Jack In The Box 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Jack In The Box annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

If market conditions deteriorate or if operating results decline unexpectedly, we may be required to record impairment charges, which will negatively impact

results of operations for the periods in which they are recorded. Due to the foregoing factors, results for any one quarter are not necessarily indicative of results

to be expected for any other quarter or for a full fiscal year and these fluctuations may cause our operating results to be below expectations of public market

analysts and investors, adversely impacting our stock price.

Risks Related to Food Costs. Our profitability depends in part on our ability to anticipate and react to changes in food costs and availability, fuel costs

and other supply and distribution costs. Additionally, prices for feed ingredients used to produce beef and chicken could be adversely affected by changes in

worldwide supply and demand or by regulatory mandates. Further, increases in fuel prices could result in increased distribution costs. Throughout 2011,

commodity costs increased significantly, outpacing general inflation and industry expectations, and volatile conditions are expected to continue in the future.

We seek to manage our costs, including through long-term fixed price contracts and strong category management and purchasing fundamentals. However, we

cannot predict whether we will be able to anticipate and react effectively to changing food costs by adjusting purchasing practices and menu prices, and a

failure to do so could adversely affect our operating results. In addition, we may not be able to pass along price increases to our customers as a result of

adverse economic conditions or the prices offered by our competitors.

Although the number of Jack in the Box company-operated restaurants has decreased over the past several years as a result of our refranchising strategy, a

significant number of our restaurants remain company-operated, so we continue to have exposure to operating cost issues. Exposure to these fluctuating costs,

including increases in commodity costs, could negatively impact our margins as well as franchise margins and franchisee financial health.

Risk Related to Our Brands and Reputation. Multi-unit food service businesses such as ours can also be materially and adversely affected by

widespread negative publicity of any type, particularly regarding food quality, nutritional content, safety or public health issues (such as epidemics or the

prospect of a pandemic), obesity or other health concerns. Adverse publicity in these areas could damage the trust customers place in our brand. We believe we

have selected high-caliber, experienced franchisees. However, we cannot control the actions of our franchisees, and if customers have negative perceptions or

experiences with operational execution, food quality or safety at our franchised locations, our brands could suffer, and this could have an adverse effect on our

business. To minimize the risk of foodborne illness, we have implemented a HACCP system for managing food safety and quality. Nevertheless, these risks

cannot be completely eliminated. Any outbreak of such illness attributed to our restaurants or within the food service industry, or any widespread negative

publicity regarding our brands or the restaurant industry in general could cause a decline in our restaurant sales and sales of franchises, and could have a

material adverse effect on our financial condition and results of operations.

In addition, the success of our business strategy depends on the value and relevance of brand and reputation and in part on our continued ability to use our

trademarks and service marks. We believe we must protect and grow the value of our brands, in order to increase brand awareness in both existing and new

markets. If customers perceive that we fail to deliver a consistently positive experience, our brands could suffer which could have an adverse effect on our

business. Additionally, while we devote considerable efforts and resources to protecting our intellectual property, if these efforts are not successful, the value of

our brands may be harmed, which could also have a material adverse effect on our business.

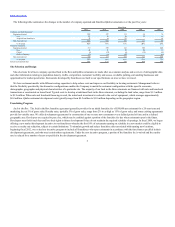

Risks Associated with Suppliers and Distributors . Dependence on frequent deliveries of fresh produce and other food products subjects food service

businesses such as ours to the risk that shortages or interruptions in supply could adversely affect the availability, quality and cost of ingredients or require

us to incur additional costs to obtain adequate supplies. Our deliveries of supplies may be affected by adverse weather conditions, natural disasters, supplier

financial or solvency issues, product recalls, failure to meet our high standards for quality or other issues. In addition, if any of our suppliers, vendors or

contractors do not perform adequately or if any one or more of such entities seeks to terminate its agreement or fails to perform as anticipated, or if there is

11