JP Morgan Chase 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1010

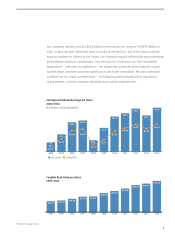

I. AN OUTSTANDING FRANCHISE

Our businesses have been able to gain market

share, which only happens when we are

creating happy clients

Importantly, much of the growth has been

organic. Please review some of the numbers in

the chart above – they speak for themselves.

If you had asked me back in 2006 if we could

have accomplished those kinds of market

share numbers, I would have been skeptical.

And, fortunately, we have plenty of areas

where we still can grow or do better – I will

talk about this in a later section of this letter.

Most of our businesses have exhibited improving

customer satisfaction

The chart on the next page shows the great

progress that our Consumer Bank has made

in improving satisfaction scores. In fact,

American Customer Satisfaction Index

named Chase #1 in customer satisfaction

among large banks in 2014. We have received

even better scores than most of the regional

banks and essentially are equal in ranking to

the midsized banks. (We still are not satis-

fied, however, and want to be even better.)

We believe that our customer satisfaction

has been going up for multiple reasons: error

rate reduction, better products and services,

good old-fashioned service with a smile, and,

importantly, innovations like deposit-friendly

ATMs and continual improvement in online

and mobile banking services. While the chart

shows satisfaction in the Consumer Bank, we

also have had increasing customer satisfac-

tion scores in our small business, mortgage,

auto finance and credit card franchises.

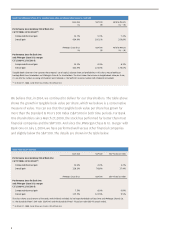

Leading Client Franchises

Building exceptional client franchises

We have built our client franchises over time with substantial share gains and opportunity for more

2006 2014

Consumer &

Community

Banking

Deposits market share

# of top 50 Chase markets where we are #1

(top 3) deposits

Card sales market share

Merchant processing volume

3.6%1

11 (25)

16%2

#33

7.5%

15 (40)

21%2

#14

Relationships with ~50% of U.S. households

#1 customer satisfaction among largest U.S. banks

for the third consecutive year14

#1 primary banking relationship share in Chase footprint15

#1 U.S. credit card issuer based on loans outstanding2

~50% of U.S. e-Commerce volume16

Corporate &

Investment

Bank

Global Investment Banking fees5

Market share5

Total Markets6,7

Market share6,7

FICC6,7

Market share6,7

Equities6,7

Market share6,7

#2

8.6%

#8

7.9%

#7

9.1%

#8

6.0%

#1

8.1%

#1

16.2%

#1

18.6%

#3

11.5%

>80% of Fortune 500 companies do business with us

Top 3 in 15 product categories out of 1617

#1 in both U.S. and EMEA Investment Banking fees18

#1 in Global debt, equity and equity-related18

#1 in Global long-term debt and Loan syndications18

Top 3 Custodian globally with AUC of $20.5 trillion

#1 USD clearinghouse with 19.2% share in 201419

Commercial

Banking

# of states with Middle Market banking presence

# of states with top 3 Middle Market banking

market share8

Multifamily lending9

Gross Investment Banking revenue ($ in billions)

% of North America Investment Banking fees

22

6

#28

$0.7

16%

30

10

#1

$2.0

35%

Average loans grew by 13% CAGR 2006-201420

Industry-leading credit performance TTC — 8 consecutive

quarters of net recoveries or single-digit NCO rate

Leveraging the firm’s platform — average ~9 products/client

Asset

Management

Global active long-term open-end mutual fund

AUM flows10

AUM market share10

Overall Global Private Bank (Euromoney)

Client assets market share11

U.S. Hedge Fund Manager (Absolute Return)12

AUM market share12

#2

1.8%

#5

~1%

#1113

1.4%

#1

2.5%

#1

~2%

#2

3.4%

84% of 10-year long-term mutual fund AUM in top 2

quartiles21

23 consecutive quarters of positive long-term AUM flows

Revenue growth >70% and long-term AUM growth >80%

since 2006

Doubled Global Wealth Management client assets

(2x industry rate) since 200622

For footnoted information, refer to slides 11 and 50 in the 2015 Firm Overview Investor Day presentation, which is available on JPMorgan Chase & Co.’s website at

(http://investor.shareholder.com/jpmorganchase/presentations.cfm), under the heading Investor Relations, Investor Presentations, JPMorgan Chase 2015 Investor Day,

Firm Overview, and on Form 8-K as furnished to the SEC on February 24, 2015, which is available on the SEC’s website (www.sec.gov). Further, for footnote 20,

CAGR represents compound annual growth rate