KeyBank 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

50

-40

-35

-30

-25

-20

-15

-10

-5

5

10

15

20

25

30

35

40

45

2002 2003 2004 200520012000

4 ᔤKey 2005

WHAT’S CHANGED?

Stronger management team: Six of Key’s 12 senior managers

have joined the company since 2002.

More profitable business mix: Divestitures of low-return,

transaction-only businesses, such as auto leasing and lending,

have made more capital available to build industry-leading

positions in such businesses as commercial real estate and

equipment financing.

Emerging sales culture: Desktop technology, better aligned

incentive compensation plans and new cross-selling programs

are energizing the ways Key bankers deliver their ideas.

Credit-quality discipline: Key has restored its long tradition

of strong credit quality.

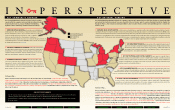

Accelerated Progress

Key’s Strategic Moves Paid Off In 2005

Key’s progress toward becoming a high-performing, relationship-based

company accelerated in 2005 because of the company’s ongoing strategic

actions. The result: Total return on Key’s shares since the beginning of 2001

has significantly outperformed the broad S&P 500 Index and finished

2005 about five percentage points above the S&P 500 Bank Index.

2001

Exit

Auto Leasing

Nonperforming

Assets: $947 Million

2002

Acquisitions:

Conning Asset Management, Union Bancshares

Senior Management Additions:

Tom Bunn, Vice Chairman;

Jeff Weeden, Chief Financial Officer

Nonperforming Assets: $993 Million

2005

Exit Indirect Auto Lending

Acquisitions:

Malone Mortgage Company,

ORIX Capital Markets servicing unit

Nonperforming Assets:

$307 Million

2004

Acquisitions:

American Capital Resource, Inc., American Express

Business Finance, EverTrust Financial Group,

Sterling Bank & Trust branches

Senior Management Additions:

Chuck Hyle, Chief Risk Officer;

Tim King, President, Retail Group;

Steve Yates, Chief Information Officer

Nonperforming Assets: $379 Million

2003

Acquisitions:

Toronto Dominion Leasing Portfolio,

NewBridge Partners

Senior Management Addition:

Paul Harris, General Counsel

Nonperforming Assets: $753 Million

KEY

46.14%

S&P 500

Banks

41.38%

S&P 500

2.74%

(Year Ended December 31)

NEXT PAGEPREVIOUS PAGE SEARCH BACK TO CONTENTS