Jack In The Box 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Jack In The Box annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

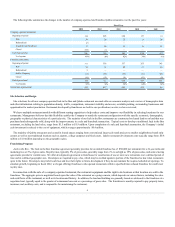

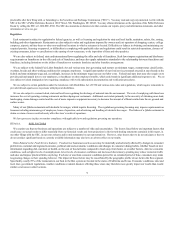

The following table summarizes the changes in the number of company-operated and franchise Qdoba restaurants over the past five years:

Company-operated restaurants:

Beginning of period

316

245

188

157

111

New

34

26

25

15

24

Refranchised

(3)

—

—

—

—

Acquired from franchisees

13

46

32

16

22

Closed

(64)

(1)

—

—

—

End of period total

296

316

245

188

157

% of system

48%

50%

42%

36%

31%

Franchise restaurants:

Beginning of period

311

338

337

353

343

New

34

32

42

21

38

Refranchised

3

—

—

—

—

Sold to Company

(13)

(46)

(32)

(16)

(22)

Closed

(16)

(13)

(9)

(21)

(6)

End of period total

319

311

338

337

353

% of system

52%

50%

58%

64%

69%

System end of period total

615

627

583

525

510

Site selections for all new company-operated Jack in the Box and Qdoba restaurants are made after an economic analysis and a review of demographic data

and other information relating to population density, traffic, competition, restaurant visibility and access, available parking, surrounding businesses and

opportunities for market penetration. Restaurants developed by franchisees are built to our specifications on sites we have reviewed.

We have multiple restaurant models with different seating capacities to help reduce costs and improve our flexibility in selecting locations for our

restaurants. Management believes that this flexibility enables the Company to match the restaurant configuration with the specific economic, demographic,

geographic or physical characteristics of a particular site. The majority of our Jack in the Box restaurants are constructed on leased land or on land that was

purchased and subsequently sold, along with the improvements, in a sale and leaseback transaction. Typical costs to develop a traditional Jack in the Box

restaurant, excluding the land value, range from $1.5 million to $1.9 million. Upon completion of a sale and leaseback transaction, the Company’s initial

cash investment is reduced to the cost of equipment, which averages approximately $0.4 million.

The majority of Qdoba restaurants are located in leased spaces ranging from conventional large-scale retail projects to smaller neighborhood retail strip

centers as well as non-traditional locations such as airports, college campuses and food courts. Qdoba restaurant development costs typically range from $0.6

million to $1.0 million depending on the geographic region.

Jack in the Box. The Jack in the Box franchise agreement generally provides for an initial franchise fee of $50,000 per restaurant for a 20-year term and

marketing fees at 5% of gross sales. Royalty rates, typically 5% of gross sales, generally range from 2% to as high as 15% of gross sales, and some existing

agreements provide for variable rates. We offer development agreements to franchisees for construction of one or more new restaurants over a defined period of

time and in a defined geographic area. Developers are required to pay a fee, which may be credited against a portion of the franchise fee due when restaurants

open in the future. Developers may forfeit such fees and lose their rights to future development if they do not maintain the required schedule of openings. To

simulate growth, beginning in fiscal 2012, we began offering franchisees who opened restaurants within a specified time reduced franchise fees and lower

royalty rates.

In connection with the sale of a company-operated restaurant, the restaurant equipment and the right to do business at that location are sold to the

franchisee. The aggregate price is negotiated based upon the value of the restaurant as a going concern, which depends on various factors, including the sales

and cash flows of the restaurant, as well as its location and history. In addition, the land and building are generally leased or subleased to the franchisee at a

negotiated rent, typically equal to the greater of a minimum base rent or a percentage of gross sales. The franchisee is usually required to pay property taxes,

insurance and ancillary costs, and is responsible for maintaining the restaurant.

4