Kodak 2002 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

2

“

CHAIRMAN’S LETTER

To Our Shareholders

In 2002 — an exceptionally difficult year for most businesses — Eastman Kodak Company turned

in a strong performance that achieved or exceeded most of our strategic, operational and

financial objectives.

We strengthened our balance sheet and improved free cash flow. We also maintained our

common stock dividend. Our business groups introduced innovative new products. Worldwide

manufacturing productivity improved significantly. With a 25% total return, including dividends,

Kodak closed the year as the best-performing stock among companies that make up the Dow

Jones Industrial Average.

The continuing economic slump in the U.S., Europe and many other countries dampened

sales growth. Restrained consumer spending and a sluggish travel and vacation industry — along

with the continuing evolution of digital technology — impacted traditional photography sales in the

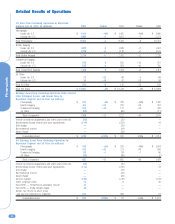

U.S. and Western Europe, especially in the fourth quarter. In this environment, 2002 worldwide

sales declined 3% compared with 2001. Even so, we managed the operational elements of our

business to achieve a 16% year-over-year increase in operational earnings. We continued to see

strong growth in the emerging markets of China (+25%), Russia (+20%) and India (+8%). In the

U.S., we held market share in consumer film steady for the fifth straight year.

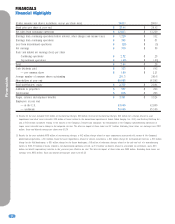

FINANCIAL PERFORMANCE

Our financial strategy again focused on generating cash to support the underlying value of the

company, pay down debt, and enable prudent investments for growth. By year’s end, we

delivered $948 million in operating cash flow by lowering inventories, reducing receivables and

keeping a tight lid on capital expenditures. In the process, we reduced debt by $594 million by

year’s end. We also bought back 7.4 million shares of Kodak stock from the company’s U.S.

pension plan, and ended a costly company-owned life insurance plan. Our cash position

increased by $121 million to $569 million.

Continuing in 2002 was a worldwide workforce reduction, with the final phase to be

completed in 2003. A further reduction in Kodak’s worldwide employment of an estimated 3% is

planned for 2003. A significant part of these reductions will result from consolidation of

photofinishing operations in the U.S. and Western Europe as the company continues to

rationalize and align its investments under our growth strategies.

GROWTH PLATFORM

While cost containment helped us navigate the shoals of a tough economy, we forged ahead with

activities related to our growth strategies. We continued significant investments in research and

development (R&D), the primary source of future growth through product innovation. Joint

venture investments with Heidelberger Druckmaschinen AG to form NexPress (digital printing),

Sanyo Electric to create SK Display Corp. (electronic displays) and with Hewlett-Packard for

Phogenix (retail photofinishing) are on track to deliver innovative new products to their markets.

Guiding our growth plans are four key strategies within the $385 billion infoimaging

market, where the convergence of imaging and information technology offers vast opportunity for

Kodak as we seek to expand our participation into growing segments:

• Expanding the benefits of film. Our traditional film business is sound as digital imaging

continues to evolve. An aggressive share management strategy enabled us to maintain our

U.S. consumer film market share. Sales in emerging markets such as China and Russia had

solid double-digit growth, allowing more people to benefit from the awesome capabilities of

film technology. Our new Kodak Vision2 motion picture film received rave reviews in

Hollywood and among the world’s cinematographers. Innovative one-time-use cameras

continued to grow as a major source of film revenues. We are leveraging our technical

leadership in film and digital imaging technology to create imaging systems for consumer,

health care, professional and commercial imaging markets.

• Driving image output in all forms. As digital image capture grows in the many markets

we serve, demand will accelerate for hard copy images from digital files. For example, in

In 2002—an exceptionally

difficult year for most

businesses—Kodak turned

in a strong performance . . .

With a 25% total return . . .

Kodak closed the year as

the best-performing stock

in the Dow Jones

Industrial Average.

. . . achieved a 16%

year-over-year increase

in operational

earnings.

. . . strong sales growth

in the emerging markets

of China (+25%),

Russia (+20%)

and India (+8%).