatic transmission, which will be used in a modified form in Chrysler Group vehicles and for this purpose will be produced at a new gearbox plant in Indiana, USA, starting in the year 2004. A product example is the Chrysler Crossfire... -

Page 22

... Asian markets through our strategic partners I I I Mitsubishi Motors and Hyundai Motor Europe Production Revenues in locations Sales outlets millions of â,¬ Employees Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Sales Organization Automotive Businesses Services Other... -

Page 23

... Revenues in locations Sales outlets millions of â,¬ Employees Australia/Oceania Production Revenues in locations Sales outlets millions of â,¬ Employees Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Sales Organization Automotive Businesses Services Other Activities... -

Page 24

... only a few years ago would have been regarded as unattainable: Our objective is to prevent most accidents or at least to alleviate their consequences. In matters of safety, Mercedes-Benz has been at the forefront for decades. And our commitment to the "Vision of Accident-free Driving" should be an... -

Page 25

The "Vision of Accident-free Driving" 21 Night vision: Two headlights illuminate the road with beams of invisible infrared light. An infrared video camera captures the reflected light and the image is shown on an LCD screen. Our researchers also make use of so-called teachable methods. So the ... -

Page 26

... safety concept. Active safety in particular still offers considerable potential. The "Vision of Accident-free Driving" today. DaimlerChrysler already offers driver-assistance systems that help increase safety in many of its production passenger cars and commercial vehicles. Crucial stopping... -

Page 27

... Accident-free Driving" 23 of the future Distronic, a comfort system, also eases the burden on the driver. A radar sensor located in the radiator grille measures the distance to the vehicle in front. The sensor can observe the traffic scenario up to 150 meters (almost 500 feet) ahead. If the car... -

Page 28

... vehicle exterior; the images they provide are analyzed in real-time. Engineers are investigating how the driver's peripheral field of vision can be improved with the Bubble-top Car. Human beings process 90% of all information visually. A Mercedes-Benz CLK convertible fitted with a glass bubble roof... -

Page 29

...instruments. The electronically controlled brake system (Brake by Wire) is already available in certain Mercedes-Benz production vehicles. The "Vision of Accident-free Driving" at DaimlerChrysler: vehicles will become increasingly skilled at understanding their surroundings. They will recognize the... -

Page 30

... brand continued to grow in nearly all markets in 2001. Sales of Mercedes-Benz vehicles in Western Europe rose 6%. In Germany, despite a weakening market, we nearly equaled our sales level of the previous year, while further increasing market share to 11.9% (2000: 11.8%). We sold 206,600 passenger... -

Page 31

Worldwide Mercedes-Benz Passenger Cars & smart 27 luxury brand No.1 A dream come true: The new SL is Mercedes-Benz' interpretation of a thoroughbred sports car - it offers roadster exhilaration combined with maximum safety and supreme comfort. -

Page 32

...an open roadster with the excellent comfort of a Mercedes-Benz coupe. Emil Jellinek commissioned Wilhelm Maybach, chief engineer of the Daimler Motoren Gesellschaft (DMG), to build 36 vehicles for resale. Jellinek used the pseudonym Mercedes (his daughter's name) for his cars when they were driving... -

Page 33

... the smart in the UK and Greece was followed by its launch in Japan in the year under review. The smart city coupe has been available as a right-hand-drive vehicle since October 2001, and is also now offered as a "kei car" version subject to a lower vehicle tax in Japan. Upcoming new smart products... -

Page 34

... the prior year. Worldwide, Chrysler Group sold 2.76 million cars, minivans, SUVs and light trucks in 2001 (2000: 3.05 million). These figures reflect Chrysler Group's short term strategy of improving profits rather than protecting market share at any price. New and additional products will provide... -

Page 35

The American Chrysler Group 31 way of life...Convincing for customers: Stunning design and innovative features put the all-new 2002 Dodge Ram 1500 at the head of its class. -

Page 36

... of incorporating new technology from Mercedes-Benz. Unit sales of the Jeep brand were 523,000 vehicles in 2001 (2000: 607,500). Presentation of pioneering automotive concepts. Build- strong global demand for the PT Cruiser, we have steadily increased production of this innovative and versatile... -

Page 37

... generally difficult market conditions, however, unit sales by the Dodge brand were 1,457,400 vehicles (2000: 1,695,400). More than nine million minivans sold. Eighteen years Unit Sales 2001 *) 1,000 units 01:00 (in %) Total of which: Passenger Cars Light Trucks Minivans SUVs**) USA Canada Mexico... -

Page 38

... with market shares of 34% (2000: 37%) and 35% (2000: 36%), respectively. Amounts in millions 2001 US $ 2001 â,¬ 2000 â,¬ Operating profit (loss) Operating profit adjusted Revenues Investments in property, plant and equipment Research and development Production (units) Unit sales Employees (Dec... -

Page 39

Customized transport Commercial Vehicles 35 solutions for our customers Specific range of application: The new Mercedes-Benz Axor semi-trailer truck is designed to fulfill customer requirements such as low weight, low fuel consumption, attractive price and maximum economy. -

Page 40

... fell to 7,800 vehicles (2000: 12,000), Mercedes-Benz remained the market leader in the comparable segment. The Mercedes-Benz Sprinter was launched in the US market under the Freightliner brand name in mid 2001 and sales reached more than 2,200 by the end of the year. Restructuring at Freightliner... -

Page 41

... the joint venture "Daimler Hyundai Truck Corporation." The company was set up to produce Series 900 Mercedes-Benz diesel engines in South Korea. A large proportion of Hyundai commercial vehicles will be equipped with these engines in the future. Planning of a production facility in the immediate... -

Page 42

... also offers fleet management programs, mobility services and target-group focused insurance solutions. Great success has been achieved in using services to support the sales of vehicles by the Mercedes-Benz Passenger Cars & smart, Chrysler Group and Commercial Vehicles divisions. With more than... -

Page 43

... our credit principles. The losses sustained on the sale of off-lease vehicles primarily involved Chrysler and Freightliner products. Measures introduced to increase profitability. In order of off-lease vehicles, programs have been developed in cooperation with dealers that offer customers various... -

Page 44

... for shares in EADS. Excluding one-time effects, operating profit amounted to â,¬205 million (2000: â,¬67 million). Global partnerships. Together with its partners, the MTU Aero Engines business unit develops and produces engines for civil and military applications. It also performs servicing and... -

Page 45

...April 2001. Starting in November 2002, it will be able to repair engines close to the Asian customer base. The business unit is also investing in new programs that will strengthen its position as an engine manufacturer. For example, MTU Aero Engines is participating in the GP 7000 engine program for... -

Page 46

.../02 financial year of 13.1 billion yen (â,¬121 million). That loss was 44% less than the figure for the first six months of 2000/01 (23.2 billion yen). This significant improvement was largely a result of the turnaround measures introduced in February 2001. The loss before one-time effects and taxes... -

Page 47

... measures designed to reduce material costs, and fixed costs. Mitsubishi Motors is on schedule with regard to fixed costs, and the company is confident it will surpass the 2001/02 cost-cutting targets for materials. The planned workforce reductions (9,500 employees by the end of the 2003 financial... -

Page 48

... the vehicle's suspension and shock absorbers to the road surface and the driving situation. is currently testing and researching hybrid drive concepts aimed at reducing fuel consumption and emissions without diminishing driving pleasure, comfort or a vehicle's utility value. The "smart hyper... -

Page 49

... has already demonstrated a fuel-cell powered go-cart - the world's first small vehicle to use this technology. Modern production technology. The extensive use of light materials can significantly reduce fuel consumption and emissions, thereby providing benefits for customers and the environment... -

Page 50

...vehicles for practical applications. At the beginning of 2001, the world's first methanol-powered fuel-cellvehicle equipped with technology suitable for everyday use was tested on public roads in Japan. The vehicle was the NECAR 5 which is based on the Mercedes-Benz A-Class. First production vehicle... -

Page 51

... trials in city traffic: The first Mercedes-Benz Sprinter with fuel-cell technology was delivered to a customer in 2001. Renewable fuels: an opportunity for the future. Techno- logical progress should not be limited to the vehicle itself. Advances also need to be made in the fuels used. The... -

Page 52

... on all processes - from supply to production - in near real-time, conducted several promising pilot projects in North America and Europe in 2001. Purchasing Volume â,¬106.5 bilion (2000: â,¬113.3 billion) Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Other 33 % 43 % 19... -

Page 53

... definition of material groups and the application of these definitions to derive strategic goals for procurement activities. Sixty material groups were identified in 2000, equivalent to half of total purchasing volume in that year. Another 21 groups were added in 2001. Assessing supplier potential... -

Page 54

...skills. In this way, employees of all age groups are automatically prepared for the e-business applications of the future. Employees (Dec. 31) 2001 2000 DaimlerChrysler Group Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Sales Organization Automotive Businesses Services... -

Page 55

.... In this way, the ongoing globalization of our company is reflected and supported by our human-resources activities. Executive development with LEAD. We use the LEAD again, more than 2,800 young people began a training program at DaimlerChrysler in Germany. Some 10,400 people are presently... -

Page 56

... in DaimlerChrysler stock worldwide was about 1.3 billion shares in 2001 (2000: 1.0 billion) of which 130 million shares were traded on US stock exchanges (2000: 127 million) and 1,169 million in Germany (2000: 888 million). Prize for best communication with investors. At the Share Price Index 140... -

Page 57

...) Number of shares (in millions) Market capitalization (in billions) Number of shareholders (in millions) Weighting on share index DAX 30 2,322 2,609 1,003.3 2,609 1,003.3 44.89 1.9 41.81 48.51 1.9 6.8% 2.2% 5.1% 1.8% Shareholders Structure as of Dec. 31, 2001 12% 7% Deutsche Bank AG Kuwait... -

Page 58

... plan and special costs associated with unforeseen market developments. Furthermore, as a result of the Group's investment in Operating Profit (Loss) by Segments 01 In millions US $ 01 â,¬ 00 â,¬ Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Services Other Activities... -

Page 59

... includes an impairment charge allocated to the segment relating to the Group's e-business activities. The prior year's operating profit included one-time charges of â,¬0.7 billion mainly due to the strategic review of the smart brand and the initial application of the European Union's end-of-life... -

Page 60

... sales incentives and decline in market share were mainly attributable to intense competitive pressures in the North American market. This situation particularly affected two of Chrysler Group's historically more profitable market segments of upper-middle sport utility vehicles and pick-up trucks... -

Page 61

... restructuring program at Mitsubishi Motors had a negative impact on operating profit. In 2000, one-time income totaling â,¬3.5 billion resulted from the exchange of the Group's controlling interest in DaimlerChrysler Aerospace for shares in EADS and from the sale of the Fixed Installations business... -

Page 62

...with net income of â,¬7.9 billion in the prior year. The Group reported a loss per share of â,¬0.66 after earnings per share of â,¬7.87 in 2000. The one-time charges and gains as described in the preceding paragraphs with respect to operating profit and financial income had a net negative effect of... -

Page 63

... taxes) Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Services2) Other Industrial Activities3) 54.7 48.8 1.4 9.5 11.1 26.6 9.2 2.2 5.6 10.9 25.0 7.6 1.1 4.2 26.7 (8.2) 0.6 1.9 7.2 26.3 2.1 16.5 9.5 10.8 Stockholders' Equity Return on Equity4) Financial Services... -

Page 64

... with the year 2002. The various parameters of capital costs according to the capital-asset-pricing model led to a net reduction in the Group's cost of capital rate to 8% after taxes. This results in a minimum required rate of return of 13% (before taxes) for the industrial business activities, and... -

Page 65

...caused by the market launch of new products in the Mercedes-Benz Passenger Cars & smart segment (â,¬0.9 billion). The deconsolidation of the Adtranz Group had an offsetting effect of â,¬0.5 billion. Trade receivables and other receivables increased slightly to â,¬22.6 billion (2000: â,¬22.4 billion... -

Page 66

... reduction of trade liabilities in the Mercedes-Benz Passenger Cars & smart and Commercial Vehicles divisions. Statement of cash flows impacted by financial services business. Cash provided by operating activities remained substantially unchanged in 2001 at â,¬15.9 billion (2000: â,¬16.0 billion... -

Page 67

... A- to BBB+. Moody's Investors Services, however, left our rating unchanged at A3. Early recognition and consistent management of future risks. In view of the global operations of Daimler- Chrysler and the increasingly intense competition in all markets, the Group's business units are subject to... -

Page 68

... consumers and investors with a downward spiral of expectations. This could lead to a stronger drop in U.S. domestic demand and significant stock-market losses. Due to trading and capital-market links, with such a scenario the assumed economic recovery in the Group's important markets of Western... -

Page 69

... to which management can continue to successfully implement the planned measures despite worsened market conditions. DaimlerChrysler's financial services business primarily consists of the leasing and financing of Group products, mainly vehicles. Refinancing is carried out to a considerable extent... -

Page 70

... In 2001, the average and period-end values-at-risk of DaimlerChrysler's portfolio of interest rate sensitive financial instruments increased significantly, primarily due to higher volatilities and an increased mismatch funding of the Group's leasing and sales financing business. Equity price risk... -

Page 71

... described above have occurred since the end of the 2001 financial year which are of major significance to DaimlerChrysler and would lead to a changed assessment of the Group's position. The course of business in the first two months of 2002 confirms the statements made in the section Outlook. the... -

Page 72

... (loss), cash flows and changes in stockholders' equity for each of the financial years; 2001, 2000 and 1999) were prepared in accordance with generally accepted accounting principles in the United States of America (U.S. GAAP). In order to comply with Section 292a of the HGB (German Commercial Code... -

Page 73

... ("DaimlerChrysler") as of December 31, 2001 and 2000, and the related consolidated statements of income (loss), changes in stockholders' equity, and cash flows for each of the years in the three-year period ended December 31, 2001. These consolidated financial statements are the responsibility of... -

Page 74

... (in millions, except per share amounts) 2001 (Note 1) $ 2001 â,¬ 2000 â,¬ 1999 â,¬ Revenues Cost of sales Gross margin Selling, administrative and other expenses Research and development Other income Turnaround plan expenses - Chrysler Group Income (loss) before financial income Financial income... -

Page 75

...Revenues Cost of sales Gross margin Selling, administrative and other expenses Research and development Other income Turnaround plan expenses - Chrysler Group Income (loss) before financial income Financial income (expense), net (therein gain on issuance of associated company stock of â,¬747 in 2001... -

Page 76

... (in millions) 2001 (Note 1) $ 2001 â,¬ 2000 â,¬ Industrial Business* At December 31, 2001 â,¬ 2000 â,¬ Financial Services* At December 31, 2001 â,¬ 2000 â,¬ Assets Intangible assets Property, plant and equipment, net Investments and long-term financial assets Equipment on operating leases, net... -

Page 77

... - - 1,363 - (149) - (408) - 6 - - 7,894 812 8,706 Increase in stated value of capital stock Issuance of capital stock Purchase of capital stock Re-issuance of treasury stock Dividends Balance at December 31, 2000 44 - - - - 2,609 (44) 1 - - - 7,286 - - - - (2,358) 29,461 - - - - - 3,285... -

Page 78

... receivables from financial services: - Finance receivables collected - Proceeds from sales of finance receivables Acquisitions of securities (other than trading) Proceeds from sales of securities (other than trading) Change in other cash Cash used for investing activities Change in commercial paper... -

Page 79

... receivables from financial services: - Finance receivables collected - Proceeds from sales of finance receivables Acquisitions of securities (other than trading) Proceeds from sales of securities (other than trading) Change in other cash Cash used for investing activities Change in commercial paper... -

Page 80

... Assets Schedule Acquisition or Manufacturing Costs Change Balance at Balance at in consoliDecember 31, January 1, Currency dated Reclassi2001 2001 change companies Additions fications Disposals 880 4,413 5,293 17 170 187 (104) (724) (828) 248 137 385 52 - 52 59 16 75 1,034 3,980 5,014 (in millions... -

Page 81

... 3,113 (in millions of â,¬) Other intangible assets Goodwill Intangible assets Land, leasehold improvements and buildings including buildings on land owned by others Technical equipment and machinery Other equipment, factory and office equipment Advance payments relating to plant and equipment and... -

Page 82

... Reserve Bank of New York on December 31, 2001. Certain prior year balances have been reclassified to conform with the Group's current year presentation. Commercial practices with respect to the products manufactured by DaimlerChrysler necessitate that sales financing, including leasing alternatives... -

Page 83

... net of related income taxes as a separate component of stockholders' equity until realized. The Group is not aware of an active market for the purchase or sale of retained interests, and accordingly, determines the estimated fair value of the retained interests by discounting the expected cash flow... -

Page 84

... The effect of this change on the net loss of 2001 was not significant. Leasing - The Group is a lessee of property, plant and equipment and lessor of equipment, principally passenger cars and commercial vehicles. All leases that meet certain specified criteria intended to represent situations where... -

Page 85

... selling price of the product or service resulting from any cash sales incentive should be classified as a reduction of revenue. If the sales incentive is a free product or service delivered at the time of the sale, the cost of the free product or service should be classified as cost of sales. The... -

Page 86

... to Consolidated Financial Statements In July 2001, the FASB issued SFAS 141, "Business Combinations," and SFAS 142. SFAS 141 requires that the purchase method of accounting be used for all business combinations initiated after June 30, 2001. SFAS 141 also specifies the types of acquired intangible... -

Page 87

... include 96 associated companies (2000: 74) accounted for at cost and recorded under investments in related companies as these companies are not material to the respective presentation of the financial position, results of operations or cash flows of the Group. Further information with respect to... -

Page 88

.... In June 2001, Volvo AB sold its 3.3% interest in MMC, plus its operational contracts with MMC, to DaimlerChrysler for $297 million (â,¬343 million) increasing DaimlerChrysler's interest in MMC to 37.3%. In August 2000, DaimlerChrysler signed a sale and purchase agreement with the Canadian company... -

Page 89

... investment in Hyundai as an available-for-sale security. In September 2000, DaimlerChrysler acquired 100% of the outstanding shares of the Canadian company Western Star Trucks Holdings Ltd. for approximately â,¬500 million. The acquisition was accounted for using the purchase method of accounting... -

Page 90

... (â,¬42 million) for the year 2000. In 2000, DaimlerChrysler recorded an impairment charge in cost of sales of approximately â,¬500 million for certain leased vehicles in the Services segment. Declining resale prices of used vehicles in the North American and the U.K. markets required the Group to... -

Page 91

... and rental income, other than relating to financial services leasing activities (â,¬191 million, â,¬178 million and â,¬153 million in 2001, 2000 and 1999, respectively). In 2001, gains on sales of companies of â,¬465 million were recognized in other income. 7. Turnaround Plan for the Chrysler Group... -

Page 92

... program under which dealers may earn cash payments based on levels of achievement compared to pre-assigned monthly retail sales objectives. 8. Financial Income, net Year ended December 31, (in millions of â,¬) 2001 2000 1999 Income (loss) from investments of which from affiliated companies... -

Page 93

... millions of â,¬) 2001 2000 1999 Current taxes Germany Non-German countries Deferred taxes Germany Non-German countries 637 (1,695) (777) 1,490 (606) 1,999 836 1,085 4,533 793 (512) (45) 1,160 1,074 1,538 For German companies, the deferred taxes at December 31, 2001 are calculated using a federal... -

Page 94

...061 million) and credit carryforwards amounting to â,¬1,552 million (2000: â,¬776 million), determined in accordance with U.S. GAAP. The corporate tax NOLs and credit carryforwards relate to losses of non-German companies and German non-Organschaft companies and are partly limited in their use to... -

Page 95

..., (in millions of â,¬) 2001 2000 1999 Expense (benefit) for income taxes before extraordinary items Income tax expense of extraordinary items Income tax benefit from changes in accounting principles Stockholders' equity for employee stock option expense in excess of amounts recognized for financial... -

Page 96

... matters or at certain times after three years. The price is based on the average closing mid-market price of EADS shares during the 30 trading days prior to the exercise of the put option. In 2000, Ballard Power Systems Inc., a developer of fuel cells and related power generation systems, issued... -

Page 97

...from customers for equipment on operating leases at December 31, 2001 are as follows: (in millions of â,¬) Less: Advance payments received thereof relating to long-term contracts and programs in process â,¬110 (2000: â,¬608) (536) 16,754 16,283 Certain of the Group's U.S. inventories are valued... -

Page 98

... 31, 2001, â,¬35,551 million of the financing receivables mature after more than one year (2000: â,¬28,138 million). Sales financing and finance lease receivables consist of retail installment sales contracts secured by automobiles and commercial vehicles. Contractual maturities applicable to... -

Page 99

... Trading Securities Investments and long-term financial assets available-for-sale The aggregate costs, fair values and gross unrealized holding gains and losses per security class are as follows: (in millions of â,¬) Cost 819 112 27 131 301 96 1,239 241 410 3,376 460 3,836 At December 31, 2001... -

Page 100

... primarily of purchase agreements, commercial paper and certificates of deposit. 19. Liquid Assets As of December 31, 2001, â,¬7,632 million of the total prepaid expenses mature after more than one year (2000: â,¬6,819 million). 21. Stockholders' Equity Number of Shares Issued and Outstanding... -

Page 101

... this date will be mandatorily converted at a conversion rate between 0.86631 and 1.25625 Ordinary Shares of DaimlerChrysler AG per note to be determined on the basis of the average market price for the shares during the last 20 trading days before June 8, 2002. During 2001, 87 (2000: 92; 1999: 665... -

Page 102

...-month and one-year anniversaries of the consummation date. A summary of the activity related to the Group's SAR plans as of and for the years ended December 31, 2001, 2000 and 1999 is presented below (SARs in millions): 2001 2000 1999 Weightedaverage Number exercise of SARs price Weightedaverage... -

Page 103

... price of the original option and the fair value of the Group's stock at the exercise date rather than receiving DaimlerChrysler Ordinary Shares. Analysis of the stock options issued to eligible employees is as follows (options in millions): 2001 2000 1999 Average Average Average Number conversion... -

Page 104

...earned in the last year or last five years of employment while others are fixed plans depending on ranking (both wage level and position). At December 31, 2001, plan assets were invested in diversified portfolios that consisted primarily of debt and equity securities, including 2.0 million shares of... -

Page 105

...) (1,357) 807 (110) (7,383) - 1,540 (35) (6,631) Change in plan assets: Fair value of plan assets at beginning of year Foreign currency exchange rate changes Actual return on plan assets Employer contributions Plan participant contributions Dispositions Acquisitions and other Benefits paid Fair... -

Page 106

... assumptions: Discount rate Expected return on plan assets Rate of compensation increase 6.0 7.9 3.0 6.5 7.9 3.0 6.0 7.7 2.8 7.4 10.1 5.4 7.7 10.2 5.5 7.5 9.8 5.9 The components of net pension cost were as follows for the years ended December 31, 2001, 2000 and 1999: 2001 2000 1999 (in millions of... -

Page 107

... on plan assets Employer contributions Benefits paid Fair value of plan assets at end of year 2,995 167 (181) 9 (8) 2,982 2,816 The components of net postretirement benefit cost were as follows for the years ended December 31, 2001, 2000 and 1999: (in millions of â,¬) 2001 2000 1999 Service cost... -

Page 108

... for termination benefits of â,¬1,504 million (2000: â,¬16 million; 1999: â,¬183 million), in 2001 principally within Chrysler Group (see Note 7) and Freightliner (see Note 5), in 2000 principally within Mercedes-Benz Passenger Cars & smart and Commercial Vehicles and in 1999 principally within... -

Page 109

...from capital lease and residual value guarantees of which due in more than five years â,¬209 (2000: â,¬226) Long-term financial liabilities 40,773 2003- 2019 8,194 6,800 71 149 At December 31, 2001, the Group had unused short-term credit lines of â,¬5,796 million (2000: â,¬15,216 million) and... -

Page 110

... Total one year five years 536 794 8,291 9,621 1 - 1,283 1,284 1 - 161 162 (in millions of â,¬) Liabilities to affiliated companies Liabilities to related companies Other liabilities As of December 31, 2001, other liabilities include tax liabilities of â,¬620 million (2000: â,¬683 million) and... -

Page 111

... voluntary service actions and recall actions to address various customer satisfaction, safety and emissions issues related to vehicles it sells. DaimlerChrysler establishes reserves for product warranty, including the estimated cost of these service and recall actions, when the related sale is... -

Page 112

... rental and lease agreements which have initial or remaining terms in excess of one year at December 31, 2001 are as follows: (in millions of â,¬) Market risks are quantified according to the "value-at-risk" method, which is commonly used among banks. Using historical variability of market... -

Page 113

...2001 and 2000. The fair values of residual cash flows and other subordinated amounts arising from receivable sale transactions were estimated by discounting expected cash flows at current interest rates. Financial Liabilities - The fair value of publicly traded debt was estimated using quoted market... -

Page 114

...and cash needs of its day-to-day operations. In addition a substantial volume of interest rate sensitive assets and liabilities is related to the leasing and sales financing business which is operated by DaimlerChrysler Services. In particular, the Group's leasing and sales financing business enters... -

Page 115

... reclassified into financial income, net, as a yield adjustment in the same period in which the related interest on the floating-rate debt obligations affect earnings. For the year ended December 31, 2001, net losses of â,¬12 million (2000: net losses of â,¬3 million), representing principally... -

Page 116

...received and paid to securitization trusts were as follows: (in millions of â,¬) 2001 2000 At December 31, 2001, the significant assumptions used in estimating the residual cash flows from sold receivables and the sensitivity of the current fair value to immediate 10% and 20% adverse changes are as... -

Page 117

... parts and accessories. The products are sold mainly under the brand names Mercedes-Benz and Freightliner. Services. The activities in this segment extend to the marketing of services related to financial services (principally retail and lease financing for vehicles and dealer financing), insurance... -

Page 118

...represent the purchase of property, plant and equipment. Segment information as of and for the years ended December 31, 2001, 2000 and 1999 follows: (in millions of â,¬) Mercedes-Benz Passenger Cars & smart Chrysler Group Commercial Vehicles Other Services Activities Eliminations Consolidated... -

Page 119

... Profit of the Mercedes-Benz Passenger Cars & smart segment for the year ended December 31, 2000, includes â,¬470 million of non-cash charges related to the adoption of the European Union's directive regarding end-of-life vehicles and related to fixed cost reimbursement agreements with MCC smart... -

Page 120

... per share for the years ended December 31, 2001 and 2000, because the options' underlying exercise prices were greater than the average market prices for DaimlerChrysler Ordinary Shares on December 31, 2001 and 2000, respectively. Income tax charges of â,¬263 million and â,¬812 million relating to... -

Page 121

... Group Earl G. Graves New York Chairman and CEO of Earl G. Graves Ltd. (since April 12, 2001) Prof. Victor Halberstadt Amsterdam Professor of Public Economics at Leiden University, Netherlands (since April 12, 2001) Robert J. Lanigan Toledo Chairman Emeritus of Owens-Illinois, Inc.; Founder Partner... -

Page 122

...Motors Corporation (MMC). The current stage of plans to build a small car with MMC was also discussed in this context. Furthermore, the Supervisory Board consented to the sale of a majority interest in the TEMIC Group to Continental AG. In April 2001, the strategy of the Mercedes-Benz Passenger Cars... -

Page 123

..., human resources and earnings objectives, as well as the scope of financing limits for the year 2002. In April 2001, Mr. Robert E. Allen and Lord Browne of Madingley retired from their positions as members of the Supervisory Board representing the shareholders. In the 2001 Annual Meeting Mr. Earl... -

Page 124

... of the DaimlerChrysler Group Stockholders' equity in millions2) of â,¬ Ownership1) in % Revenues3) in millions of â,¬ 2001 2000 Employment at year-end 2001 2000 Mercedes-Benz Passenger Cars & smart Micro Compact Car smart GmbH, Renningen Mercedes-Benz U.S. International, Inc., Tuscaloosa... -

Page 125

Major Subsidiaries of the DaimlerChrysler Group 121 Ownership1) in % Stockholders' equity in millions2) of â,¬ Revenues3) in millions of â,¬ 2001 2000 Employment at year-end 2001 2000 Vehicle Sales Organization Mercedes-Benz USA, Inc., Montvale4) DaimlerChrysler France S.A.S., Le Chesnay ) ... -

Page 126

...on leased equipment Cash provided by operating activities Cash used for investing activities From the stock exchanges: Share price at year-end Frankfurt (â,¬) New York (US $) Average shares outstanding (in millions) Average dilutive shares outstanding (in millions) Average annual number of employees... -

Page 127

... 484 6161 Fax +34 91 484 6019 Melbourne Phone +61 39 566 9104 Fax +61 39 566 6210 Mexico City Phone +52 5081 7376 Fax +52 5081 7674 Moscow Phone +7 095 797 5350 Fax +7 095 797 5352 New Delhi Phone +91 1 1410 4959 Fax +91 1 1410 5226 Paris Phone +33 1 39 23 5400 Fax +33 1 39... -

Page 128

..., Form 20-F and the interim reports are available on the Internet. The most important financial charts can also be accessed. Our address is: www.daimlerchrysler.com Auburn Hills, MI 48326-2766 USA Phone +1 248 576 5741 www.daimlerchrysler.com DaimlerChrysler Services AG 10875 Berlin Germany Phone... -

Page 129

... online Additional information on DaimlerChrysler is available on the Internet: www.daimlerchrysler.com Financial Diary 2002 Annual Results Press Conference February 20, 2002 10:00 a.m. Mercedes-Benz Technology Center (MBTC) Sindelfingen Analysts' and Investors' Conference February 20, 2002... -

Page 130

DaimlerChrysler AG Stuttgart, Germany Auburn Hills, USA www.daimlerchrysler.com