Isuzu 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Isuzu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Special Feature

Special Feature: Highlights from Isuzu Motors

Financial Statements A&A Company Report

Business outlook for the fi scal year ending March 31, 2012

Isuzu announces earnings estimates based on a recovery in production in the wake of the

Great East Japan Earthquake and future demand trends

Despite the lingering effect of the Great East Japan Earthquake during the fi rst half, Isuzu expects

sales to increase during the fi scal year ending March 31, 2012, due to factors including further growth

in demand in emerging countries and increased sales of industrial engines. In terms of profi t, the

Company expects soaring material costs, the strong yen, and development costs and other up-front

investments in advance of future expansion to offset increased sales, pushing operating income down

to ¥80.0 billion (a decrease of ¥8.2 billion from the previous year). As the Company moves beyond

earthquake-related extraordinary losses, net income is expected to rebound to ¥65.0 billion (an

increase of ¥13.4 billion from the previous year).

Highlights

➊ Assuring an advantageous position in emerging and resource-producing countries that

are expected to grow in the future

Notably, overseas sales account for about 60% of Isuzu’s consolidated sales, and the Company

has established an advantageous position in emerging countries in Asia and beyond, highlighting the

success of its long-running efforts to strengthen overseas performance. With operations in not only

Asia, but also in the Middle East, Africa, South and Central America, Oceania, and Europe, Isuzu’s

business portfolio is characterized by global distribution.

In light of continuing robust demand for trucks, particularly in emerging countries, Isuzu plans to

ship 625,000 commercial and light commercial vehicles during the fi scal year ending March 31, 2012,

of which 576,000 are destined for overseas markets. This exceeds performance milestones set prior to

the fi nancial crisis. Under these plans, overseas exports of commercial vehicles will set a new high.

➋ Achieving high profi tability despite the strong yen through the aggressive pursuit of

product competitiveness and low-cost operations

Profi ts by geographic segment indicate that the Japan, Asia, and Other segments are generating

profi ts commensurate with their respective sales fi gures.

Particularly noteworthy is the fact that Isuzu’s manufacture and sale of commercial vehicles, which

are manufactured in Japan and shipped worldwide, are independently profi table despite the strong

yen. The Company’s domestic businesses are generating stable profi ts despite the slowdown in new-

vehicle demand thanks to the streamlining of domestic sales structures and the expansion of life

cycle businesses such as service and parts. Most overseas exports are priced in yen, and transactions

denominated in foreign currencies account for just 10% of overall sales. While the exchange rate

poses certain challenges, the Company has managed to grow sales as the market recovers by

overcoming the strong yen with highly competitive products. Efforts to implement low-cost operations

in the wake of the Lehman Shock have taken root, and improvements in the Company’s profi t structure

have allowed it to achieve stable profi ts despite the yen’s strength.

➌ ASEAN light commercial vehicle business

In the pick-up truck segment, which accounts for approximately half of all automobile sales in

Thailand, Isuzu continues to enjoy robust sales as the top brand. The Company has steadily increased

exports of pick-up trucks from Thailand since the transfer of production there from Japan in 2004,

and the ASEAN light commercial vehicle business continues to grow steadily. In March 2010, Isuzu

transferred pick-up truck development to Thailand, including decision-making authority, and created

a business structure capable of accomplishing the entire development process locally.

➍ Industrial diesel engines: A new mainstay of Isuzu’s business

Diesel engines from truck manufacturers, who are leading the way in complying with environmen-

tal regulations, are being widely adopted for use in industrial machinery such as products made by

construction machinery manufacturers. Signifi cant growth in shipments of Isuzu’s industrial diesel

engines refl ects factors such as increasing demand for construction machinery in emerging countries,

strengthening of emissions regulations worldwide, and the Company’s extensive product portfolio.

It is noteworthy that the growth in shipments is not limited to Japanese manufacturers, but

extends to construction machinery manufacturers in China.

Share data

Principal market: First Section, Tokyo Stock Exchange

Share price (as of 8/31/2011): ¥341

Outstanding shares: 16.97 million

Percentage of foreign ownership: 28.61%

Share price

Isuzu—Towards Sustainable Growth

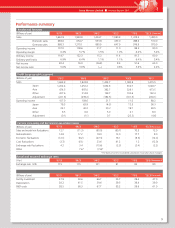

Business Performance (consolidated)

Fiscal year Sales Operating income Ordinary income Net income EPS Dividend

(millions of yen) Year-on-year (%) (millions of yen) Year-on-year (%) (millions of yen) Year-on-year (%) (millions of yen) Year-on-year (%) (yen) (yen)

’07/3 1,662,925 5.1 106,890 18.0 114,697 22.2 92,394 56.7 51.54 4.0

’08/3 1,924,833 15.7 109,573 2.4 122,322 6.6 76,021 -17.7 44.36 5.0

’09/3 1,424,708 -26.0 21,651 -80.2 15,236 -87.5 -26,858 -15.85 3.0

’10/3 1,080,928 -24.1 11,010 -49.1 11,393 -25.2 8,401 4.96 3.0

’11/3 1,415,544 31.0 88,220 701.3 91,258 701.0 51,599 514.2 30.45 4.0

’12/3 (Forecast) 1,480,000 4.6 80,000 -9.3 80,000 -12.3 65,000 26.0 38.36 5.0

Discussion: Explanatory materials from Isuzu’s briefi ng on earnings estimates (consolidated) for the fi scal year ending March 31, 2012