JetBlue Airlines 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

service, routes served, flight schedules, types of aircraft, safety record and reputation, code-sharing

relationships, capacity, in-flight entertainment systems and frequent flyer programs.

Our competitors and potential competitors include traditional network airlines, low-cost airlines, and

regional airlines. Six of the other major U.S. airlines are generally larger, have greater financial resources and

serve more routes than we do. Our competitors also use some of the same advanced technologies that we do

such as laptop computers in the cockpit and website bookings. In recent years, the U.S. airline industry

experienced significant consolidation, bankruptcy protection, and liquidation largely as a result of high fuel

costs and continued strong competition. In 2009, numerous smaller airlines around the world ceased operations

and other larger international carriers faced bankruptcy. Additionally, the merger of Delta and Northwest

created the world’s largest airline. Further industry consolidations or restructurings may result in our

competitors having a more rationalized route structure and lower operating costs, enabling them to compete

more aggressively.

Price competition occurs through price discounting, fare matching, increased capacity, targeted sale

promotions and frequent flyer travel initiatives, all of which are usually matched by other airlines in order to

maintain their share of passenger traffic. A relatively small change in pricing or in passenger traffic could

have a disproportionate effect on an airline’s operating and financial results. Our ability to meet this price

competition depends on, among other things, our ability to operate at costs equal to or lower than our

competitors. All other factors being equal, we believe customers often prefer JetBlue and the JetBlue

Experience.

During 2009, most traditional network airlines began to reduce capacity on their international routes

while continuing to reduce overall domestic and Caribbean capacity by redeploying the capacity to more

regional routes. Virgin America continued to expand in routes that compete directly with us, although other

carriers substantially reduced capacity in a number of our markets. We are encouraged by continued capacity

discipline across the industry and expect it to continue through 2010 which we believe will help offset the

impact of the recessionary environment.

Airlines frequently participate in marketing alliances which generally provide for code-sharing, frequent

flyer program reciprocity, coordinated flight schedules that provide for convenient connections and other joint

marketing activities. These alliances also permit an airline to market flights operated by other alliance airlines

as its own. The benefits of broad networks offered to customers could attract more customers to these

networks. We currently participate in marketing alliances with Deutsche Lufthansa AG, one of the world’s

preeminent airlines and our largest shareholder; Cape Air, an airline that services destinations out of Boston

and San Juan, Puerto Rico; and Aer Lingus, an airline based in Dublin, Ireland.

Route Network

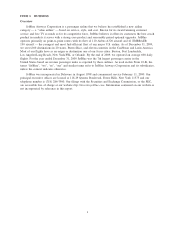

Our operations primarily consist of transporting passengers on our aircraft with domestic U.S. operations,

including Puerto Rico, accounting for 89% of our capacity in 2009. The historic distribution of our available

seat miles, or capacity, by region is as follows:

Capacity Distribution 2009 2008 2007

Year Ended December 31,

East Coast – Western U.S. ......................... 34.7% 41.5% 47.4%

Northeast – Florida ............................... 32.8 33.9 31.8

Medium – haul .................................. 3.5 3.0 2.8

Short – haul .................................... 7.7 7.6 7.4

Caribbean, including Puerto Rico .................... 21.3 14.0 10.6

Total . ........................................ 100.0% 100.0% 100.0%

5