JP Morgan Chase 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

delivering results:

ANNUAL REPORT 2003

Table of contents

-

Page 1

A NNUA L REPORT 2003 delivering results: -

Page 2

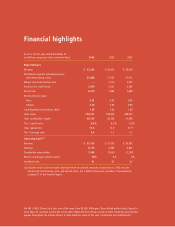

...Reported basis Revenue Noninterest expense (excluding merger and restructuring costs) Merger and restructuring costs Provision for credit losses Net income Net income per share: Basic Diluted Cash dividends declared per share Total assets Total stockholders' equity Tier 1 capital ratio Total capital... -

Page 3

...leaders are results leaders. A truly top-tier firm does more than make markets or serve customers. It delivers - value to shareholders, solutions to clients, and capital to the markets and communities in which it conducts business. JPMorgan Chase, a global market leader, is driven to produce results... -

Page 4

... the second-largest U.S. bank based upon core deposits, with assets of over $1 trillion. From coast to coast, we will provide mortgages, auto loans and credit cards, and welcome customers into more than 2,300 bank branches in 17 states. Our new firm will have a complete financial services platform... -

Page 5

... Equity-Related, and we maintained our #5 position in Global Announced M&A while increasing our market share. We also continued to rank #1 in Interest Rate and Credit Derivatives as well as in Global Loan Syndications. Even with the anticipated shift in market activity, we believe our fixed income... -

Page 6

... home equity, where we achieved significant increases in outstandings. Personal Financial Services, our branch-based business offering banking and investing services to upper-tier retail customers, continues to gain momentum, having increased new investment fee-based sales by 63% and bringing assets... -

Page 7

... growth and development in providing premier global wholesale financial services. In other areas, such as Institutional Trust Services, we may choose to augment our skills through tactical acquisitions. For the most part, however, our wholesale banking business will grow through better execution... -

Page 8

... discussing corporate governance issues with leading experts. Topics covered included risk management, financial disclosure, audit quality, the role of the compensation committee, fiduciary duties of directors, the board evaluation process and the integrity of the U.S. financial markets. Based on... -

Page 9

...financial officers is available at the firm's website. Alignment w ith shareholders Good corporate governance requires that compensation policies align with shareholder interests. JPMorgan Chase's compensation policy for executive officers emphasizes performance-based pay over fixed salary and uses... -

Page 10

From left to right: David A. Coulter, Vice Chairman Investment Bank, Investment Management & Private Banking; William B. Harrison, Chairman and CEO, Chairman of the Executive Committee; Donald H. Layton, Vice Chairman Chase Financial Services, Treasury & Securities Services, Technology -

Page 11

... recent strong deposit volume growth into revenue and profit improvement. J.P. M organ Chase & Co. / 2003 Annual Report David, with markets rebounding and firms bracing for a renewed flurry of client activity, how will the wholesale businesses look to not only capitalize but also build on their... -

Page 12

... the world. M eeting unparalleled demand: Chase Home Finance The 2003 U.S. real estate and home-finance markets were best described as explosive. Remarkably strong new-home construction starts, combined with plummeting interest rates, encouraged first-time home buyers not only to make purchases but... -

Page 13

...in the largest equity derivative or option sale ever executed. This was a one-of-a-kind transaction. The offering incorporated solutions for complex legal, tax and accounting issues. Consequently, JPMorgan is seeking U.S. patent protection on the concept and process. Setting a global benchmark: KfW... -

Page 14

... record time to create a unique, customized global service for one of the largest investors in the world. Based in Asia Pacific, this financial institution required a broad array of advisory and execution services. In structuring this solution, JPMorgan drew upon the expertise in its Investment Bank... -

Page 15

...processing and to offer home financing as an employee benefit. These cross-business partnerships enabled CAF to achieve a third-place ranking in 2003 loan originations, behind only General Motors Acceptance Corp. and Ford Motor Credit Co. Augo financie J.P. M organ Chase & Co. / 2003 Annual Report... -

Page 16

...to Personal Line, an around-the-clock phone servicing unit, and to PFS Online, which provides integrated banking and investing capability. In 2003, Personal Financial Services served 433,000 clients with deposit and investment assets of $54 billion. 14 J.P. M organ Chase & Co. / 2003 Annual Report -

Page 17

...U.S. retail asset management market. JPMorgan Chase is positioned to capitalize on this market's explosive growth by aligning JPMorgan Retirement Plan Services and BrownCo to offer mainstream U.S. retail investors a simpler, smarter way to roll over IRA accounts. JPMorgan Retirement Plan Services is... -

Page 18

... client credit review process, which improved risk management and profitability in the Investment Bank, to improving the process of identifying potential customers for credit card offers, the firm's broad-ranging productivity and quality efforts yielded more than $1 billion in net financial benefits... -

Page 19

... provide small cash loans and health and nutrition education to women living in rural areas of the developing world. The examples are international, the theme universal: the foundation was a valuable partner in strengthening the global community. J.P. M organ Chase & Co. / 2003 Annual Report 17 -

Page 20

... trustee and paying-agent functions to global securities clearance. Investor Services provides securities custody and related functions, such as securities lending, investment analytics and reporting, to mutual funds, investment managers, pension funds, insurance companies and banks w orldw ide... -

Page 21

... Capital markets and lending total return revenues grew 22%, driven by activity in fixed income and equity capital markets and by the Global Treasury business. • JPMorgan advised on the largest transatlantic acquisition of 2003 - Amersham's $10 billion acquisition by the General Electric Company... -

Page 22

..., excluding mortgage-backed and asset-backed securities • #1 issuing and paying agent for U.S. commercial paper • #1 ADR bank for reported ADR market cap under management Invest ment M anagement & Private Banking • #1 private bank in the U.S. and #3 in the world based on total client assets... -

Page 23

...consolidated financial statements Corporate: 132 133 134 135 136 Community Advisory Board Regional Advisory Board National Advisory Board JPM organ International Council Board of Directors Office of the Chairman Executive Committee Other corporate officers Corporate data and shareholder information... -

Page 24

... a full range of investment banking and commercial banking products and services, including advising on corporate strategy and structure, capital raising, risk management, and market-making in cash securities and derivative instruments in all major capital markets. The three businesses w ithin TSS... -

Page 25

...of management accounting policies or changes in organizational structure among businesses. JPM P revenue w as impacted in 2003 by losses on sales and w ritedow ns of private third-party fund investments. JPM P decreased its operating loss for the year by 64% compared w ith 2002. IB reported record... -

Page 26

... company, headquartered in New York, w ill be know n as J.P . M organ Chase & Co. and w ill have combined assets of $1.1 trillion, a strong capital base, 2,300 branches in 17 states and top-tier positions in retail banking and lending, credit cards, investment banking, asset management, private... -

Page 27

... offset by higher fees from origination and sales activity and other fees derived from volume and market-share grow th. M ortgage fees and related income, on a reported basis, excludes the impact of NII and securities gains and losses related to Chase Home Finance's mortgage banking activities. For... -

Page 28

... of commercial loans and low er spreads on investment securities. As a component of NII, trading-related net interest income of $2.1 billion w as up 13% from 2002 due to a change in the composition of, and grow th in, trading assets. The Firm's total average interest-earning assets in 2003 w ere... -

Page 29

... Banking Businesses: • Investment M anagement JPM organ Partners Business: • Private equity investments Chase Financial Services Businesses: • Home Finance • Debt and equity underw riting • M arket-making, trading and investing: - Fixed income - Treasury - Equities • Corporate lending... -

Page 30

... Partners (1)% Support Units and Corporate (2)% Consumer includes: Chase Home Finance 20% Chase Cardmember Services 10% Chase Auto Finance 3% Chase Regional Banking 1% Chase Middle Market 5% Other consumer services (2)% Wholesale and other includes: Investment Bank 55% Treasury & Securities... -

Page 31

... banking and commercial banking products and services, including advising on corporate strategy and structure, capital raising in equity and debt markets, sophisticated risk management, and market-making in cash securities and derivative instruments in all major capital markets. The Investment Bank... -

Page 32

... #4 #5 Capital markets revenue includes Trading revenue, Fees and commissions, Securities gains, related Net interest income and Other revenue. These activities are managed on a total-return revenue basis, w hich includes operating revenue plus the change in unrealized gains or losses on investment... -

Page 33

...on investment securities and low er loan volumes. The IB credit outlook is stable, although credit costs may be higher than the unusually low levels seen in 2003. IB Dimensions of 2003 revenue diversification By business revenue Fixed income capital markets Treasury Debt underwriting Equity capital... -

Page 34

... trustee and paying-agent functions to global securities clearance. Investor Services provides securities custody and related functions, such as securities lending, investment analytics and reporting, to mutual funds, investment managers, pension funds, insurance companies and banks w orldw ide... -

Page 35

... low er loan volumes and higher related expenses, slightly offset by a decrease in credit costs. Business outlook TSS revenue in 2004 is expected to benefit from improved global equity markets and from tw o recent acquisitions: the November 2003 acquisition of the Bank One corporate trust portfolio... -

Page 36

... & Private Banking (" IM PB" ) operating earnings are influenced by numerous factors, including equity, fixed income and other asset valuations; investor flow s and activity levels; investment performance; and expense and risk management. Global economic conditions rebounded in 2003, as corporate... -

Page 37

... Bank and retail investment management strategies are expected to drive operating earnings grow th. Assets under supervision (a) At December 31, (in billions) 2003 2002 Change Asse t cla ss: Liquidity $ 160 Fixed income 144 Equities and other 255 Assets under management 559 Custody/brokerage... -

Page 38

... mark-to-market gains (losses) due to public securities sales. $ (465) (293) (1,275) $ (808) Invest ment pace, port f olio diversif icat ion and capit al under management In 2003, increased emphasis w as placed on leveraged buyouts and grow th equity opportunities. JPM P's direct investments for... -

Page 39

... America 5% Asia/Pacific 3% Buyout 41% Growth equity 37% Venture 22% Total investment portfolio by industry at December 31, 2003 Real estate 3% Media 4% Life sciences 4% Healthcare infrastructure 6% Financial services 11% Technology 9% Telecommunications 5% Consumer retail & services 15% Funds 15... -

Page 40

... in 2003, CFS focused its efforts on grow ing or maintaining market share in its various businesses, enhancing its online banking capabilities, disciplined expense management and maintaining the credit quality of its loan portfolios. As a result of 38 $1,500 $1,414 01 Return on allocated capital 18... -

Page 41

... Lending. The Production business originates and sells mortgages. The Servicing business manages accounts for CHF's four million customers. The Portfolio Lending business holds for investment adjustable-rate first mortgage loans, home equity and manufactured housing loans originated and purchased... -

Page 42

...home equity revenue. M anagement expects a decrease in revenue in 2004, as production margins are expected to decline due to low er origination volumes and increased price competition. In its hedging activities, CHF uses a combination of derivatives and AFS securities to manage changes in the market... -

Page 43

... consumers to use cash received in their mortgage refinancings to pay dow n credit card debt. CCS w as able to grow earnings and originate a record number of new accounts by offering rew ards-based products, improving operating efficiency, delivering high-level customer service and improving... -

Page 44

... of CRB customers holding Chase credit cards. CRB is compensated by CFS's credit businesses for the home finance and credit card loans it originates and does not retain these balances. While CRB continues to position itself for grow th, decreased deposit spreads related to the low -rate environment... -

Page 45

... 46% Demand deposits 18% Time 15% Interest checking 13% Money market 8% (a) Deposits, money market funds and/or investment assets (including annuities). Chase M iddle M arket CM M is a premier provider of commercial banking and corporate financial services to companies w ith annual sales of $10... -

Page 46

...and Corporate sector includes technology, legal, audit, finance, human resources, risk management, real estate management, procurement, executive management and marketing groups w ithin Corporate. The technology and procurement services organizations seek to provide services to the Firm's businesses... -

Page 47

... of the Firm's capital and debt levels • Recommends balance sheet limits by line of business • Recommends dividend and stock repurchase policies • Review s funds transfer pricing policies and methodologies Risk M anagement Committee • Provides oversight and direction of the risk profile and... -

Page 48

... model - the Firm's goal to limit losses, even under stress conditions - targeted regulatory ratios and credit ratings - the Firm's liquidity management strategy. • Directing capital investment to activities w ith the most favorable risk-adjusted returns. Capital also is assessed against business... -

Page 49

... an acquisition in the fourth quarter of 2003. There w as minimal impact to the Firm's Tier 1 and Total capital ratios due to the adoption of FIN 46, as the Federal Reserve Board provided interim regulatory capital relief related to asset-backed commercial paper conduits and trust preferred vehicles... -

Page 50

... 2003. Credit card loans declined modestly, affected by increased securitization activity and higher levels of payments from cash redeployed from consumer mortgage refinancings. The securities portfolio declined due to changes in positioning related to structural interest rate risk management... -

Page 51

... market liquidity by facilitating investors' access to specific portfolios of assets and risks. SPEs are not operating entities; typically they are established for a single, discrete purpose, have a limited life and have no employees. The basic SPE structure involves a company selling assets... -

Page 52

...Net of risk participations totaling $16.5 billion at December 31, 2003. (b) Includes unused advised lines of credit totaling $19 billion at December 31, 2003, which are not legally binding. In regulatory filings with the Federal Reserve Board, unused advised lines are not reportable. (c) Included on... -

Page 53

... market loan sales • M anages derivatives collateral risk Policy and Strategy Group • Formulates credit policies, limits, allowance appropriateness and guidelines • Independently audits, monitors and assesses risk ratings and risk management processes • Addresses country risk, counterparty... -

Page 54

... loan and commitment sales. This w as partially offset J.P. M organ Chase & Co. / 2003 Annual Report Consumer Consumer credit risks are monitored at the aggregate CFS level and w ithin each line of business (mortgages, credit cards, automobile finance, small business and consumer banking). Consumer... -

Page 55

... of this Annual Report. The follow ing table reconciles Derivative receivables on a M TM basis w ith the Firm's Economic credit exposure basis, a non-GAAP financial measure. For commercial lending-related commitments, the Firm measures its Economic credit exposure using a " loan equivalent" amount... -

Page 56

... in Lending-related commitments. The remaining $6.3 billion of commitments to these VIEs is excluded, as the underlying assets of the vehicles are reported as follows: $4.8 billion in Loans and $1.5 billion in Available-for-sale securities. As of December 31, 2003, total Economic credit exposure... -

Page 57

... this Annual Report for a further discussion. (f) Ratings are based on the underlying referenced assets. Commercial exposure - selected industry concentrations During 2003, the Firm undertook a thorough analysis of industry risk correlations. As a result, the Firm developed a new industry structure... -

Page 58

...against derivative receivables Top 10 indust rie s(e) Commercial banks $ Asset managers Securities firms and exchanges Finance companies and lessors Utilities Real estate State and municipal governments M edia Consumer products Insurance Ot he r se le ct e d indust rie s Telecom services Automotive... -

Page 59

... of credit exposure to 21 industry segments. Exposures related to special-purpose entities and high net w orth individuals totaled 38% of this category. Specialpurpose entities provide secured financing (generally backed by receivables, loans or bonds) originated by companies in a diverse group of... -

Page 60

... located outside the country if the enhancements fully cover the country risk, as w ell as the commercial risk. In addition, the benefit of collateral, credit derivative hedges and other short credit or equity trading positions are reflected. Total exposure includes exposure to both government... -

Page 61

... Report. The Firm believes that active risk management is essential to controlling the dynamic credit risk in the derivatives portfolio. The Firm hedges its exposure to changes in CVA by entering into credit derivative transactions, as w ell as interest rate, foreign exchange, equity and commodity... -

Page 62

... and changes in value due to movement in spreads and credit events, w hereas the loans and lending-related commitments being hedged are accounted for on an accrual basis in Net interest income and assessed for impairment in the Provision for credit 60 J.P. M organ Chase & Co. / 2003 Annual Report -

Page 63

...or risk management purposes. The credit derivatives trading function operates w ithin the same framew ork as other market-making desks. Risk limits are established and closely monitored. As of December 31, 2003, the total notional amounts of protection purchased and sold by the dealer business w ere... -

Page 64

... 31, 2003 and 2002. U.S. managed consumer loans by region (a) 2003 Southwest 3% West 7% Texas 7% Northeast 18% (b) Midwest 14% Southeast 16% (a) Based on U.S. 1-4 family residential mortgage, managed credit card and automobile financing loans. (b) Excludes New York. 2002 New York 16% California... -

Page 65

...consumer: 1-4 family residential mortgages - first liens Home equity 1-4 family residential mortgages Credit card - reported (b)(c) Credit card securitizations (b)(d) Credit card - managed Automobile financings Other consumer (e) Total managed consumer loans Lending-related commitments $ 46 $ 57... -

Page 66

... and $87 million of commercial specific and commercial expected loss components, respectively, at December 31, 2002. (c) Includes $138 million related to the transfer of the allowance for accrued interest and fees on securitized credit card loans. 64 J.P. M organ Chase & Co. / 2003 Annual Report -

Page 67

... the total allow ance for loan losses, w ithin the Firm's target range of betw een 10% and 20% . The Firm anticipates that if the current positive trend in economic conditions and credit quality continues, the commercial and residual components w ill continue to be reduced. Lending-relat ed commit... -

Page 68

... and financial instruments caused by adverse movements in market variables, such as interest and foreign exchange rates, credit spreads, and equity and commodity prices. JPM organ Chase employs comprehensive and rigorous processes intended to measure, monitor and control market risk. M arket risk... -

Page 69

... of a business w hose strategy is to trade, make markets or take positions for the Firm's ow n trading account; gains and losses in these positions are reported in Trading revenue. Nontrading risk includes mortgage banking positions held for longer-term investment and positions used to manage the... -

Page 70

... in the mortgage banking business, w hich w ere then included in the Firm's trading portfolio, but w hich are now included in the nontrading portfolio w ith other mortgage banking positions. The graph below depicts the number of days on w hich JPM organ Chase' s market risk-related revenues fell... -

Page 71

...lending rate), pricing strategies on deposits and changes in product mix. These stress tests also take into account forecasted balance sheet changes, such as asset sales and securitizations, as w ell as prepayment and reinvestment behavior. RIFLE In addition to VAR, JPM organ Chase employs the Risk... -

Page 72

... to interest rate, foreign exchange, equity and commodity risk w ithin their portfolio risk structures. Nontrading Risk M ajor risk - Int erest rat es The execution of the Firm's core business strategies, the delivery of products and services to its customers, and the discretionary positions the... -

Page 73

...'s Risk M anagement Committee review s and approves risk limits at least tw ice a year. M RM further controls the Firm's exposure by specifically designating approved financial instruments for each business unit. The potential stress-test loss as of December 4, 2003, is the result of the " Credit... -

Page 74

...pages 76-77 of this Annual Report. M odel review M any of the Firm's financial instruments cannot be valued based on quoted market prices but are instead valued using pricing models. Such models are used for management of risk positions, such as reporting risk against limits, and for valuation. The... -

Page 75

...-based tool. When fully implemented, this model w ill enable the Firm to enhance its reporting and analysis of operational risk data, leading to improved risk management and financial performance. Audit alignment: In addition to conducting independent internal audits, the Firm's internal audit group... -

Page 76

... market and concentration risk. Private equity risk is initially monitored through the use of industry and geographic limits. Additionally, to manage the pace of new investments, a ceiling on the amount of annual private equity investment activity has been established. JPM P's public equity holdings... -

Page 77

... distributions, collections and the historical loss experience of a business segment, differ across business lines. For example, credit card revolving credit has significantly higher charge-off ratios than fixed mortgage credit. Determination of each factor is based primarily on statistical data and... -

Page 78

...Securities sold (a) Derivatives (b) AFS securities Fair value of financial instruments A portion of JPM organ Chase's assets and liabilities are carried at fair value, including trading assets and liabilities, AFS securities and private equity investments. Held-for-sale loans and mortgage servicing... -

Page 79

... private equity investments, see the Private equity risk management discussion on page 74 and Note 15 on page 106 of this Annual Report. M SRs and cert ain ot her ret ained int erest s M SRs and certain other retained interests from securitization activities do not trade in an active, open market... -

Page 80

..., at this time and based on management's current interpretation, the Firm does not believe that the implementation of FIN 46R w ill have a material impact on the Firm's Consolidated financial statements, earnings or capital resources. Derivative instruments and hedging activities In April 2003, the... -

Page 81

...management's assessment of the Firm's internal control over financial reporting, w hich report is also required to be filed as part of the Annual Report. Accounting for trading derivatives In October 2002, the EITF concluded on Issue 02-3, w hich, effective January 1, 2003, precludes mark-to-market... -

Page 82

... businesses. In IB, revenue declined 15% , driven by the reduction in capital markets and lending revenue, as w ell as in Investment banking fees. The reduction in capital markets revenue w as primarily attributable to low er portfolio management revenue related to both fixed income and equities... -

Page 83

... LLP • 1177 AVENUE OF THE AM ERICAS • N EW YORK, NY 10036 To the Board of Directors and stockholders of J.P . M organ Chase & Co.: In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, of changes in stockholders' equity and of cash flow... -

Page 84

...banking fees Trading revenue Fees and commissions Private equity gains (losses) Securities gains M ortgage fees and related income Other revenue Total noninterest revenue Interest income Interest expense Net interest income Revenue before provision for credit losses Provision for credit losses Total... -

Page 85

... s Cash and due from banks Deposits w ith banks Federal funds sold and securities purchased under resale agreements Securities borrow ed Trading assets: Debt and equity instruments (including assets pledged of $81,312 in 2003 and $88,900 in 2002) Derivative receivables Securities: Available-for-sale... -

Page 86

... for purchase accounting acquisitions Shares issued and commitments to issue common stock for employee stock-based aw ards and related tax effects Balance at end of year Re t a ine d e a rnings Balance at beginning of year Net income Cash dividends declared: Preferred stock Common stock ($1.36... -

Page 87

...reconcile net income to net cash provided by (used in) operating activities: Provision for credit losses Surety settlement and litigation reserve Depreciation and amortization Deferred tax provision (benefit) Private equity unrealized (gains) losses Net change in: Trading assets Securities borrow ed... -

Page 88

...range of services to a global client base that includes corporations, governments, institutions and individuals. For a discussion of the Firm's business segment information, see Note 34 on pages 126-127 of this Annual Report. The accounting and financial reporting policies of JPM organ Chase and its... -

Page 89

... employee benefit plans Employee stock-based incentives Securities Securities financing activities Loans Allowance for credit losses Loan securitizations Variable interest entities Private equity investments Goodwill and other intangibles Premises and equipment Income taxes Derivative instruments... -

Page 90

... include fees from investment management, custody and institutional trust services, deposit accounts, brokerage services, loan commitments, standby letters of credit and financial guarantees, compensating balances, insurance products and other financial service-related products. These fees are... -

Page 91

... Postretirement employee benefit plans 2003 Investment management and service fees $ 2,244 Custody and institutional trust service fees 1,601 Credit card fees 2,971 Brokerage commissions 1,181 Lending-related service fees 580 Deposit service fees 1,146 Other fees 929 Total fees and commissions... -

Page 92

... to surplus assets of group annuity contracts. (c) At December 31, 2003 and 2002, Accrued expenses related to non-U.S. defined benefit pension plans that JPMorgan Chase elected not to prefund fully totaled $99 million and $81 million, respectively. 90 J.P. M organ Chase & Co. / 2003 Annual Report -

Page 93

... of $178 million. Compensation expense related to the Firm's other defined benefit pension plans totaled $19 million in 2003, $15 million in 2002 and $22 million in 2001. changing yields. Other asset-class returns are derived from their relationship to equity and bond markets. In the United Kingdom... -

Page 94

...postretirement benefit plan, are held in separate accounts w ith an insurance company and are invested in equity and fixed income index funds. Assets used to fund the Firm's U.S. and non-U.S. defined benefit pension and postretirement benefit plans do not include JPM organ Chase common stock, except... -

Page 95

... all stock-based compensation aw ards, including stock options, to be accounted for at fair value. Fair value is based on a BlackScholes valuation model, w ith compensation expense recognized in earnings over the required service period. Under J.P. M organ Chase & Co. / 2003 Annual Report 93 -

Page 96

... of JPM organ Chase's broad-based employee stock option plan activity during the past three years: 2002 Number of options Weighted-average exercise price Number of options 2001 Weighted-average exercise price 2003 Weighted-average exercise price Options outstanding, January 1 Granted Exercised... -

Page 97

... beyond that planned at the time of the merger. Restructuring costs associated w ith programs announced after January 1, 2002, are reflected in the related expense category of Net income as reported Add: Employee stock-based compensation expense originally included in reported net income, net of... -

Page 98

...-to-maturity securities (b) (a) Includes CMOs of private issuers, which generally have underlying collateral consisting of obligations of U.S. government and federal agencies and corporations. (b) Consists primarily of mortgage-backed securities. 96 J.P. M organ Chase & Co. / 2003 Annual Report -

Page 99

... is based on amortized cost balances at year-end. Yields are derived by dividing interest income (including the effect of related derivatives on AFS securities and the amortization of premiums and accretion of discounts) by total amortized cost. Taxable-equivalent yields are used where applicable... -

Page 100

... interest on residential mortgage products, automobile financings and certain other consumer loans are accounted for in accordance w ith the nonaccrual loan policy J.P. M organ Chase & Co. / 2003 Annual Report 2003 $ 62,801 41,834 $ 105,409 2,461 2002 Securities purchased under resale agreements... -

Page 101

... of the dates indicated w as as follow s: 2003 2002 Total U.S. Non-U.S. Total December 31, (in millions) U.S. Non-U.S. Com m ercial loans: Commercial and industrial Commercial real estate: Commercial mortgage Construction Financial institutions Non-U.S. governments Total commercial loans $ 43... -

Page 102

... securitizations JPM organ Chase securitizes, sells and services various consumer loans originated by Chase Financial Services (residential mortgage, credit card and automobile loans), as w ell as certain commercial loans (primarily real estate) originated by the Investment Bank. Interests in the... -

Page 103

... interests are not subject to prepayment risk. Expected credit losses for prime mortgage securitizations are minimal and are incorporated into other assumptions. Not applicable due to collateral coverage on loans in commercial securitizations. J.P. M organ Chase & Co. / 2003 Annual Report 101 -

Page 104

... (a) No expected static-pool net credit losses on commercial securitizations due to collateral coverage on loans in commercial securitizations. (b) Static-pool losses not applicable to credit card securitizations due to their revolving structure. 102 J.P. M organ Chase & Co. / 2003 Annual Report -

Page 105

...mutual funds. IM PB earns a fixed fee based on assets managed; such fee varies w ith each fund's investment objective and is industry-competitive. The majority of the residual returns and expected losses are for the account of the funds' investors. The Firm generally does not hold an equity interest... -

Page 106

... The Firm has created structured commercial loan vehicles managed by third parties, in w hich loans are purchased from third parties or through the Firm's syndication and trading functions and funded by issuing commercial paper. Investors provide collateral and have a first risk of loss up to the... -

Page 107

...by the VIE to transfer the risk of the referenced credit to the investors in the VIE. Clients and investors often prefer a VIE structure, since the credit-linked notes generally carry a higher credit rating than they w ould if issued directly by JPM organ Chase. The Firm's derivative contract is not... -

Page 108

... public companies, changes in market outlook and changes in the third-party financing environment. The Valuation Control Group w ithin the Finance area is responsible for review ing the accuracy of the carrying values of private investments held by JPM P . JPM P also holds public equity investments... -

Page 109

...as adverse changes in the business climate, indicate there may be impairment. Other acquired intangible assets determined to have finite lives, such as core deposits and credit card relationships, are amortized over their estimated useful lives in a manner that best reflects the economic benefits of... -

Page 110

... losses on AFS securities are reported in Other comprehensive income. In addition, certain nonhedge derivatives, w hich have not been designated by management in SFAS 133 hedge relationships, are used to manage the economic risk exposure of M SRs and are recorded in M ortgage fees and related income... -

Page 111

... credit card relationships and other intangible assets No purchased credit card relationships w ere acquired during 2003. Other intangibles (primarily customer relationships) increased by approximately $428 million, principally due to the businesses acquired by Treasury & Securities Services... -

Page 112

... financial statements J.P . M organ Chase & Co. By remaining contractual maturity at December 31, (in millions) Under 1 year 1-5 years Aft er 5 years 2003 t ot al 2002 total Parent com pany Senior debt: Fixed rate Variable rate(a) Interest rates(b) Subordinated debt: Fixed rate Variable rate... -

Page 113

...real estate investment trust (" REIT" ) established for the purpose of acquiring, holding and managing real estate mortgage assets. On February 28, 2002, Chase Preferred Capital redeemed all 22 million outstanding shares of its 8.10% Cumulative Preferred Stock, Series A, at a redemption price of $25... -

Page 114

... stock w ere reserved for issuance under various employee incentive, option and stock purchase plans. Comprehensive income is composed of Net income and Other comprehensive income, w hich includes the after-tax change in unrealized gains and losses on AFS securities, cash flow hedging activities... -

Page 115

... tax effects of unrealized gains and losses on AFS securities, SFAS 133 hedge transactions and certain tax benefits associated w ith JPM organ Chase's employee stock plans. The tax effect of these items is recorded directly in Stockholders' equity. Stockholders' equity increased by $898 million and... -

Page 116

... ance for credit losses up to a certain percentage of risk-w eighted assets, less investments in certain subsidiaries. Under the risk-based capital guidelines of the Federal Reserve Board, JPM organ Chase is required to maintain minimum ratios of Tier 1 and total (Tier 1 plus Tier 2) capital to risk... -

Page 117

...debentures issued to JPMorgan Chase less the capital securities of the issuer trusts. For a further discussion, see Note 18 on pages 110-111 of this Annual Report. (c) The provisions of SFAS 115 do not apply to the calculations of the Tier 1 capital and Tier 1 leverage ratios. The risk-based capital... -

Page 118

...exchange rate changes on future earnings. All amounts have been included in earnings consistent w ith the classification of the hedged item, primarily Net interest income. J.P. M organ Chase & Co. / 2003 Annual Report Note 28 Accounting for derivative instruments and hedging activities Derivative... -

Page 119

... securities as economic hedges of mortgage servicing rights. Changes in the fair value of credit derivatives used to manage the Firm's credit risk are recorded in Trading revenue because of the difficulties in qualifying such contracts as hedges of loans and commitments. Off-balance sheet lending... -

Page 120

... credit losses on lending-related commitments included $167 million related to standby letters of credit and financial guarantees. JPM organ Chase holds customers' securities under custodial arrangements. At times, these securities are loaned to third parties, and the Firm issues securities lending... -

Page 121

... is a 50% partner w ith one of the leading companies in electronic payment services in a joint venture, know n as Chase M erchant Services (the " joint venture" ) that provides merchant processing services in the United States. The joint venture is contingently liable for processed credit card sales... -

Page 122

... Credit exposure On-balance sheet (a) Off-balance sheet (b) Commercial-related: Commercial banks Asset managers Securities firms and exchanges Finance companies and lessors Utilities All other commercial Total commercial-related Consumer-related: Credit cards (c) 1-4 family residential mortgages... -

Page 123

... cash flow s are discounted using the appropriate market rates for the applicable maturity. Valuation adjustments are determined based on established policies and are controlled by a price verification group independent of the risk-taking function. Economic substantiation of models, prices, market... -

Page 124

... rates used for consumer installment loans are current rates offered by commercial banks. For 1-4 family residential mortgages, secondary market yields for comparable mortgage-backed securities, adjusted for risk, are used. Fair value for credit card receivables is based on discounted expected cash... -

Page 125

... value $ Federal funds sold and securities purchased under resale agreements Trading assets Securities available-for-sale Securities held-to-maturity Loans: Commercial, net of allowance for loan losses Consumer, net of allowance for loan losses Other assets Total financial assets 84.6 76.9 252... -

Page 126

...127 of this Annual Report. The Firm's long-lived assets for the periods presented are not considered by management to be significant in relation to total assets. The majority of the Firm's long-lived assets are located in the United States. Revenue(a) Expense(b) Income (loss) before income taxes Net... -

Page 127

... Cash w ith banks Deposits w ith banking subsidiaries Securities purchased under resale agreements, primarily w ith nonbank subsidiaries Trading assets Available-for-sale securities Loans Advances to, and receivables from, subsidiaries: Bank and bank holding company Nonbank Investment (at equity) in... -

Page 128

...not directly incurred by them, such as corporate overhead. In addition, management has developed a risk-adjusted capital methodology that quantifies the different types of risk - credit, market, operational, business and private equity - w ithin the various businesses and assigns capital accordingly... -

Page 129

..., financial information relating to JPM organ Chase's operations by geographic area is provided in Note 32 on page 124 of this Annual Report. (table continued from previous page) Corporate/ reconciling items(a) 2001 JPM organ Partners Chase Financial Services 2001 Total 2001 2003 $ (264... -

Page 130

... Chase's common stock is listed and traded on the New York Stock Exchange, the London Stock Exchange Limited and the Tokyo Stock Exchange. The high, low and closing prices of JPMorgan Chase's common stock are from the New York Stock Exchange Composite Transaction Tape. (d) Includes credit card... -

Page 131

... interests issued by consolidated variable interest entities on the Consolidated balance sheet. (c) JPMorgan Chase's common stock is listed and traded on the New York Stock Exchange, the London Stock Exchange Limited and the Tokyo Stock Exchange. The high, low and closing prices of JPMorgan Chase... -

Page 132

... Board Opinion. APB 25: " Accounting for Stock Issued to Employees." Asset capital tax: Capital allocated to each business segment based on its average asset level and certain off-balance sheet credit-related exposures; reflects the need for the Firm to maintain minimum leverage ratios to meet bank... -

Page 133

...the Firm does not have repayment risk. M arket risk: The potential loss in value of portfolios and financial instruments caused by movements in market variables, such as interest and foreign exchange rates, credit spreads, and equity and commodity prices. M aster netting agreement: An agreement betw... -

Page 134

...-Based Programs Public/Private Ventures Philadelphia, P A Harold DiRienzo President & CEO Parodneck Foundation New York, NY William Frey Vice President & Director Enterprise Foundation New York City Office New York, NY David Gallagher Executive Director Center for Neighborhood Economic Development... -

Page 135

...Foods M ichael C. Nahl Senior Vice President and Chief Financial Officer Albany International Corp. Samuel I. New house, III Advance Publications William C. Rudin President Rudin M anagement Company, Inc. John Shalam Chairman and Chief Executive Officer Audiovox Corporation Arthur T. Shorin Chairman... -

Page 136

... Executive Officer SPX Corporation David Bonderman Founding Partner Texas Pacific Group Richard J. Bressler Senior Executive Vice President and Chief Financial Officer Viacom Inc. Frank A. D'Amelio Executive Vice President and Chief Financial Officer Lucent Technologies Nancy J. De Lisi Senior Vice... -

Page 137

...of the Board The Chase M anhattan Corporation New York, New York Jess Søderberg Partner and Chief Executive Officer A.P . M øller-M aersk Group Copenhagen, Denmark William S. Stavropoulos Chairman of the Board The Dow Chemical Company M idland, M ichigan Ratan Naval Tata Chairman Tata Sons Limited... -

Page 138

... and Chief Executive Officer Bechtel Group, Inc. Frank A. Bennack, Jr. Chairman of the Executive Committee and Vice Chairman of the Board The Hearst Corporation John H. Biggs Former Chairman and Chief Executive Officer Teachers Insurance and Annuity AssociationCollege Retirement Equities Fund (TIAA... -

Page 139

... the reinvestment agent for the plan, at the address indicated above. Independent accountants Pricew aterhouseCoopers LLP 1177 Avenue of the Americas New York, New York 10036 Direct deposit of dividends For information about direct deposit of dividends, please contact M ellon Investor Services LLC... -

Page 140

J.P. Morgan Chase & Co. www.jpmorganchase.com