Marks and Spencer 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 MARKS AND SPENCER GROUP PLC

Remuneration report

Compliance

The Remuneration Committee has adopted the principles of good

governance relating to directors’ remuneration as set out in the

new Combined Code. This report complies with the Companies

Act 1985, as amended by the Directors’ Remuneration Report

Regulations 2002 and the Listing Rules of the Financial Services

Authority.

Part 1: Unaudited Information

Remuneration Committee

With effect from 15 July 2004, the Committee comprises Jack

Keenan (Chairman), Anthony Habgood, Steven Holliday and Kevin

Lomax, all of whom are independent, non-executive directors.

Dame Stella Rimington and Brian Baldock were members of the

Committee until they left the Company on 14 July 2004 and

Barbara Cassani, until she left the Company on 30 April 2004.

There were six meetings of the Remuneration Committee during

the period under review and all individuals who were a member of

the Committee at that time attended the meetings, with the

exception of Barbara Cassani, who did not attend the meeting on

21 April 2004. The Committee recommends to the Board the

remuneration framework to allow the Company to attract and

retain its executive directors and senior management, giving due

regard to the financial and commercial health of the Company. In

addition, the Committee is responsible for setting the remuneration

for the Chairman. The Committee’s approach reflects the

Company’s overall philosophy that all employees should be

appropriately and competitively rewarded, in particular to recognise

that the highest standards of performance deliver improved

business results.

The Committee keeps itself fully informed of all relevant

developments and best practice in the field of remuneration and

seeks advice where appropriate from external advisors. New

Bridge Street Consultants LLP have provided material advice to

the Committee and the Company on directors’ remuneration and

share schemes in the past year, in particular the role and shape of

the incentive schemes.

The Company Chairman, Chief Executive, Group Secretary and

Head of Senior Remuneration also materially assisted the

Committee in its deliberations, except in relation to their own

remuneration.

Remuneration policy

Marks & Spencer depends upon the skill and experience of

motivated employees throughout all levels of the business. It is part

of our strategy to have a range of schemes to attract, motivate

and retain high calibre individuals to drive the Company’s recovery

and deliver improved performance. The Board considers the

principles of good governance when deciding the remuneration

strategy, and recognises that the level of remuneration and benefits

we offer is key to supporting this objective and maintaining our

market position as an employer of choice.

Total remuneration for executive directors comprises base pay,

variable pay, pension and benefits. Base pay and benefits are set

having regard to market practice and levels paid by similar

companies. Variable pay provides the opportunity to earn greater

amounts for the highest standards of performance. The

performance-related element forms a significant proportion of the

total potential package.

During the year, the Remuneration Committee has undertaken a

comprehensive review of the remuneration policy, and in particular

the role of variable pay. Following this review, the Company is

proposing to make changes to the bonus and share incentive

arrangements. Shareholder approval will be sought for a new

Performance Share Plan and a new Executive Share Option Plan.

Full details of both these Plans are contained in the Notice of

Meeting.

In summary, the proposals are:

•To enhance annual bonus potential for approximately

400 of the more senior executives. Payment will require

the satisfaction of stretching targets and a significant

proportion of the bonus payable will be deferred into shares

for three years;

•To adopt a new Performance Share Plan as the Company’s

primary long-term incentive arrangement. It is intended to

make awards under this Plan to approximately 100 of the most

senior executives. Vesting of these awards will be based on

demanding earnings per share growth targets;

•To adopt a new Executive Share Option Scheme to be used

by the Remuneration Committee upon recruitment or in

exceptional circumstances, if it considers it appropriate

to do so; and

•To make no further awards under the Company’s Share

Matching Plan.

The proposals have been designed to rebalance the remuneration

package by weighting variable pay more towards annual

performance. To receive awards, executives will be required to

achieve demanding targets under the annual and long-term

arrangements, with the focus on targets that are most relevant

to them.

The proposals will use substantially fewer shares than the current

arrangements, resulting in a lower cost to the Company at target

performance than is currently the case, and only results in

additional cost at high levels of performance.

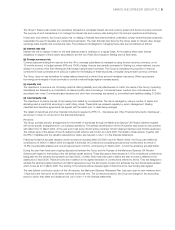

Expected proportions of future annual remuneration

package for executive directors

The value placed on long-term incentives assumes ‘on-target’

performance and comprises the expected cash value to executives

after three years, discounted back to its present value, of i) bonus

compulsorily deferred into shares and ii) performance shares

awarded under the Performance Share Plan.

Chairman’s and non-executive directors’ remuneration

The remuneration for the non-executive directors is determined by

the Chairman and executive directors and is designed to recognise

both the responsibilities of non-executive directors and to attract

individuals with the necessary skills and experience to contribute to

the future growth of the Company. The non-executives are paid a

basic fee with additional fees payable for committee membership

and to the chair of the committees. These fees are neither

Long-term

incentives

35%

On-target

annual cash

bonus

13%

Pension

9%

Salary

43%

Performance-relatedFixed