KeyBank 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

MANAGEMENT’S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES

Corporate strategy

Our strategy for achieving Key’s long-term goals includes the following

five primary elements:

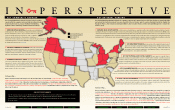

•Focus on our core businesses. We concentrate on businesses that

enable us to build relationships with our clients. We focus on our

“footprint” operations (i.e., those businesses conducted primarily

within the states in which we have KeyCenters) that serve individuals,

small businesses and middle market companies. In addition, we

focus nationwide on businesses such as commercial real estate lending,

investment management and equipment leasing. We believe we

possess resources of the scale necessary to compete nationally in the

market for these services.

•Build relationships. We work to deepen our relationships with

existing clients and to build relationships with new clients, particularly

those that have the potential to purchase multiple products and

services or to generate repeat business. To that end, we emphasize

deposit growth across all our lines of business. We also are putting

considerable effort into enhancing our service quality.

•Enhance our business. We strive for continuous improvement in

our businesses. We continue to focus on increasing revenues,

controlling expenses and maintaining the credit quality of our loan

portfolios. We will continue to leverage technology to reduce costs and

to achieve these objectives.

•Cultivate a workforce that demonstrates Key’s values and works

together for a common purpose. Key intends to achieve this by:

— paying for performance if achieved in ways that are consistent with

Key’s values;

— attracting, developing and retaining a quality, high-performing and

inclusive workforce;

— developing leadership at all staff and management levels; and

— creating a positive, stimulating and entrepreneurial work environment.

•Enhance performance measurement. We will continue to refine and

to rely upon performance measurement mechanisms that help us

ensure that we are maximizing returns for our shareholders, that those

returns are appropriate considering the inherent levels of risk involved

and that our incentive compensation plans are commensurate with the

contributions employees make to profitability.

Economic overview

In 2005, U.S. economic growth was very healthy as measured by the

Gross Domestic Product (“GDP”). GDP growth remained above 3.3%

during the first three quarters of 2005, marking ten straight quarters

above that level. The nation’s unemployment rate averaged 5% during

the year, while the economy created an average of 165,000 new jobs per

month. New and existing home sales reached record levels in mid-

2005, but showed signs of slowing toward the end of the year. Rising

energy prices, which were exacerbated by hurricanes Rita and Katrina,

served to at least temporarily increase a variety of inflation measures

to the upper end of the FRB’s expected range. Crude oil prices rose

approximately 45% during 2005. Despite higher energy costs, personal

spending remained robust as consumers continued to borrow against

rising real estate values. In an effort to keep inflation from escalating, the

Federal Reserve raised the federal funds target rate from 2.25% to

4.25%, gradually over the course of the year. Core consumer inflation

rose at a 2.2% rate, matching the 2004 level. In addition, continued

domestic and foreign investor demand for high quality Treasury bonds

served to keep long-term interest rates low, resulting in a relatively flat

yield curve. The benchmark 10-year Treasury yield began 2005 trading

at 4.21% and finished the year at 4.39%. The 2-year Treasury yield

began 2005 at 3.10%, but closed the year at 4.41%. During 2005, the

banking sector, including Key, experienced modest commercial and

mortgage loan growth.

Critical accounting policies and estimates

Key’s business is dynamic and complex. Consequently, management

must exercise judgment in choosing and applying accounting policies

and methodologies in many areas. These choices are important: not only

are they necessary to comply with GAAP, they also reflect management’s

view of the most appropriate manner in which to record and report

Key’s overall financial performance. All accounting policies are

important, and all policies described in Note 1 (“Summary of Significant

Accounting Policies”), which begins on page 57, should be reviewed for

a greater understanding of how Key’s financial performance is recorded

and reported.

In management’s opinion, some accounting policies are more likely

than others to have a significant effect on Key’s financial results and to

expose those results to potentially greater volatility. These policies

apply to areas of relatively greater business importance or require

management to make assumptions and estimates that affect amounts

reported in the financial statements. Because these assumptions and

estimates are based on current circumstances, they may change over time

or prove to be inaccurate. Key relies heavily on the use of assumptions

and estimates in a number of important areas, including accounting for

the allowance for loan losses; loan securitizations; contingent liabilities,

guarantees and income taxes; principal investments; goodwill; and

pension and other postretirement obligations. A brief discussion of

each of these areas follows.

Allowance for loan losses. The loan portfolio is the largest category of

assets on Key’s balance sheet. Management determines probable losses

inherent in Key’s loan portfolio and establishes an allowance that is

sufficient to absorb those losses by considering factors including

historical loss rates, expected cash flows and estimated collateral values.

In assessing these factors, management benefits from a lengthy

organizational history and experience with credit decisions and related

outcomes. Nonetheless, if management’s underlying assumptions later

prove to be inaccurate, the allowance for loan losses would have to be

adjusted, possibly having an adverse effect on Key’s results of operations.

Management estimates the appropriate level of Key’s allowance for

loan losses by separately evaluating impaired and nonimpaired loans.

An impaired loan is allocated an allowance by applying an assumed

rate of loss to the outstanding balance based on the credit rating

assigned to the loan. If the outstanding balance is greater than $2.5

million, and the resulting allocation is deemed insufficient to cover the

extent of the impairment, a specific allowance is assigned to the loan. A

specific allowance may also be assigned even when sources of repayment

appear sufficient, if management remains uncertain about whether the

loan will be repaid in full. The methodology used to assign an allowance

NEXT PAGEPREVIOUS PAGE SEARCH BACK TO CONTENTS