Jack In The Box 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Jack In The Box annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

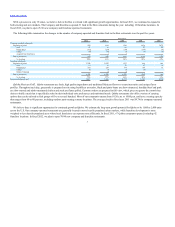

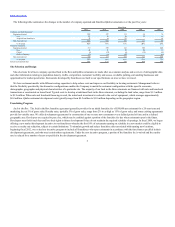

The following table summarizes the changes in the number of company-operated and franchise Qdoba restaurants over the past five years:

Company-operated restaurants:

Beginning of period 188 157 111 90 70

New 25 15 24 21 10

Acquired from franchisees 32 16 22 - 10

End of period total 245 188 157 111 90

% of system 42% 36% 31% 24% 23%

Franchise restaurants:

Beginning of period 337 353 343 305 248

New 42 21 38 56 77

Closed (9) (21) (6) (18) (10)

Sold to Company (32) (16) (22) - (10)

End of period total 338 337 353 343 305

% of system 58% 64% 69% 76% 77%

System end of period total 583 525 510 454 395

Site selections for all new company-operated Jack in the Box and Qdoba restaurants are made after an economic analysis and a review of demographic data

and other information relating to population density, traffic, competition, restaurant visibility and access, available parking, surrounding businesses and

opportunities for market penetration. Restaurants developed by franchisees are built to our specifications on sites we have reviewed.

We have restaurant models with different seating capacities to help reduce costs and improve our flexibility in locating restaurants. Management believes

that the flexibility provided by the alternative configurations enables the Company to match the restaurant configuration with the specific economic,

demographic, geographic and physical characteristics of a particular site. The majority of our Jack in the Box restaurants are financed with sale and leaseback

transactions or constructed on leased land. Typical costs to develop a traditional Jack in the Box restaurant, excluding the land value, range from $1.3 million

to $1.9 million. When sale and leaseback financing is used, the initial cash investment is reduced to the cost of equipment, which averages approximately

$0.4 million. Qdoba restaurant development costs typically range from $0.5 million to $1.0 million depending on the geographic region.

Jack in the Box. The Jack in the Box franchise agreement generally provides for an initial franchise fee of $50,000 per restaurant for a 20-year term and

marketing fees at 5% of gross sales. Royalty rates, typically 5% of gross sales, range from 2% to as high as 15% of gross sales, and some existing agreements

provide for variable rates. We offer development agreements for construction of one or more new restaurants over a defined period of time and in a defined

geographic area. Developers are required to pay a fee, which may be credited against a portion of the franchise fee due when restaurants open in the future.

Developers may forfeit such fees and lose their rights to future development if they do not maintain the required schedule of openings. In fiscal 2009, we began

offering a new market development incentive to our franchisees whereby the first 10% of restaurants opening on schedule in a new market could be eligible to

receive a royalty rate reduction, subject to certain limitations. To stimulate growth and reduce franchisee risks associated with opening new locations,

beginning fiscal 2012, we revised our incentive program to include all franchisees who open restaurants in accordance with the time frames specified in their

development agreements, and who meet certain other requirements. Under the new incentive program, a portion of the franchise fee is waived and the royalty

rate is reduced for a number of years as specified in the development agreement.

4