KeyBank 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NEXT PAGEPREVIOUS PAGE SEARCH BACK TO CONTENTS

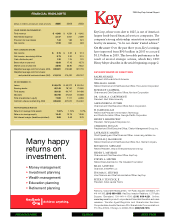

2005 BUSINESS GROUP RESULTS

Consumer Banking earned $483 million in 2005, up 17 percent from $412

million in 2004. Net income increased in 2005 primarily because of two actions

that effectively depressed earnings in 2004: the fourth quarter 2004 sale of

the broker-originated home equity loan portfolio, and the reclassification of

the indirect automobile loan portfolio to held-for-sale status. These actions

significantly reduced noninterest income and the provision for loan losses, and

substantially increased noninterest expense in 2004. Excluding the effects of

the above actions, 2004 net income for Consumer Banking was $489 million.

In 2006, results for Retail, Small Business, McDonald Financial Group and

Commercial Banking (midsize companies served from the KeyCenter network)

will be reported under Key Community Banking.

Corporate and Investment Banking earned $615 million in 2005, up 16 percent

from $532 million in 2004. The increase in 2005 was the result of significant

growth in net interest income and higher noninterest income. The growth in

net interest income reflected strong growth in average loans and leases, bolstered

by the acquisition of the equipment leasing unit of American Express’ small

business division in the fourth quarter of 2004, and a higher level of deposits.

Letter of credit and loan fees drove the improvement in noninterest income.

In addition to the acquisition mentioned above, we completed over the past two

years several other acquisitions that served to expand our market share

positions and strengthen our business. In the fourth quarter of 2005, we continued

the expansion of our commercial mortgage servicing business by acquiring the

commercial mortgage-backed servicing business of ORIX Capital Markets,

LLC, headquartered in Dallas, Texas. This acquisition increased our commercial

mortgage servicing portfolio from $44 billion at September 30, 2005, to more than

$70 billion. In the prior quarter, we expanded our FHA financing and servicing

capabilities by acquiring Malone Mortgage Company, also based in Dallas.

In 2006, results from Key’s national consumer finance businesses will be

reported with Corporate Banking’s, joining those from Real Estate Capital,

Key Equipment Finance, Institutional Banking, Capital Markets and Victory

Capital Management.

NET INCOME

100% = $1,129 mm (Key)

100% = $483 mm (Group)

REVENUE (TE)

100% = $4,989 mm (Key)

100% = $2,880 mm (Group)

in millions

Revenue

Net interest income (TE)......................... $ 1,943

Noninterest income .............................. 937

Total revenue (TE)................................... 2,880

Net Income............................................. $ 483

Average Balances

Loans.................................................... $29,274

Total assets........................................... 35,870

Deposits ............................................... 42,043

CONSUMER BANKING

45%

78%

30%

70%

13%

22%

13%

30%

in millions

Revenue

Net interest income (TE)......................... $ 1,177

Noninterest income .............................. 954

Total revenue (TE)................................... 2,131

Net Income............................................. $ 615

Average Balances

Loans.................................................... $34,981

Total assets........................................... 41,241

Deposits ............................................... 9,948

NET INCOME

100% = $1,129 mm (Key)

100% = $615 mm (Group)

CORPORATE AND INVESTMENT BANKING

REVENUE (TE)

100% = $4,989 mm (Key)

100% = $2,131 mm (Group)

10%

24%

22%

50%

11%

26%

11%

21%

25%

47%

18%

32%

TE: Taxable Equivalent

Group amounts exclude “other segments,” e.g., income (losses) produced by Corporate Treasury and Key’s Principal Investing unit, and “reconciling items,” e.g., costs

associated with funding unallocated nonearning assets of corporate support functions; Key amounts include them. Consequently, line-of-business results, where

expressed as a percentage of Key’s results, total slightly less than 100 percent.

■Community Banking

■Consumer Finance

%Key

%Group

■Corporate Banking

■KeyBank Real Estate Capital

■Key Equipment Finance

%Key

%Group

10 ᔤKey 2005