Intel 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

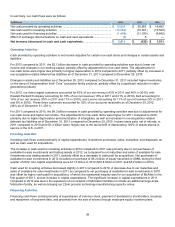

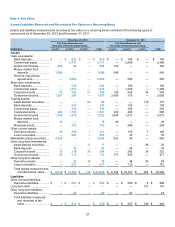

48

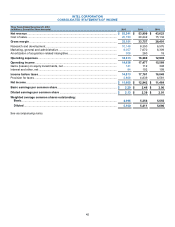

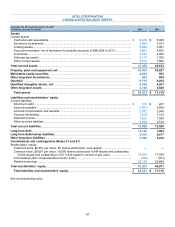

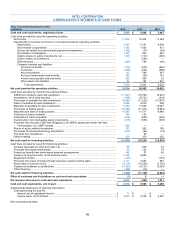

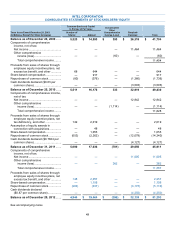

INTEL CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

Three Years Ended December 29, 2012

(In Millions)

2012

2011

2010

Cash and cash equivalents, beginning of year .....................................................................................

$ 5,065

$ 5,498

$ 3,987

Cash flows provided by (used for) operating activities:

Net income............................................................................................................................................

11,005

12,942

11,464

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation................................................................................................................................

6,357

5,141

4,398

Share-based compensation.............................................................................................................

1,102

1,053

917

Excess tax benefit from share-based payment arrangements.........................................................

(142)

(37)

(65)

Amortization of intangibles...............................................................................................................

1,165

923

240

(Gains) losses on equity investments, net .......................................................................................

(141)

(112)

(348)

(Gains) losses on divestitures..........................................................................................................

—

(164)

—

Deferred taxes ................................................................................................................................

(242)

790

(46)

Changes in assets and liabilities:

Accounts receivable....................................................................................................................

(176)

(678)

(584)

Inventories ................................................................................................................................

(626)

(243)

(806)

Accounts payable .......................................................................................................................

67

596

407

Accrued compensation and benefits...........................................................................................

192

(95)

161

Income taxes payable and receivable ........................................................................................

229

660

53

Other assets and liabilities..........................................................................................................

94

187

901

Total adjustments ..................................................................................................................

7,879

8,021

5,228

Net cash provided by operating activities .............................................................................................

18,884

20,963

16,692

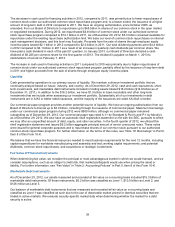

Cash flows provided by (used for) investing activities:

Additions to property, plant and equipment ..........................................................................................

(11,027)

(10,764)

(5,207)

Acquisitions, net of cash acquired ........................................................................................................

(638)

(8,721)

(218)

Purchases of available-for-sale investments ........................................................................................

(8,694)

(11,230)

(17,675)

Sales of available-for-sale investments ................................................................................................

2,282

9,076

506

Maturities of available-for-sale investments..........................................................................................

5,369

11,029

12,627

Purchases of trading assets..................................................................................................................

(16,892)

(11,314)

(8,944)

Maturities and sales of trading assets................................................................................................

15,786

11,771

8,846

Collection of loans receivable ...............................................................................................................

149

134

—

Origination of loans receivable..............................................................................................................

(216)

(206)

(498)

Investments in non-marketable equity investments ..............................................................................

(475)

(693)

(393)

Proceeds from the sale of IM Flash Singapore, LLP (IMFS) assets and certain IM Flash

Technologies, LLC (IMFT) assets................................................................................................

605

—

—

Return of equity method investments ................................................................................................

137

263

199

Purchases of licensed technology and patents.....................................................................................

(815)

(66)

(14)

Proceeds from divestitures ...................................................................................................................

—

50

—

Other investing................................................................................................................................

369

370

232

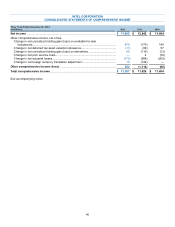

Net cash used for investing activities................................................................................................

(14,060)

(10,301)

(10,539)

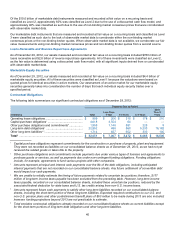

Cash flows provided by (used for) financing activities:

Increase (decrease) in short-term debt, net..........................................................................................

65

209

23

Proceeds from government grants........................................................................................................

63

124

79

Excess tax benefit from share-based payment arrangements..............................................................

142

37

65

Issuance of long-term debt, net of issuance costs................................................................................

6,124

4,962

—

Repayment of debt................................................................................................................................

(125)

—

(157)

Proceeds from sales of shares through employee equity incentive plans ............................................

2,111

2,045

587

Repurchase of common stock ..............................................................................................................

(5,110)

(14,340)

(1,736)

Payment of dividends to stockholders ................................................................................................

(4,350)

(4,127)

(3,503)

Other financing................................................................................................................................

(328)

(10)

—

Net cash used for financing activities................................................................................................

(1,408)

(11,100)

(4,642)

Effect of exchange rate fluctuations on cash and cash equivalents ..................................................

(3)

5

—

Net increase (decrease) in cash and cash equivalents........................................................................

3,413

(433)

1,511

Cash and cash equivalents, end of year................................................................................................

$ 8,478

$ 5,065

$ 5,498

Supplemental disclosures of cash flow information:

Cash paid during the year for:

Interest, net of capitalized interest ................................................................................................

$ 71

$ —

$ —

Income taxes, net of refunds............................................................................................................

$ 3,930

$ 3,338

$ 4,627

See accompanying notes.