Marks and Spencer 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MARKS AND SPENCER GROUP PLC 9

The Group’s Treasury also enters into derivatives transactions, principally interest rate and currency swaps and forward currency contracts.

The purpose of such transactions is to manage the interest rate and currency risks arising from the Group’s operations and financing.

It has been, and remains, the Group’s policy that no trading in financial instruments shall be undertaken, except where financial constraints

necessitate the need to liquidate any outstanding investments. The main financial risks faced by the Group relate to interest rates, foreign

exchange rates, liquidity and counterparty risks. The policies and strategies for managing these risks are summarised as follows:

(a) Interest rate risk

Interest rate risk in respect of debt on the retail balance sheet is reviewed on a regular basis. At the balance sheet date, interest

obligations in respect of the property securitisation and the two Public Bond issues in Sterling were at fixed rates.

(b) Foreign currency risk

Currency exposure arising from exports from the UK to overseas subsidiaries is managed by using forward currency contracts, out to

15 months forward, to hedge between 80% and 100% of sales. Imports are primarily contracted in Sterling but, where relevant, imports

arising in a currency other than Sterling are fully hedged using forward contracts. The Group is increasing the proportion of imports

contracted in local currencies and a policy is in place for the hedging of these exposures, principally using forward currency contracts.

The Group does not use derivatives to hedge balance sheet and profit and loss account translation exposures. Where appropriate,

borrowings are arranged in local currencies to provide a natural hedge against overseas assets.

(c) Liquidity risk

The objective is to ensure a mix of funding methods offering flexibility and cost effectiveness to match the needs of the Group. Operating

subsidiaries are financed by a combination of retained profits, bank borrowings, commercial paper, medium-term note issuance and

securitised loan notes. Commercial paper issuance and short-term borrowings are backed by committed bank facilities totalling £1,260m.

(d) Counterparty risk

The objective is to reduce the risk of loss arising from default by counterparties. The risk is managed by using a number of banks and

allocating each a credit limit according to credit rating criteria. These limits are reviewed regularly by senior management. Dealing

mandates and derivative agreements are agreed with the banks prior to deals being arranged.

The details of derivatives and other financial instruments required by FRS 13 – ‘Derivatives and Other Financial Instruments: Disclosures’,

are shown in notes 19, 22 and 24 to the financial statements.

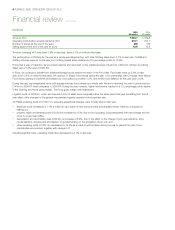

Pensions

The Group provides pension arrangements for the benefit of employees through the Marks and Spencer UK Pension Scheme together

with some specific arrangements for our overseas operations. The defined benefit section of the UK scheme was closed to new entrants

with effect from 31 March 2002. At the year end it had some 35,000 active members, 56,000 deferred members and 36,000 pensioners.

The market value of the assets of the UK defined benefit scheme was £3.9bn at 2 April 2005. Full details of these assets, together with

the FRS 17 liabilities and the valuation assumptions made, are included in note 11 to the financial statements.

Following the last full actuarial valuation (which showed an actuarial deficit of £585m as at 31 March 2003), the Group paid additional

contributions of £400m in March 2004 and agreed a Schedule of Contributions comprising annual service contributions at a level of

15.8% of pensionable salaries and nine annual payments of £33m, commencing 31 March 2007, to fund the remaining actuarial deficit.

During the year there have been ongoing discussions between the Group and the Trustees of the Marks and Spencer UK Pension

Scheme with regard to the funding of the UK defined benefit scheme. These discussions have resulted in £115m of additional contributions

being paid into the scheme during March and April 2005, of which £64m had been paid in before the year end and is reflected in the

assets as at 2 April 2005. These amounts are in addition to the agreed Schedule of Contributions referred to above. They are designed to

address the less favourable investment conditions experienced over the last couple of years and anticipate the next full actuarial valuation

which is due as at 31 March 2006. The funding of the scheme will be reviewed again at that time and a new funding plan agreed.

The new defined contribution section of the UK scheme, the Marks and Spencer Retirement Plan, has been open to new members from

1 April 2003 and had some 4,000 active members at the year end. The contributions paid by the Group are charged in the accounting

period to which they relate and details are set out in note 11 to the financial statements.