Marks and Spencer 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT AND FINANCIAL STATEMENTS 2005

Table of contents

-

Page 1

ANNUAL REPORT AND FINANCIAL STATEMENTS 2005 -

Page 2

...full Annual Report and Accounts of Marks and Spencer Group plc for 2005, prepared in accordance with the Companies Act 1985. 1 2 3 11 16 26 26 27 29 30 30 30 31 32 33 58 61 CHAIRMAN'S STATEMENT CHIEF EXECUTIVE'S REVIEW FINANCIAL REVIEW CORPORATE GOVERNANCE REMUNERATION REPORT DIRECTORS' INTERESTS... -

Page 3

... contribution and welcome the new Board members. Our relationship with Marks & Spencer investors - both individual and institutional - is high on the Board's list of priorities. Last year, we made sure a far greater proportion of shareholders had access to the Company's management than ever before... -

Page 4

... to shareholders and sold M&S Money, our Financial Services business, to HSBC. We reduced the Executive Board to a team of three. The business unit directors all now report directly to the Chief Executive and we have set up a stock planning function. These actions have laid the foundations necessary... -

Page 5

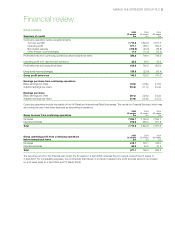

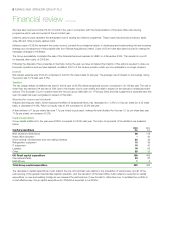

MARKS AND SPENCER GROUP PLC 3 Financial review Group summary Summary of results Continuing operations before exceptional items Turnover (ex VAT) Operating proï¬t Net interest expense Other ï¬nance income/(charges) Proï¬t before tax from continuing operations before exceptional items Operating ... -

Page 6

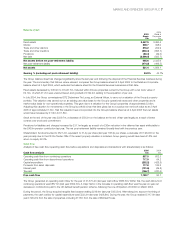

... of the changes to the general merchandise logistics operation introduced last year. UK Retail operating costs of £1,843.1m, excluding exceptional charges, were broadly level on last year employee costs increased by 1.1% to £922.4m as a result of new stores and the annual salary review, offset by... -

Page 7

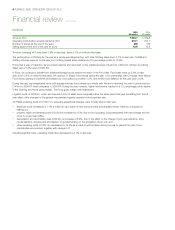

... Marks & Spencer branded businesses increased by 45.2% to £60.7m. In the Republic of Ireland, sales were ahead of last year and the performance of the new stores in Blanchardstown and Dundrum has been encouraging. Our franchisees have seen good like-for-like sales increases and are investing in new... -

Page 8

... and implementing the new business strategy as a consequence of the possible offer from Revival Acquisitions Limited. Costs of £8.4m have also been incurred in making the necessary changes to the Board. The Group successfully completed the sale of the Financial Services business to HSBC on... -

Page 9

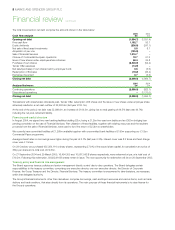

... the balance sheet for the Financial Services businesses at that date. Fixed assets decreased by £45.9m to £3,447.5m. Included within this are properties owned by the Group with a net book value of £2.1bn, of which £1.7bn was unencumbered, and goodwill of £122.4m relating to the acquisition of... -

Page 10

... policies and senior management directly control day-to-day operations. The Board delegates certain responsibilities to the treasury committee, comprising one executive director, one non-executive director, the Director of Corporate Finance, the Group Treasurer and the Director, Financial Services... -

Page 11

... of the scheme will be reviewed again at that time and a new funding plan agreed. The new deï¬ned contribution section of the UK scheme, the Marks and Spencer Retirement Plan, has been open to new members from 1 April 2003 and had some 4,000 active members at the year end. The contributions paid by... -

Page 12

... changes in the accounting treatment for property, share-based payments, ï¬nancial instruments and software. The Group has restated the results for the period ended 2 April 2005 to reï¬,ect these changes and a summary of the impact is set out below: 2004/05 UK GAAP IFRS Change Change % Turnover... -

Page 13

... and practices and to provide insight into how the Board and management run the business for the beneï¬t of shareholders. A detailed account of how we comply with the Code provisions can be found on the Corporate Governance section of the Company's website, together with the terms of reference of... -

Page 14

...Lomax became a member on 15 July 2004. Its primary role is to recommend to the Board the remuneration strategy and framework, giving due regard to the ï¬nancial and commercial health of the company and to ensure the executive directors and senior management are fairly rewarded for their individual... -

Page 15

..., including being named as Business in the Community's (BitC) 2004 Company of the Year. Further information is given on page 16 of the Annual Review and our CSR report is available on the Company's website. The following table sets out the number of meetings of the Board and its committees during... -

Page 16

...• monthly comparison of operating divisions' actual ï¬nancial performance against budget; and • regular consideration by the Board of year-end forecasts. Regulatory update • reporting of accounting and legal developments; and • regular brieï¬ngs on latest best practice corporate governance... -

Page 17

.... At last year's Annual General Meeting, the Chairman made a commitment to explore how we could best reward our loyal shareholders who are also customers. In August 2004 we sent Café Revive and Spend and Save vouchers to shareholders offering Autumn discounts in stores, which proved very popular... -

Page 18

... review of the remuneration policy, and in particular the role of variable pay. Following this review, the Company is proposing to make changes to the bonus and share incentive arrangements. Shareholder approval will be sought for a new Performance Share Plan and a new Executive Share Option Plan... -

Page 19

... be receivable in the event that the executive leaves employment during the deferral period. Long-term Incentive Schemes (a) Executive Share Matching Plan An Executive Share Matching Plan for senior management was approved by shareholders at the Annual General Meeting in 2002 and was introduced in... -

Page 20

...increased shareholder value. (d) All-Employee Share Schemes Executive directors can also participate in the share schemes open to all employees of the Company. The Save As You Earn (SAYE) Scheme is currently offered annually. Details of grants and awards made to executive directors under all schemes... -

Page 21

...guaranteed to increase by the rise in inï¬,ation, up to a maximum of 3% per annum. The Marks & Spencer Deï¬ned Beneï¬t Pension Scheme was closed to new members with effect from 31 March 2002. The Marks & Spencer Retirement Plan Executive directors, along with other employees joining the Company on... -

Page 22

... and paid in monthly instalments. However, entitlement to participate in future awards under the Company's share schemes ceases on summary termination. Executive directors All executive directors have rolling service contracts, which can be terminated by the Company giving 12 months' notice and... -

Page 23

... 2004, reï¬,ecting his increased responsibilities. His termination payment was made up of salary £485,000, beneï¬ts £246,000. Luc Vandevelde's salary was paid in the form of shares bought on the 10th of each month at the market price of shares on that day. His termination payment, was made up... -

Page 24

... with bonus. Market price on date of award was 362.25p. Laurel Powers-Freeling was the only executive director who was a member of this scheme until she left the Group. All outstanding shares lapsed when Maurice Helfgott left the Group's employment, apart from the 1,702 matching shares which... -

Page 25

MARKS AND SPENCER GROUP PLC 23 b) Directors' Share Option Schemes The options detailed in the table below may not be exercisable for either of the following reasons: (i) The options have not been held for three years and therefore cannot be exercised under scheme rules; or (ii) The options have not... -

Page 26

... attached to the Executive Share Matching Plan and the Executive Share Option Schemes as described in long-term incentive schemes (section (a) and (b) on pages 17 and 18) have been audited. 3 3 Directors' pension information a) Pension beneï¬ts The Directors' Remuneration Report Regulations 2002... -

Page 27

... 2005 respectively. The additional pension relates to the increase in the deferred pension during the year gross and net of inï¬,ation under the Directors' Remuneration Report Regulations 2002, and the Listing Rules respectively. The transfer value of the deferred pension calculated as at 2 April... -

Page 28

...employee share option schemes is given in note 10 to the ï¬nancial statements. There have been no other changes in the directors' interests in shares or options granted by the Company and its subsidiaries between the end of the ï¬nancial year and one month prior to the notice of the Annual General... -

Page 29

...non-equity shares. The ï¬nal ordinary dividend will be paid on 15 July 2005 to shareholders whose names are on the Register of Members at the close of business on 3 June 2005. Changes in share capital (i) Issue of new ordinary shares During the period, 28,309,324 ordinary shares in the Company were... -

Page 30

...the business. We continue to support employee share ownership through long-established employee share schemes, membership of which is service-related, details of which are given on pages 40 to 41. Equal opportunities The Group is committed to an active Equal Opportunities Policy from recruitment and... -

Page 31

... and the Annual review and summary ï¬nancial statement. We review whether the Corporate governance statement reï¬,ects the Company's compliance with the nine provisions of the 2003 FRC Combined Code speciï¬ed for our review by the Listing Rules of the Financial Services Authority, and we report if... -

Page 32

... 290.6 CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES Notes 52 weeks ended 2 April 2005 £m 53 weeks ended 3 April 2004 £m Proï¬t attributable to shareholders Exchange differences on foreign currency translation Unrealised surplus on revaluation of investment properties Impairment... -

Page 33

...post-retirement liability Net assets Capital and reserves Called up share capital Share premium account Capital redemption reserve Revaluation reserve Other reserve Proï¬t and loss account Shareholders' funds (including non-equity interests) Equity shareholders' funds Non-equity shareholders' funds... -

Page 34

... Cash inï¬,ow from operating activities Returns on investments and servicing of ï¬nance Interest received Interest paid Non-equity dividends paid Net cash outï¬,ow from returns on investments and servicing of ï¬nance Taxation UK corporation tax paid Overseas tax paid Cash outï¬,ow for taxation... -

Page 35

... Companies Act 1985 requirements. Turnover Retail turnover comprises sales of goods to customers outside the Group less an appropriate deduction for actual and expected returns, discounts and loyalty scheme voucher costs, and is stated net of Value Added Tax and other sales taxes. Sales of furniture... -

Page 36

... or in Financial Services turnover as appropriate. This represents a departure from the Companies Act 1985 requirements concerning the valuation of current asset investments. These assets are held as investments in the insurance and the long-term assurance businesses and the directors consider that... -

Page 37

...relate entirely to Financial Services activities. Operating proï¬t for Financial Services includes £1.6m (last year £9.3m) arising on Marks & Spencer Chargecard transactions. This fee is payable by UK...last year £518.1m). value of goods exported from the UK, including shipments to international ... -

Page 38

... in the above are fees paid to the Group's auditors in the UK in relation to the Tender Offer of £0.4m, the sale of Financial Services of £0.5m, the acquisition of per una of £0.1m and Defence of £0.8m. Of these costs, £1.6m is included within further assurance services and £0.2m within tax... -

Page 39

... year relates to the closure of the Continental European operations. On 9 November 2004, the Group completed the sale of Marks and Spencer Retail Financial Services Holdings Limited to HSBC Holdings plc. The net sale proceeds were £533.6m (see note 30B) after accounting for a pre-sale dividend of... -

Page 40

...in excess of) depreciation Other timing differences Net effect of restructuring charges Net effect of different rates of tax in overseas businesses Adjustments to tax charge in respect of prior periods Proï¬t on sale of Financial Services Other exceptional charges Total current taxation 745.3 223... -

Page 41

... The aggregate remuneration and associated costs of Group employees were: 2005 Continuing operations1 £m Discontinued operations £m Total £m Continuing operations1 £m Discontinued operations £m 2004 Total £m Wages and salaries Social security costs Pension costs (see note 11) Employee welfare... -

Page 42

... 223p 156p 250p 283p 228p 280p E Executive Share Option Schemes Under the terms of the current Scheme, approved by shareholders in 2002, the Board may offer options to purchase ordinary shares in the Company to executive directors and senior employees at the market price on a date to be determined... -

Page 43

...plan currently operates for nine members of senior management. Participants are required to invest one-third of any annual bonus earned in shares in the Company. The balance of the annual bonus may be invested voluntarily. The pre-tax value of the invested bonus will be matched by an award of shares... -

Page 44

... qualiï¬ed actuaries to take account of the requirements of FRS 17 in order to assess the liabilities of the schemes at 2 April 2005: 2005 % 2004 % 2003 % Rate of increase in salaries Rate of increase in pensions in payment1 Discount rate Inï¬,ation rate Long-term healthcare cost increases... -

Page 45

...Expected long-term rate of return p.a. 2005 2004 2003 % % % 2005 £m 2004 £m Value 2003 £m UK equities Overseas equities Government bonds Corporate bonds (Triple B or above) Other Total market value of assets1 Present value of scheme liabilities Pension scheme deï¬cit Unfunded pension plans Post... -

Page 46

...533.7 (15.2) 213.8 0.2 (669.5) The UK deï¬ned beneï¬t pension scheme is closed to new members and so under the projected unit method the service cost rate would be expected to increase over time due to the expected increase in the average age of employed members subject to actual experience. cash... -

Page 47

MARKS AND SPENCER GROUP PLC 45 13 INTANGIBLE FIXED ASSETS Cost Additions At 2 April 2005 Accumulated amortisation Charge for the period At 2 April 2005 Net book value at 2 April 2005 Group Goodwill £m 125.5 125.5 3.1 3.1 122.4 On 4 October 2004, the Group acquired Per Una Group Limited for a ... -

Page 48

...% equity interest in Hedge End Park Limited, a property investment company incorporated in Great Britain. The partner in the joint venture is J Sainsbury plc. The Group's investment in the joint venture includes accumulated reserves of £2.6m (last year £2.4m). investments include listed securities... -

Page 49

... Chester Limited Marks and Spencer SCM Limited Per Una Group Limited The Zip Project Limited Retailing Holding Company Holding Company Holding Company Retailing Retailing Retailing Credit Card Handling Financial Services Financial Services Finance Finance Finance Finance Finance Property Investment... -

Page 50

....5m) in relation to the long-term assurance business. 18 CASH AT BANK AND IN HAND Cash at bank includes commercial paper and short-term deposits with banks and other ï¬nancial institutions with initial maturity of three months or less. 19 ANALYSIS OF FINANCIAL ASSETS After taking into account the... -

Page 51

...225.2 - - - - - 2,165.0 - - - - 0.2 160.7 2,325.9 1 2 Bank loans, overdrafts and commercial paper includes a £5.0m (last year £5.0m) loan from the Hedge End Park Limited joint venture. Other creditors include £2.3m (last year £32.6m) which is shown in the calculation of the Group's net debt... -

Page 52

... Notes to the ï¬nancial statements 22 ANALYSIS OF FINANCIAL LIABILITIES continued B Maturity of ï¬nancial liabilities Repayable within one year or on demand: Bank loans, overdrafts and commercial paper Syndicated bank facility Medium term notes Securitised loan notes B shares (see note 25) Other... -

Page 53

... short-term deposits placed with banks, ï¬nancial institutions and on money markets, and investments in short-term securities. Therefore, these fair values closely approximate book values. 2 Interest rate, cross currency swaps and forward foreign currency contracts have been marked to market to... -

Page 54

.... After taking into account the effect of any hedging transactions that manage transactional currency exposures, no Group company had any material monetary assets or liabilities in currencies other than their functional currencies at the balance sheet date. 25 CALLED UP SHARE CAPITAL Authorised... -

Page 55

... Spencer plc and shares are awarded to employees by the Trust in accordance with the wishes of Marks and Spencer plc under senior executive share schemes, the Share Matching Plan and Restricted Share Plan. 3The Company Share capital Ordinary Non-equity shares B shares £m £m Share premium account... -

Page 56

...losses) relating to the year Actuarial (losses)/gains net of taxation Sale/(purchase) of shares held by employee trusts New share capital subscribed Redemption of B shares Purchase of own shares Tender Offer expenses Net (decrease)/increase in shareholders' funds Opening shareholders' funds Closing... -

Page 57

... deposits treated as liquid resources Net sale of government securities Net sale/(purchase) of listed investments Net purchase of unlisted investments Cash inï¬,ow/(outï¬,ow) from decrease/(increase) in liquid resources C Financing Increase/(decrease) in bank loans, overdrafts and commercial paper... -

Page 58

...November 2004 the Group disposed of its interest in Marks and Spencer Retail Financial Services Holdings Limited to HSBC Holdings plc. £m Tangible ï¬xed assets Debtors Prepayments Cash and current asset investments Bank loans and overdrafts Creditors: amounts falling due within one year Creditors... -

Page 59

...- 3.5 33 FOREIGN EXCHANGE RATES The principal foreign exchange rates used in the ï¬nancial statements are as follows (local currency equivalent of £1): Weighted average sales rate 2005 2004 Weighted average proï¬t rate 2005 2004 Balance sheet rate 2005 2004 Euro US dollar Hong Kong dollar 1.46... -

Page 60

... cost of sales of Financial Services Discontinued operations Total operating proï¬t Analysed as: Before exceptional operating charges Exceptional operating charges Provision for loss on operations to be discontinued Proï¬t/(loss) on sale/closure of businesses (Loss)/proï¬t on disposal of property... -

Page 61

... Returns on investments and servicing of ï¬nance Taxation Capital expenditure and ï¬nancial investment Acquisitions and disposals Equity dividends paid Cash inï¬,ow/(outï¬,ow) before management of liquid resources and ï¬nancing Management of liquid resources Financing (Decrease)/increase in cash... -

Page 62

... items Dividend per share Dividend cover2 Proï¬t attributable to shareholders Dividends Proï¬t attributable to equity shareholders Average equity shareholders' funds Retail debt + net post-retirement liability Retail gearing Retail debt + net post-retirement liability + retail shareholders' funds... -

Page 63

... proï¬t Return on equity Risk management 57 16 53 30 60 14 C Capital commitments Capital expenditure Cash ï¬,ow statement Chairman's statement Charitable donations Chief Executive's review Contingent liabilities Corporate governance Cost of sales Creditors Currency risk Customer advances 57 6, 45... -

Page 64

www.marksandspencer.com