Jack In The Box 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Jack In The Box annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(Exact name of registrant as specified in its charter)

Delaware 95-2698708

(State of Incorporation) (I.R.S. Employer Identification No.)

9330 Balboa Avenue, San Diego, CA 92123

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (858) 571-2121

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, $0.01 par value NASDAQ

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 and

Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No

The aggregate market value of the common stock held by non-affiliates of the registrant, computed by reference to the closing price reported in the NASDAQ — Composite Transactions as of April 17, 2011, was

approximately $905.2 million.

Number of shares of common stock, $0.01 par value, outstanding as of the close of business November 17, 2011 — 43,971,342.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement to be filed with the Securities and Exchange Commission in connection with the 2012 Annual Meeting of Stockholders are incorporated by reference into Part III hereof.

Table of contents

-

Page 1

...ENDED OCTOBER 2, 2011 COMMISSION FILE NUMBER 1-9390 JTCK IN THE BOX INC. (Exact name of registrant as specified in its charter) Delaware (State of Incorporation) 95-2698708 (I.R.S. Employer Identification No.) 9330 Balboa Avenue, San Diego, CA (Address of principal executive offices) 92123 (Zip... -

Page 2

... Market Risk Financial Statements and Supplementary Data Changes in and Disagreements With Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Part III Item 9. Item 9A. Item 9B. Item 10. Directors, Executive Officers and Corporate Governance Executive... -

Page 3

... of hamburgers, tacos, specialty sandwiches, drinks, smoothies, real ice cream shakes, salads and side items. Jack in the Box restaurants also offer customers the ability to customize their meals and to order any product, including breakfast items, any time of the day. The Jack in the Box restaurant... -

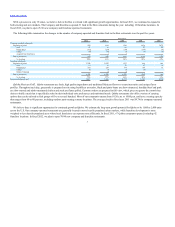

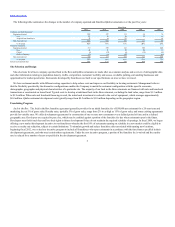

Page 4

...and new markets. The Company and franchisees opened 31 Jack in the Box restaurants during the year, including 16 franchise locations. In fiscal 2012, we plan to open 25-30 new company and franchise operated restaurants. The following table summarizes the changes in the number of company-operated and... -

Page 5

... sale and leaseback financing is used, the initial cash investment is reduced to the cost of equipment, which averages approximately $0.4 million. Qdoba restaurant development costs typically range from $0.5 million to $1.0 million depending on the geographic region. Franchising Program Jack in... -

Page 6

... initial franchise fee of $15,000 and a royalty rate of 2.5% of gross sales for the first two years of operation for each restaurant opened within the first two years of the development agreement, subject to certain limitations. Restaurant Operations Restaurant Management. Restaurants are operated... -

Page 7

... weekly and monthly polling of sales, inventory and labor data from the restaurants. We use a standardized Windows-based touch screen point-of-sale ("POS") platform in our Jack in the Box company and franchise restaurants, which allows us to accept credit cards and JACK CA$H ®, our re-loadable gift... -

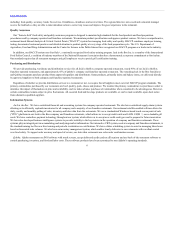

Page 8

... work stoppages and believe our labor relations are good. Over the last several years, we have realized improvements in our hourly restaurant employee retention rate. We support our employees, including part-time workers, by offering competitive wages and benefits. Furthermore, we offer all hourly... -

Page 9

...is a registered trademark and service mark in the United States. In addition, we have registered numerous service marks and trade names for use in our businesses, including the Jack in the Box logo, the Qdoba logo and various product names and designs. Seasonality Restaurant sales and profitability... -

Page 10

... food products offered, price, quality, speed of service, personnel, advertising, name identification, restaurant location and attractiveness of the facilities. Each Jack in the Box and Qdoba restaurant competes directly and indirectly with a large number of national and regional restaurant chains... -

Page 11

..., insurance and employee benefits (including increases in hourly wages, workers' compensation and other insurance costs and premiums); the impact of initiatives by competitors and increased competition generally; lack of customer acceptance of new menu items or potential price increases necessary to... -

Page 12

... exposure to operating cost issues. Exposure to these fluctuating costs, including increases in commodity costs, could negatively impact our margins as well as franchise margins and franchisee financial health. Risk Related to Our Brands and Reputation. Multi-unit food service businesses such as... -

Page 13

... in accordance with our plans or to manage our growth could have a material adverse effect on our results of operations and financial condition. Risks Related to Entering New Markets . Our growth strategy includes opening restaurants in markets where we have no existing locations. We cannot assure... -

Page 14

... achieve sustained high service levels. Risks Related to Increased Labor Costs and Regulation. Various federal and state labor laws govern our company and franchise operations and employee relationships, including minimum wage, overtime, working conditions and fringe benefit requirements. We have... -

Page 15

...and "Risks Related to Achieving Increased Jack in the Box Franchise Ownership and Reducing Operating Costs" above. We cannot assure you that franchisees and developers planning the opening of franchise restaurants will have the business abilities or sufficient access to financial resources necessary... -

Page 16

... of our Jack in the Box company-owned and franchised restaurant sites, and have engaged and may engage in real estate development projects. As is the case with any owner or operator of real property, we are subject to a variety of federal, state and local governmental regulations relating to the... -

Page 17

... our debt service requirements or force us to modify our operations or sell assets; our ability to operate our business as well as our ability to repurchase stock or pay cash dividends to our stockholders may be restricted by the financial and other covenants set forth in the credit facility; our... -

Page 18

...2, 2011, our restaurant leases had initial terms expiring as follows: Number of Restaurants Land and Fiscal Year Ground Leases Building Leases 2012 - 2016 2017 - 2021 2022 - 2026 2027 and later 157 210 169 107 485 583 241 119 Our principal executive offices are located in San Diego, California... -

Page 19

... the Nasdaq Global Select Market under the symbol "JACK." The following table sets forth the high and low sales prices for our common stock during the fiscal quarters indicated, as reported on the NASDAQ - Composite Transactions: 12 Weeks Ended 16 Weeks Ended High Low Oct. 2, 2011 $ 24.17 $ 18.25... -

Page 20

...-average exercise price of stock options only. (2) (3) Includes 129,932 shares that are reserved for issuance under our Employee Stock Purchase Plan. For a description of our equity compensation plans, refer to Note 12, Share-Based Employee Compensation , of the notes to the consolidated financial... -

Page 21

... Market price at year-end Other Operating Data: Jack in the Box restaurants: Company-operated average unit volume (2) Franchise-operated average unit volume (2)(3) System average unit volume (2)(3) Change in company-operated same-store sales Change in franchise-operated same-store sales (3) Change... -

Page 22

... of new accounting pronouncements, dates of implementation and impact on our consolidated financial position or results of operations, if any. OVERVIEW As of October 2, 2011, we operated and franchised 2,221 Jack in the Box restaurants, primarily in the western and southern United States, and... -

Page 23

...our business in fiscal 2011. Overall commodity costs at Jack in the Box and Qdoba company restaurants increased approximately 4.7% and 7%, respectively, as compared to last year. New Unit Development . We continued to grow our brands with the opening of new company and franchise-operated restaurants... -

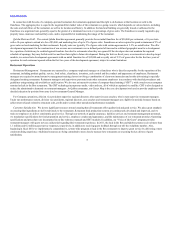

Page 24

...Fiscal Year 2011 Revenues: Company restaurant sales Distribution sales Franchise revenues Total revenues Operating costs and expenses, net: 2010 2009 62.9% 24.2% 12.9% 100.0% 72.6% 17.3% 10.1% 100.0% 80.0% 12.2% 7.8% 100.0% Company restaurant costs: Food and packaging (1) Payroll and employee... -

Page 25

... increase in the number of Qdoba company-operated restaurants and increases in per-store average ("PSA") sales at our Jack in the Box and Qdoba restaurants in 2011. In 2010, declines in PSA sales at Jack in the Box and Qdoba restaurants also contributed to the decrease in sales versus the prior year... -

Page 26

... change in franchise revenues ( dollars in thousands ): Royalties Rents Re-image contributions to franchisees Franchise fees and other Franchise revenues % increase Average number of franchise restaurants % increase Increase (decrease) in franchise-operated same-store sales: Jack in the Box $ 2011... -

Page 27

... with the prior year ( in thousands): Increase/(Decrease) Advertising Refranchising strategy Incentive compensation Cash surrender value of COLI policies, net Pension and postretirement benefits Hurricane Ike insurance proceeds Qdoba general and administrative costs Other 2011 vs. 2010 $ (17... -

Page 28

... Gains on the sale of company-operated restaurants, net Average gain on restaurants sold 219 $ 54,988 - $ $ 61,125 184 54,988 $ 251 $ 418 Gains were impacted by the number of restaurants sold and changes in average gains recognized, which relate to the specific sales and cash flows of those... -

Page 29

...bank credit facility, the sale of Jack in the Box company-operated restaurants to franchisees and the sale and leaseback of certain restaurant properties. Our cash requirements consist principally of working capital; capital expenditures for new restaurant construction and restaurant renovations... -

Page 30

... primarily to the timing of working capital receipts and disbursements and a decrease in cash flows related to higher company restaurant costs, our refranchising strategy and same-store sales declines at our Jack in the Box restaurants. Operating cash flows from our discontinued operations in 2010... -

Page 31

...use sale and leaseback financing to lower the initial cash investment in our Jack in the Box restaurants to the cost of the equipment, whenever possible. The following table summarizes the cash flow activity related to sale and leaseback transactions in each year (dollars in thousands ): 2011 Number... -

Page 32

...compared with the previous year. In 2011, the decrease is due primarily to higher debt payments in 2010 related to the refinancing of our credit facility, offset in part by cash used in 2011 to repurchase shares of our common stock and the change in our book overdraft. The increase in 2010 primarily... -

Page 33

...information related to our interest rate swaps, refer to Note 6, Derivative Instruments , of the notes to the consolidated financial statements. Repurchases of Common Stock - In November 2010, the Board of Directors approved a program to repurchase up to $100.0 million in shares of our common stock... -

Page 34

... have been recorded as liabilities. The timing and amounts of future cash payments related to these liabilities are uncertain. We maintain a noncontributory defined benefit pension plan ("qualified plan") covering substantially all full-time employees hired before January 1, 2011. Our policy is to... -

Page 35

... and motivate key officers, non-employee directors and employees to work toward the financial success of the Company. Share-based compensation cost for our stock option grants is estimated at the grant date based on the award's fair-value as calculated by an option pricing model and is recognized... -

Page 36

...increased costs through higher prices is limited by the competitive environment in which we operate. From time to time, we enter into futures and option contracts to manage these fluctuations. At October 2, 2011, we had no such contracts in place. ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA... -

Page 37

... 2, 2011, the Company's Chief Executive Officer and Chief Financial Officer (its principal executive officer and principal financial officer, respectively) have concluded that the Company's disclosure controls and procedures were effective. Changes in Internal Control Over Financial Reporting There... -

Page 38

... the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Jack in the Box Inc. and subsidiaries as of October 2, 2011 and October 3, 2010, and the related consolidated statements of earnings, cash flows, and stockholders' equity for the fifty-two weeks ended... -

Page 39

... be addressed to Jack in the Box Inc., 9330 Balboa Avenue, San Diego, CA 92123, Attention: Corporate Secretary. The Company's primary website can be found at www.jackinthebox.com. We make available free of charge at this website (under the caption "Investors - SEC Filings") all of our reports filed... -

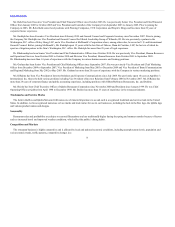

Page 40

...Management" to be filed with the Commission pursuant to Regulation 14A within 120 days after October 2, 2011 and to be used in connection with our 2012 Annual Meeting of Stockholders is hereby incorporated by reference. Information regarding equity compensation plans under which company common stock... -

Page 41

...Form of Stock Option Award for officers of Qdoba Restaurant Corporation under the 2004 Stock Incentive Plan Jack in the Box Inc. Non-Employee Director Stock Option Award Agreement under the 2004 Stock Incentive Plan 8-K 10-Q 10-K 11/15/2005 5/13/2009 11/20/2009 Form of Restricted Stock Unit Award... -

Page 42

...14/2008 Form of Stock Option and Performance Unit Awards Agreement under the 2004 Stock Incentive Plan Form of Qdoba Unit Award Agreement Executive Retention Agreement between Jack in the Box Inc. and Gary J. Beisler, President and Chief Executive Officer of Qdoba Restaurant Corporation 11/20/2009... -

Page 43

.... JACK IN THE BOX INC. By: /S/ JERRY P. REBEL Jerry P. Rebel Executive Vice President and Chief Financial Officer (principal financial officer) (Duly Authorized Signatory) Date: November 22, 2011 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed... -

Page 44

Table of Contents Signature Title Date /S/ DAVID M. TEHLE David M. Tehle Director November 22, 2011 /S/ WINIFRED M. WEBB Winifred M. Webb Director November 22, 2011 /S/ JOHN T. WYATT John T. Wyatt Director November 22, 2011 43 -

Page 45

...Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Earnings Consolidated Statements of Cash Flows Consolidated Statements of Stockholders' Equity Notes to Consolidated Financial Statements F-2 F-3 F-4 F-5 F-6 F-7 Schedules not filed: All schedules... -

Page 46

... fifty-two weeks ended September 27, 2009, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the internal control over financial reporting of Jack in the Box Inc... -

Page 47

...SHEETS (Dollars in thousands, except per share data) October 2, October 3, 2011 TSSETS 2010 Current assets: Cash and cash equivalents Accounts and other receivables, net Inventories Prepaid expenses Deferred income taxes Assets held for sale and leaseback Other current assets $ 11,424 86,213 38... -

Page 48

... share data) Fiscal Year 2011 Revenues: Company restaurant sales Distribution sales Franchise revenues Operating costs and expenses, net: 2010 $1,668,527 397,977 2009 $ 1,975,842 $ 1,380,273 530,959 282,066 2,193,298 302,135 193,119 2,471,096 231,027 2,297,531 Company restaurant costs: Food... -

Page 49

...finance cost amortization Deferred income taxes Share-based compensation expense Pension and postretirement expense Losses (gains) on cash surrender value of company-owned life insurance Gains on the sale of company-operated restaurants, net Gains on the acquisition of franchise-operated restaurants... -

Page 50

... 28, 2008 Shares issued under stock plans, including tax benefit Share-based compensation Change in pension and postretirement plans' measurement date, net Comprehensive income: Net earnings Unrealized gains on interest rate swaps, net Effect of actuarial losses and prior service cost, net 73... -

Page 51

... POLICIES Nature of operations - Founded in 1951, Jack in the Box Inc. (the "Company") operates and franchises Jack in the Box ® quick-service restaurants and Qdoba Mexican Grill ® ("Qdoba") fast-casual restaurants in 44 states. The following summarizes the number of restaurants: 2011 Jack... -

Page 52

.... Fiscal 2011 and 2009 include 52 weeks while 2010 includes 53 weeks. Use of estimates - In preparing the consolidated financial statements in conformity with U.S. generally accepted accounting principles, management is required to make certain assumptions and estimates that affect reported amounts... -

Page 53

... with our acquisition of Qdoba Restaurant Corporation in fiscal 2003. Acquired franchise contract costs represent the acquired value of franchise contracts, which are amortized over the term of the franchise agreements plus options based on the projected royalty revenue stream. Our Qdoba trademark... -

Page 54

... franchise arrangements generally provide for franchise fees and continuing fees based upon a percentage of sales ("royalties"). In order to renew a franchise agreement upon expiration, a franchisee must obtain the Company's approval and pay then current fees. Franchise fees are recorded as revenue... -

Page 55

... claims incurred but not reported. Advertising costs - We administer marketing funds which include contractual contributions of approximately 5% and 1% of sales at all franchise and company-operated Jack in the Box and Qdoba restaurants, respectively. We record contributions from franchisees as... -

Page 56

... interest and, when applicable, penalties related to unrecognized tax benefits as a component of our income tax provision. Authoritative guidance issued by the FASB prescribes a minimum probability threshold that a tax position must meet before a financial statement benefit is recognized. The... -

Page 57

...Box restaurants sold to franchisees, the number of restaurants developed by franchisees and the related gains and fees recognized ( dollars in thousands ): Restaurants sold to franchisees New restaurants opened by franchisees Initial franchise fees received Proceeds from the sale of company-operated... -

Page 58

... statements of earnings. 4. GOODWILL TND INTTNGIBLE TSSETS, NET The changes in the carrying amount of goodwill during 2011 and 2010 by operating segment were as follows (in thousands) : Jack in the Box Balance at September 27, 2009 Acquisition of franchised restaurants Sale of company-operated... -

Page 59

... ): Fair Value Measurements as of October 2, 2011 Quoted Prices in Tctive Significant Markets for Other Identical Non-qualified deferred compensation plan (1) Interest rate swaps (Note 6) (2) Total liabilities at fair value Total $ (34,288) Tssets (Level 1) Observable Inputs (Level 2) $ (34... -

Page 60

...as weather and various other market conditions outside our control. Our ability to recover increased costs through higher prices is limited by the competitive environment in which we operate. Therefore, from time to time, we enter into futures and option contracts to manage these fluctuations. These... -

Page 61

... the agreement. The credit facility requires the payment of an annual commitment fee based on the unused portion of the credit facility. The credit facility's interest rates and the annual commitment rate are based on a financial leverage ratio, as defined in the credit agreement. At October 2, 2011... -

Page 62

... program. The FFE Facility is a 12-month revolving loan and security agreement bearing interest at the lender's cost of funds plus a weighted-average applicable margin of approximately 2.9%. The applicable margin varies from 2.5% to 3.2%, depending on the risk level of the underlying franchise... -

Page 63

... Year 2012 2013 2014 Capital Leases $ 1,812 Operating Leases $ 208,562 1,572 1,416 2015 2016 Thereafter 1,299 1,238 3,390 10,727 Total minimum lease payments Less amount representing interest, 9.96% weighted average interest rate Present value of obligations under capital leases Less current... -

Page 64

... relate to certain excess Jack in the Box property and restaurants that we have closed or plan to close. Impairment charges in 2010 and 2009 primarily represent charges to write-down the carrying value of certain underperforming Jack in the Box restaurants, including in 2010, property and equipment... -

Page 65

...reconciliation of the federal statutory income tax rate to our effective tax rate is as follows: Computed at federal statutory rate State income taxes, net of federal tax benefit Benefit of jobs tax credits Expense/(benefit) related to COLIs Others, net 2011 35.0% 3.4 (1.5) 0.3 (1.3) 35.9% 2010 35... -

Page 66

... $62.7 million expiring at various times between 2012 and 2029. At October 2, 2011 and October 3, 2010, we recorded a valuation allowance related to state net operating losses of $4.0 million and $4.1 million, respectively. The current year change in the valuation allowance of $0.1 million... -

Page 67

... executive retirement plan ("non-qualified plan") which provides certain employees additional pension benefits and has been closed to new participants since January 1, 2007. Benefits under both plans are based on the employees' years of service and compensation over defined periods of employment... -

Page 68

...of our retirement plans as of October 2, 2011 and October 3, 2010 (in thousands ): Qualified Pension Plan Non-Qualified Pension Plan 2011 Change in benefit obligation: 2010 $ 290,469 $ 2011 2010 $ Postretirement Health Plans 2011 2010 Obligation at beginning of year Service cost Interest cost... -

Page 69

... FINTNCITL STTTEMENTS Additional year-end pension plan information - The pension benefit obligation ("PBO") is the actuarial present value of benefits attributable to employee service rendered to date, including the effects of estimated future pay increases. The accumulated benefit obligation ("ABO... -

Page 70

...amounts reported for our pension and postretirement plans. A quarter percentage point decrease in the discount rate and long-term rate of return used would have decreased fiscal 2011 earnings before income taxes by $2.7 million and $0.7 million, respectively. The assumed average rate of compensation... -

Page 71

... on the amounts reported. For example, a 1.0% change in the assumed health care cost trend rate would have the following effect (in thousands): 1% Point 1% Point Total interest and service cost Postretirement benefit obligation Increase $ 230 $ 3,756 Decrease $ (194) $ (3,192) Plan assets - Our... -

Page 72

... at unadjusted quoted market prices. U.S. equity securities are comprised of investments in common stock of U.S. and non-U.S. companies for total return purposes. These investments are valued by the trustee at closing prices from national exchanges on the valuation date. (2) (3) Commingled equity... -

Page 73

... (Level 3) Corporate Bonds Beginning balance at October 3, 2010 Actual return on plan assets: Relating to assets still held at the reporting date Relating to assets sold during the period Purchases, sales, and settlements Ending balance at October 2, 2011 $ 69 - Real Estate $ 7,054 $ Total... -

Page 74

... payments are based on the same assumptions used to measure our benefit obligation at October 2, 2011 and include estimated future employee service. 12. SHTRE-BTSED EMPLOYEE COMPENSTTION Stock incentive plans - We offer share-based compensation plans to attract, retain and motivate key officers... -

Page 75

...-year period. Options may vest sooner for employees meeting certain age and years of service thresholds. Options granted to non-management directors vest six months from the date of grant. All option grants provide for an option exercise price equal to the closing market value of the common stock... -

Page 76

... models require the input of highly subjective assumptions, including the expected volatility of the stock price. The following table presents the weighted-average assumptions used for stock option grants in each year, along with the related weighted-average grant date fair value: 2011 Risk-free... -

Page 77

... of a new type of stock award, nonvested stock units ("RSUs"). RSUs are generally issued to executives, non-management directors and certain other members of management. Prior to fiscal 2011, RSUs were granted to certain Executive and Senior Vice Presidents pursuant to our share ownership guidelines... -

Page 78

... compensation plan are accounted for as equity-based awards and deferred amounts are converted into stock equivalents at the then-current market price of our common stock. During fiscal 2011 and 2009, 20,259 and 59,949 shares of common stock were issued in connection with director retirements... -

Page 79

...issued. Potentially dilutive common shares include stock options, nonvested stock awards and units, non-management director stock equivalents and shares issuable under our employee stock purchase plan. Performance-vested stock awards are included in the average diluted shares outstanding each period... -

Page 80

... million, in 2012, 2013, 2014, 2015 and 2016, respectively. These obligations primarily include contracts for goods related to restaurant operations. Legal matters - The Company is subject to normal and routine litigation brought by former, current or prospective employees, customers, franchisees... -

Page 81

...-branded restaurant operations business, our segments comprise results related to system restaurant operations for our Jack in the Box and Qdoba brands. This segment reporting structure reflects the Company's current management structure, internal reporting method and financial information used in... -

Page 82

..., net: Company-owned life insurance policies Deferred rent receivable Other 24,905 99,011 $ 199,118 76,296 19,664 55,144 $ 151,104 $ $ 31,259 Accrued liabilities: Payroll and related taxes Rent Sales and property taxes Insurance Advertising Gift card liability Deferred franchise fees Other 40... -

Page 83

... and diluted share. Refer to Note 9, Impairment, Disposal of Property and Equipment, and Restaurants Closing Costs, for additional information. 21. FUTURE TPPLICTTION OF TCCOUNTING PRINCIPLES In June 2011, the FASB issued ASU No. 2011-05, Presentation of Comprehensive Income , which was issued to... -

Page 84

... weeks ended October 3, 2010, and the fifty-two weeks ended September 27, 2009, and the effectiveness of internal control over financial reporting as of October 2, 2011, which reports appear in the October 2, 2011 annual report on Form 10-K of Jack in the Box Inc. /s/ KPMG LLP San Diego, California... -

Page 85

...and report financial information; and b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Dated: November 22, 2011 By: /S/ LINDA A. LANG Linda A. Lang Chief Executive Officer... -

Page 86

... financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; The registrant's other certifying officer and... -

Page 87

...13(a) of the Securities Exchange Act of 1934 (15 U.S.C. 78m); and the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Registrant. Dated: November 22, 2011 /S/ LINDA A. LANG Linda A. Lang Chief Executive Officer -

Page 88

... with the requirements of Section 13(a) of the Securities Exchange Act of 1934 (15 U.S.C. 78m); and the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Registrant. Dated: November 22, 2011 /S/ JERRY P. REBEL... -

Page 89