Mattel 2001 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2001 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

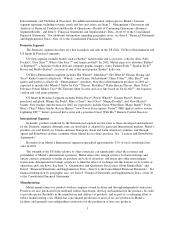

Item 6. Selected Financial Data

For the Year Ended December 31, (a)(b)

2001 2000 1999 1998 1997

(In thousands, except per share and percentage information)

Operating Results:

Net sales ............................ $4,804,062 $4,669,942 $4,595,490 $4,698,337 $4,778,663

Gross profit .......................... 2,266,884 2,100,785 2,182,021 2,309,795 2,364,085

% of net sales ..................... 47.2% 45.0% 47.5% 49.2% 49.5%

Operating profit (c) ..................... 585,142 378,403 301,773 570,279 515,212

% of net sales ..................... 12.2% 8.1% 6.6% 12.1% 10.8%

Income from continuing operations before

income taxes, cumulative effect of change in

accounting principles and extraordinary

item .............................. 430,010 225,424 170,164 459,446 425,082

Provision for income taxes ............... 119,090 55,247 61,777 131,193 135,288

Income from continuing operations before

cumulative effect of change in accounting

principles and extraordinary item ......... 310,920 170,177 108,387 328,253 289,794

Loss from discontinued operations (a) ....... — (601,146) (190,760) (122,200) (467,905)

Cumulative effect of change in accounting

principles .......................... (12,001) — — — —

Extraordinary item-loss on early retirement of

debt.............................. — — — — (4,610)

Net income (loss) ...................... 298,919 (430,969) (82,373) 206,053 (182,721)

Income (Loss) Per Common Share (d):

Income (loss) per common share—Basic

Income from continuing operations ..... 0.72 0.40 0.25 0.82 0.76

Loss from discontinued operations (a) . . . .

— (1.41) (0.46) (0.31) (1.27)

Cumulative effect of change in accounting

principles ...................... (0.03) — — — —

Extraordinary item ................. — — — — (0.01)

Net income (loss) .................. 0.69 (1.01) (0.21) 0.51 (0.52)

Income (loss) per common share—Diluted

Income from continuing operations ..... 0.71 0.40 0.25 0.76 0.74

Loss from discontinued operations (a) . . . .

— (1.41) (0.45) (0.29) (1.24)

Cumulative effect of change in accounting

principles ...................... (0.03) — — — —

Extraordinary item ................. — — — — (0.01)

Net income (loss) .................. 0.68 (1.01) (0.20) 0.47 (0.51)

Dividends Declared Per Common Share (d)

. . 0.05 0.27 0.35 0.31 0.27

As of Year End (a)(b)

2001 2000 1999 1998 1997

(In thousands)

Financial Position:

Total assets .......................... $4,540,561 $4,313,397 $4,673,964 $4,612,770 $3,915,059

Long-term liabilities .................... 1,205,122 1,407,892 1,145,856 1,124,756 808,297

Stockholders’ equity .................... 1,738,458 1,403,098 1,962,687 2,170,803 1,933,338

(a)

Financial data for 1997 through 1999 reflect the retroactive effect of the merger, accounted for as a

pooling of interests, with The Learning Company, Inc. (‘‘Learning Company’’) in May 1999. As more

fully described in Note 13 to the Consolidated Financial Statements, the Consumer Software segment, which

was comprised primarily of Learning Company, was reported as a discontinued operation effective

13