KeyBank 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 KEYCORP ANNUAL REPORT

Key

Key

KEY POSTS

RECORD EARNINGS OF

$1.13 BILLION FOR 2005

Accelerated

Progress

Board Increases Dividend for 41st Consecutive Year

Accelerated

Progress

KEY POSTS

RECORD EARNINGS OF

$1.13 BILLION FOR 2005

NEXT PAGE

Table of contents

-

Page 1

Board Increases Dividend for 41st Consecutive Year 2005 KEYCORP ANNUAL REPORT Key Accelerated Progress KEY POSTS RECORD EARNINGS OF $1.13 BILLION FOR 2005 NEXT PAGE -

Page 2

.... KeyCorp Investor Relations: 127 Public Square, Cleveland, OH 44114-1306; (216) 689-4221 . Online: www.key.com for product, corporate and ï¬nancial information and news releases. Transfer Agent/Registrar and Shareholder Services: Computershare Investor Services, Attn: Shareholder Communications... -

Page 3

...a record year for earnings, and how the company is moving toward sustained high performance. 4 BY THE NUMBERS A ï¬ve-year snapshot shows Key's strategic moves are paying off. 8 KEY IN PERSPECTIVE An overview of Key's lines of business and the markets they serve. 10 BUSINESS GROUP RESULTS How Key... -

Page 4

...form of funding. We grew average core deposits 8 percent in 2005, in part by eliminating teaser rates and shifting to relationship pricing with our clients. • Noninterest income rose due primarily to increased income from capital markets activities, higher loan fees and gains related to loan sales... -

Page 5

... as KeyBank Real Estate Capital and Key Equipment Finance, have achieved top-tier industry rankings. Tom is now working with the managers of Key's consumer ï¬nance businesses as well. Because of his outstanding contributions, Key's board of directors elected Tom a vice chairman of KeyCorp in July... -

Page 6

...positions in such businesses as commercial real estate and equipment ï¬nancing. Emerging sales culture: Desktop technology, better aligned incentive compensation plans and new cross-selling programs are energizing the ways Key bankers deliver their ideas. Credit-quality discipline: Key has restored... -

Page 7

.... Savings account, a competitive-rate savings vehicle that offers online banking and check-writing services; and Commercial Mortgage Direct, which allows borrowers to more readily obtain commercial real estate loans. SM SM Finally, our call centers have championed a "voice of the client" process... -

Page 8

... services, small loans and opportunities to open checking accounts, as well as ï¬nancial education tools and programs. The KeyBank Plus program was among the many reasons Key received its sixth consecutive "outstanding" Community Reinvestment Act rating, the highest possible, from the U.S. Office... -

Page 9

... with the Federal Reserve Bank of Cleveland (FRB). As part of those agreements, we have agreed to improve speciï¬c aspects of our PREVIOUS PAGE client due diligence procedures and installing advanced detection technologies. BOARD CHANGES In 2005 Key welcomed to its board of directors two highly... -

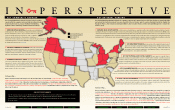

Page 10

... of services, including commercial lending, cash management, equipment leasing, investments, employee beneï¬t programs, succession planning, capital markets, derivatives and foreign exchange. áŸ' KEY EQUIPMENT FINANCE professionals meet the equipment leasing needs of businesses of all sizes and... -

Page 11

...50% 25% 47% %Key %Group â- Corporate Banking â- KeyBank Real Estate Capital â- Key Equipment Finance Corporate and Investment Banking earned $615 million in 2005, up 16 percent from $532 million in 2004. The increase in 2005 was the result of signiï¬cant growth in net interest income and higher... -

Page 12

...Line of Business Results Consumer Banking Corporate and Investment Banking Other Segments Results of Operations Net interest income Noninterest income Noninterest expense Income taxes Financial Condition Loans and loans held for sale Securities Deposits and other sources of funds Capital Off-Balance... -

Page 13

... investment management services to clients that include large corporate and public retirement plans, foundations and endowments, high net worth individuals and TaftHartley plans (i.e., multiemployer trust funds established for providing pension, vacation or other beneï¬ts to employees). KeyCorp... -

Page 14

... capital, terminate Federal Deposit Insurance Corporation ("FDIC") deposit insurance, and mandate the appointment of a conservator or receiver in severe cases. Capital markets conditions. Changes in the stock markets, public debt markets and other capital markets could affect Key's stock price, Key... -

Page 15

...4.39%. The 2-year Treasury yield began 2005 at 3.10%, but closed the year at 4.41%. During 2005, the banking sector, including Key, experienced modest commercial and mortgage loan growth. Critical accounting policies and estimates Key's business is dynamic and complex. Consequently, management must... -

Page 16

..., or $.07 per share, respectively. Management estimates the appropriate level of Key's allowance by conducting a detailed review of a signiï¬cant number of much smaller portfolio segments that make up the consumer and commercial loan portfolios. Since Key's total loan portfolio is well diversi... -

Page 17

... fee-based businesses and higher net gains from loan sales. The increase in net interest income was driven by a higher volume of average earning assets resulting from 19% growth in average commercial loans, and a 6 basis point improvement in the net interest margin to 3.69%. The increase in the net... -

Page 18

... of accounting changes - assuming dilution Net income Net income - assuming dilution Cash dividends paid Book value at year end Market price at year end Dividend payout ratio Weighted-average common shares (000) Weighted-average common shares and potential common shares (000) AT DECEMBER 31, Loans... -

Page 19

... our relationship banking strategy. We completed the sale of the prime segment of the indirect automobile loan LINE OF BUSINESS RESULTS This section summarizes the ï¬nancial performance and related strategic developments of each of Key's two major business groups, Consumer Banking, and Corporate... -

Page 20

... other savings Time Total deposits 2005 $ 6,921 20,680 14,442 $42,043 2004 $ 6,482 19,313 14,007 $39,802 2003 $ 6,302 17,653 14,676 $38,631 Change 2005 vs 2004 Amount $ 439 1,367 435 $2,241 Percent 6.8% 7.1 3.1 5.6% HOME EQUITY LOANS Community Banking: Average balance Average loan-to-value ratio... -

Page 21

...increase in letter of credit and loan fees in the Corporate Banking and KeyBank Real Estate Capital lines of business. Also contributing to the growth was a $10 million increase in net gains from the residual values of leased equipment sold, and an $8 million increase in income from operating leases... -

Page 22

... INVESTMENT BANKING DATA Year ended December 31, dollars in millions AVERAGE LEASE FINANCING RECEIVABLES MANAGED BY KEY EQUIPMENT FINANCEa Receivables held in Key Equipment Finance portfolio Receivables assigned to other lines of business Total lease ï¬nancing receivables managed a Change 2005 vs... -

Page 23

... INCOME AND YIELDS/RATES Year ended December 31, dollars in millions ASSETS Loansa,b Commercial, ï¬nancial and agricultural Real estate - commercial mortgage Real estate - construction Commercial lease ï¬nancing Total commercial loans Real estate - residential Home equity Consumer - direct... -

Page 24

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES 2002 Average Balance Interest Yield/ Rate Average Balance 2001 Interest Yield/ Rate Average Balance 2000 Interest Yield/ Rate Compound Annual Rate of Change (2000-2005) Average Balance ... -

Page 25

...home equity loans. The decision to sell these loans was driven by management's strategies for improving Key's returns and achieving desired interest rate and credit risk proï¬les. Figure 6 shows how the changes in yields or rates and average balances from the prior year affected net interest income... -

Page 26

... Year ended December 31, dollars in millions Trust and investment services income Service charges on deposit accounts Investment banking and capital markets income Operating lease income Letter of credit and loan fees Corporate-owned life insurance income Electronic banking fees Net gains from loan... -

Page 27

... to use Key's free checking products. The decrease in account analysis fees was attributable to the rising interest rate environment in which clients have elected to pay for services with compensating balances. Investment banking and capital markets income. As shown in Figure 10, during 2005 the... -

Page 28

...fees generated by the KeyBank Real Estate Capital and Corporate Banking lines of business. These improved results reï¬,ect stronger demand for commercial loans and a more disciplined approach to pricing, which considers overall client relationships. Net gains from loan securitizations and sales. Key... -

Page 29

... assets such as corporate-owned life insurance, credits associated with investments in low-income housing projects and tax deductions associated with dividends paid on Key common shares held in Key's 401(k) savings plan. In addition, a lower tax rate is applied to portions of the equipment lease... -

Page 30

... commercial real estate loans Commercial lease ï¬nancing Total commercial loans CONSUMER Real estate - residential mortgage Home equity Consumer - direct Consumer - indirect: Automobile lease ï¬nancing Automobile loans Marine Other Total consumer - indirect loans Total consumer loans Total a 2005... -

Page 31

.... KeyBank Real Estate Capital deals exclusively with nonowner-occupied properties (generally properties in which the owner occupies less than 60% of the premises), and accounted for approximately 59% of Key's total average commercial real estate loans during 2005. Our commercial real estate business... -

Page 32

... relative cost of funds; • the level of credit risk; and • capital requirements. Figure 16 summarizes Key's loan sales (including securitizations) for 2005 and 2004. FIGURE 16. LOANS SOLD (INCLUDING LOANS HELD FOR SALE) Commercial Real Estate $ 792 710 336 389 $2,227 Commercial Lease Financing... -

Page 33

...-backed securities servicing business of ORIX added more than $28 billion to our commercial mortgage servicing portfolio during 2005. FIGURE 17. LOANS ADMINISTERED OR SERVICED December 31, in millions Commercial real estate loans Education loans Commercial loans Home equity loans Commercial lease... -

Page 34

... terms. Includes primarily marketable equity securities. Weighted-average yields are calculated based on amortized cost. Such yields have been adjusted to a taxable-equivalent basis using the statutory federal income tax rate of 35%. Excludes securities of $139 million at December 31, 2005... -

Page 35

... past two years, average noninterest-bearing deposits also increased because we intensiï¬ed our cross-selling efforts, focused sales and marketing efforts on our free checking products, and collected more escrow deposits associated with the servicing of commercial real estate loans. Purchased funds... -

Page 36

... open market or through negotiated transactions. The program does not have an expiration date. At December 31, 2005, Key had 85,265,173 treasury shares. Management expects to reissue those shares from time-to-time to support the employee stock purchase, stock option and dividend reinvestment plans... -

Page 37

... for losses on loans and lending-related commitments Net unrealized gains on equity securities available for sale Qualifying long-term debt Total Tier 2 capital Total risk-based capital RISK-WEIGHTED ASSETS Risk-weighted assets on balance sheet Risk-weighted off-balance sheet exposure Less: Goodwill... -

Page 38

... services Technology equipment and software Other Total purchase obligations Total Lending-related and other off-balance sheet commitments: Commercial, including real estate Home equity Commercial letters of credit Principal investing and other commitments Total a Within 1 Year a After 5 Years... -

Page 39

... yields on loans and other assets. Conversely, when an increase in short-term interest rates is expected to generate greater net interest income, the balance sheet is said to be "asset-sensitive," Market risk management The values of some ï¬nancial instruments vary not only with changes in market... -

Page 40

... to manage net interest income during this period as short-term interest rates have increased. Additionally, management has reï¬ned simulation model assumptions to address anticipated changes in deposit pricing on select products in a very competitive marketplace. Considering Key's current asset... -

Page 41

... net interest income at risk to rising rates by .01%. As of December 31, 2005, based on the results of a model in which we simulate the effect of a gradual 200 basis point increase in short-term interest rates only in the second year of a two-year time horizon, using the "most likely balance sheet... -

Page 42

... 19. Management uses a value at risk ("VAR") simulation model to measure the potential adverse effect of changes in interest rates, foreign exchange rates, equity prices and credit spreads on the fair value of Key's trading portfolio. Using two years of historical information, the model estimates... -

Page 43

... the discussion of investment banking and capital markets income on page 26, Key used interest rate swaps to manage the economic risk associated with its sale of the indirect automobile loan portfolio. Even though these derivatives were not subject to VAR trading limits, Key measured their exposure... -

Page 44

... 8.5 40.5 100.0% dollars in millions Commercial, ï¬nancial and agricultural Real estate - commercial mortgage Real estate - construction Commercial lease ï¬nancing Total commercial loans Real estate - residential mortgage Home equity Consumer - direct Consumer - indirect lease ï¬nancing Consumer... -

Page 45

... of year Loans charged off: Commercial, ï¬nancial and agricultural Real estate - commercial mortgage Real estate - construction Total commercial real estate loansa Commercial lease ï¬nancing Total commercial loans Real estate - residential mortgage Home equity Consumer - direct Consumer - indirect... -

Page 46

...LOANS December 31, dollars in millions Commercial, ï¬nancial and agricultural Real estate - commercial mortgage Real estate - construction Total commercial real estate loansa Commercial lease ï¬nancing Total commercial loans Real estate - residential mortgage Home equity Consumer - direct Consumer... -

Page 47

...FIGURE 32. COMMERCIAL, FINANCIAL AND AGRICULTURAL LOANS Nonperforming Loans December 31, 2005 dollars in millions Industry classiï¬cation: Manufacturing Services Retail trade Financial services Property management Public utilities Wholesale trade Insurance Building contractors Public administration... -

Page 48

... are actively managed on a regular basis. These include emphasizing client deposit generation, securitization market alternatives, loan sales, extending the maturity of wholesale borrowings, purchasing deposits from other banks, and developing relationships with ï¬xed income investors. Key also... -

Page 49

... be marketable to investors at a competitive cost. FIGURE 34. DEBT RATINGS Senior Subordinated Long-Term Long-Term Capital Debt Debt Securities December 31, 2005 KEYCORP (THE PARENT COMPANY) Standard & Poor's Moody's Fitch KBNA Standard & Poor's Moody's Fitch KEY NOVA SCOTIA FUNDING COMPANY ("KNSF... -

Page 50

... quarter of 2005 were $127 million of commercial passenger airline leases. In the year-ago quarter, net charge-offs included $84 million that related to the broker-originated home equity and indirect automobile loan portfolios that Key decided to exit. Income taxes. The provision for income taxes... -

Page 51

... Book value at period end Market price: High Low Close Weighted-average common shares (000) Weighted-average common shares and potential common shares (000) AT PERIOD END Loans Earning assets Total assets Deposits Long-term debt Shareholders' equity PERFORMANCE RATIOS Return on average total assets... -

Page 52

...24, 2006, on management's assessment of Key's internal control over ï¬nancial reporting, which is included in this annual report. Henry L. Meyer III Chairman and Chief Executive Ofï¬cer Jeffrey B. Weeden Senior Executive Vice President and Chief Financial Ofï¬cer PREVIOUS PAGE SEARCH BACK TO... -

Page 53

... Accounting Oversight Board (United States), the consolidated balance sheets of Key as of December 31, 2005 and 2004, and the related consolidated statements of income, changes in shareholders' equity, and cash ï¬,ow for each of the three years in the period ended December 31, 2005 and our report... -

Page 54

... CONSOLIDATED BALANCE SHEETS December 31, dollars in millions ASSETS Cash and due from banks Short-term investments Securities available for sale Investment securities (fair value: $92 and $74) Other investments Loans, net of unearned income of $2,153 and $2,225 Less: Allowance for loan losses Net... -

Page 55

... Trust and investment services income Service charges on deposit accounts Investment banking and capital markets income Operating lease income Letter of credit and loan fees Corporate-owned life insurance income Electronic banking fees Net gains from loan securitizations and sales Net securities... -

Page 56

...): Net unrealized losses on securities available for sale, net of income taxes of ($35)a Net unrealized gains on derivative ï¬nancial instruments, net of income taxes of $5 Net unrealized gains on common investment funds held in employee welfare beneï¬ts trust, net of income taxes Foreign currency... -

Page 57

... from sales of other real estate owned NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES FINANCING ACTIVITIES Net increase in deposits Net increase (decrease) in short-term borrowings Net proceeds from issuance of long-term debt Payments on long-term debt Purchases of treasury shares Net proceeds... -

Page 58

... KeyCorp, an Ohio corporation and bank holding company headquartered in Cleveland, Ohio, is one of the nation's largest bank-based ï¬nancial services companies. KeyCorp's subsidiaries provide retail and commercial banking, commercial leasing, investment management, consumer ï¬nance, and investment... -

Page 59

... account securities are reported in "investment banking and capital markets income" on the income statement. Securities available for sale. These are securities that Key intends to hold for an indeï¬nite period of time and that may be sold in response to changes in interest rates, prepayment risk... -

Page 60

... of "net gains from loan securitizations and sales" on the income statement. A servicing asset also may be recorded if Key either purchases or retains the right to service securitized loans and receives related fees that exceed the going market rate. Income earned under servicing or administration... -

Page 61

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS KEYCORP AND SUBSIDIARIES SERVICING ASSETS Servicing assets purchased or retained by Key in a sale or securitization of loans are reported at the lower of amortized cost or fair value ($275 million at December 31, 2005, and $138 million at December 31, 2004... -

Page 62

... at fair value. Fair value is determined by estimating the present value of future cash ï¬,ows. Changes in fair value (including payments and receipts) are recorded in "investment banking and capital markets income" on the income statement. GUARANTEES Key's accounting policies related to certain... -

Page 63

..., as reported Add: Stock-based employee compensation expense included in reported net income, net of related tax effects: Stock options expense All other stock-based employee compensation expense shares, discounted stock purchase plans and certain deferred compensationrelated awards) for the years... -

Page 64

... condition or results of operations. 2. EARNINGS PER COMMON SHARE Key calculates its basic and diluted earnings per common share as follows: Year ended December 31, dollars in millions, except per share amounts NET INCOME WEIGHTED-AVERAGE COMMON SHARES Weighted-average common shares outstanding... -

Page 65

...and asset management services to assist high-net-worth clients with their banking, brokerage, trust, portfolio management, insurance, charitable giving and related needs. Consumer Finance includes Indirect Lending, Commercial Floor Plan Lending and National Home Equity. Indirect Lending offers loans... -

Page 66

... Banking line of business within the Consumer Banking group. Victory Capital Management is included as part of the Corporate Banking line within the Corporate and Investment Banking group. • Key began to charge the net consolidated effect of funds transfer pricing related to estimated deferred tax... -

Page 67

... INVESTMENT BANKING LINES OF BUSINESS) Year ended December 31, dollars in millions Total revenue (taxable equivalent) Provision for loan losses Noninterest expense Net income Average loans Average deposits Net loan charge-offs Return on average allocated equity Average full-time equivalent employees... -

Page 68

... $203 million in 2005 to fulï¬ll these requirements. KeyCorp's principal source of cash ï¬,ow to pay dividends on its common shares, to service its debt and to ï¬nance its corporate operations is capital distributions from KBNA and its other subsidiaries. Federal banking law limits the amount of... -

Page 69

... losses at December 31, 2005, $12 million relates to commercial mortgage-backed securities ("CMBS"). These CMBS are beneï¬cial interests in securitizations of commercial mortgages that are held in the form of bonds and managed by the KeyBank Real Estate Capital line of business. Principal on these... -

Page 70

... - commercial mortgage Real estate - residential mortgage Real estate - construction Home equity Education Automobile Total loans held for sale $ 2005 85 525 11 51 - 2,687 22 2004 - $ 283 26 - 29 2,278 1,737 $4,353 $3,381 Commercial and consumer lease ï¬nancing receivables are primarily direct... -

Page 71

... the sale of a pool of loan receivables to investors through either a public or private issuance (generally by a qualifying SPE) of asset-backed securities. Generally, the assets are transferred to a trust that sells interests in the form of certiï¬cates of ownership. In some cases, Key retains... -

Page 72

..."Other Off-Balance Sheet Risk" on page 86. The fair value of mortgage servicing assets is estimated by calculating the present value of future cash ï¬,ows associated with servicing the loans. This calculation uses a number of assumptions that are based on current market conditions. Primary economic... -

Page 73

... LIHTC investors" on page 85. In October 2003, management elected to discontinue this program. Commercial and residential real estate investments and principal investments. Key's Principal Investing unit and the KeyBank Real Estate Capital line of business make equity and mezzanine investments in... -

Page 74

..."). These typically are smaller-balance commercial loans and consumer loans, including residential mortgages, home equity loans and various types of installment loans. Management applies historical loss experience rates to these loans, adjusted to reï¬,ect emerging credit trends and other factors... -

Page 75

...TO CONSOLIDATED FINANCIAL STATEMENTS KEYCORP AND SUBSIDIARIES Changes in the carrying amount of goodwill by major business group are as follows: Consumer Banking $895 - 98 29 (55) - $967 5 (4) - - - $968 Corporate and Investment Banking $255 138 - - - (1) $392 - - (15) 9 1 $387 in millions BALANCE... -

Page 76

... was secured by approximately $23.6 billion of loans, primarily those in the commercial portfolio. There were no borrowings outstanding under this facility at December 31, 2005. 12. LONG-TERM DEBT The components of Key's long-term debt, presented net of unamortized discount where applicable, were... -

Page 77

... Tier 1 capital for regulatory reporting purposes, but have the same tax advantages as debt for federal income tax purposes. During the ï¬rst quarter of 2005, the Federal Reserve Board adopted a rule that allows bank holding companies to continue to treat capital securities as Tier 1 capital, but... -

Page 78

.... Key's compensation plans allow KeyCorp to grant primarily stock options, restricted stock, performance shares, discounted stock purchases and certain deferred compensation-related awards to eligible employees and directors. At December 31, 2005, KeyCorp had 74,972,586 common shares available for... -

Page 79

... income and earnings per share of applying the "fair value method" of accounting to all forms of stock-based compensation are included in Note 1 ("Summary of Signiï¬cant Accounting Policies") under the heading "Stock-Based Compensation" on page 61. 16. EMPLOYEE BENEFITS PENSION PLANS Net pension... -

Page 80

... are reï¬,ected in the market-related value, they are included in the cumulative unrecognized gains and losses subject to expense amortization. Management estimates that a 25 basis point decrease in the expected return on plan assets would increase Key's net pension cost for 2006 by approximately... -

Page 81

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS KEYCORP AND SUBSIDIARIES Key's net pension cost for 2006 by the same amount. In addition, pension cost is affected by an assumed discount rate and an assumed compensation increase rate. Management estimates that a 25 basis point change in either or both of... -

Page 82

...on net postretirement beneï¬t cost or obligations since the postretirement plans have cost-sharing provisions and beneï¬t limitations. Management estimates the expected returns on plan assets for VEBAs much the same way it estimates returns on Key's pension funds. The primary investment objectives... -

Page 83

... high technology hardware and related software, such as telecommunications equipment. The terms of the leases range from ten to ï¬fty years. Like other forms of leasing transactions, LILO transactions generate income tax deductions for Key from net rental expense associated with the leased property... -

Page 84

..., a client must pay a fee to obtain a loan commitment from Key. Since a commitment may expire without resulting in a loan, the total amount of outstanding commitments may signiï¬cantly exceed Key's eventual cash outlay. Loan commitments involve credit risk not reï¬,ected on Key's balance sheet. Key... -

Page 85

... stating that Swiss Reinsurance America Corporation ("Swiss Re") will assume and reinsure 100% of Reliance's obligations under the 4019 Policy in the event Reliance Group Holdings' ("Reliance's parent") so-called "claims-paying ability" were to fall below investment grade. Key Bank USA also entered... -

Page 86

... balance of loans outstanding at December 31, 2005. If payment is required under this program, Key would have an interest in the collateral underlying the commercial mortgage loan on which the loss occurred. Return guarantee agreement with LIHTC investors. KAHC, a subsidiary of KBNA, offered limited... -

Page 87

...debit card services when they accept MasterCard or Visa credit card services. These settlements reduced fees earned by KBNA from off-line debit card transactions. During 2005, the impact of the settlement reduced Key's pre-tax net income by approximately $12 million. It is management's understanding... -

Page 88

.... Key also uses "pay ï¬xed/receive variable" interest rate swaps to manage the interest rate risk associated with anticipated sales or securitizations of certain commercial real estate loans. These swaps protect against a possible short-term decline in the value of the loans that could result from... -

Page 89

...clients' business needs and for proprietary trading purposes. Key mitigates the associated risk by entering into other foreign exchange contracts with third parties. Adjustments to the fair value of all foreign exchange forward contracts are included in "investment banking and capital markets income... -

Page 90

... billion at December 31, 2005 and 2004, are included in the amount shown for "Loans, net of allowance." The estimated fair values of residential real estate mortgage loans and deposits do not take into account the fair values of related long-term client relationships. For ï¬nancial instruments with... -

Page 91

... Payments on long-term debt Purchases of treasury shares Net proceeds from issuance of common stock Cash dividends paid NET CASH USED IN FINANCING ACTIVITIES NET INCREASE (DECREASE) IN CASH AND DUE FROM BANKS CASH AND DUE FROM BANKS AT BEGINNING OF YEAR CASH AND DUE FROM BANKS AT END OF YEAR 2005... -

Page 92

... Relations website, Key.com/IR, provides quick access to useful information and shareholder services, including live webcasts of management's quarterly earnings discussions. ONLINE Key.com/IR BY TELEPHONE Corporate Headquarters (216) 689-6300 KeyCorp Investor Relations (216) 689-4221 Annual Report... -

Page 93

... company the next step forward wouldn't set its cash ï¬,ow three steps back. MANAGING CASH STRATEGIC ADVICE COMMERCIAL FINANCING RAISING CAPITAL When adding locations wouldn't subtract from your employees' well-being. When expanding your product line wouldn't expend all of your hard-earned...