Intel 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

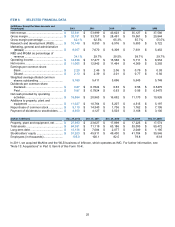

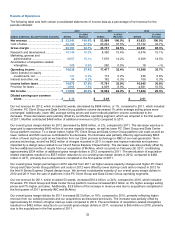

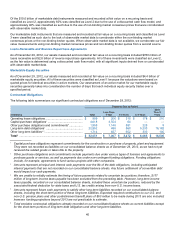

Results of Operations

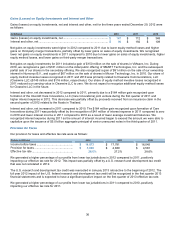

The following table sets forth certain consolidated statements of income data as a percentage of net revenue for the

periods indicated:

2012

2011

2010

(Dollars in Millions, Except Per Share Amounts)

Dollars

% of Net

Revenue

Dollars

% of Net

Revenue

Dollars

% of Net

Revenue

Net revenue................................................

$ 53,341

100.0%

$ 53,999

100.0%

$ 43,623

100.0%

Cost of sales................................................

20,190

37.9%

20,242

37.5%

15,132

34.7%

Gross margin .............................................

33,151

62.1%

33,757

62.5%

28,491

65.3%

Research and development.........................

10,148

19.0%

8,350

15.4%

6,576

15.1%

Marketing, general and

administrative ..........................................

8,057

15.1%

7,670

14.2%

6,309

14.5%

Amortization of acquisition-related

intangibles ...............................................

308

0.6%

260

0.5%

18

—%

Operating income ......................................

14,638

27.4%

17,477

32.4%

15,588

35.7%

Gains (losses) on equity

investments, net ......................................

141

0.3%

112

0.2%

348

0.8%

Interest and other, net ................................

94

0.2%

192

0.3%

109

0.3%

Income before taxes................................

14,873

27.9%

17,781

32.9%

16,045

36.8%

Provision for taxes.......................................

3,868

7.3%

4,839

8.9%

4,581

10.5%

Net income .................................................

$ 11,005

20.6%

$ 12,942

24.0%

$ 11,464

26.3%

Diluted earnings per common

share.......................................................

$ 2.13

$ 2.39

$ 2.01

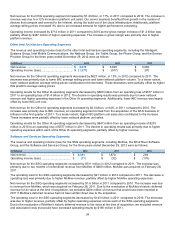

Our net revenue for 2012, which included 52 weeks, decreased by $658 million, or 1%, compared to 2011, which included

53 weeks. PC Client Group and Data Center Group platform volume decreased 1% while average selling prices were

unchanged. Additionally, lower IMC average selling prices and lower netbook platform volume contributed to the

decrease. These decreases were partially offset by our McAfee operating segment, which we acquired in the first quarter

of 2011. McAfee contributed $469 million of additional revenue in 2012 compared to 2011.

Our overall gross margin dollars for 2012 decreased by $606 million, or 2%, compared to 2011. The decrease was due in

large part to approximately $490 million of excess capacity charges, as well as lower PC Client Group and Data Center

Group platform revenue. To a lesser extent, higher PC Client Group and Data Center Group platform unit costs as well as

lower netbook and IMC revenue contributed to the decrease. The decrease was partially offset by approximately $645

million of lower start-up costs as we transition from our 22nm process technology to R&D of our next-generation 14nm

process technology, as well as $422 million of charges recorded in 2011 to repair and replace materials and systems

impacted by a design issue related to our Intel 6 Series Express Chipset family. The decrease was also partially offset by

the two additional months of results from our acquisition of McAfee, which occurred on February 28, 2011, contributing

approximately $334 million of additional gross margin dollars in 2012 compared to 2011. The amortization of acquisition-

related intangibles resulted in a $557 million reduction to our overall gross margin dollars in 2012, compared to $482

million in 2011, primarily due to acquisitions completed in the first quarter of 2011.

Our overall gross margin percentage in 2012 was flat from 2011 as higher excess capacity charges and higher PC Client

Group and Data Center Group platform unit costs in 2012 were offset by lower start-up costs and no impact in 2012 for

the Intel 6 Series Express Chipset design issue. We derived a substantial majority of our overall gross margin dollars in

2012 and 2011 from the sale of platforms in the PC Client Group and Data Center Group operating segments.

Our net revenue for 2011, which included 53 weeks, increased $10.4 billion, or 24%, compared to 2010, which included

52 weeks. PC Client Group and Data Center Group platform revenue increased $6.3 billion on 8% higher average selling

prices and 7% higher unit sales. Additionally, $3.6 billion of the increase in revenue was due to acquisitions completed in

the first quarter of 2011 (primarily IMC and McAfee).

Our overall gross margin dollars for 2011 increased $5.3 billion, or 18%, compared to 2010, primarily reflecting higher

revenue from our existing business and our acquisitions as discussed previously. The increase was partially offset by

approximately $1.0 billion of higher start-up costs compared to 2010. The amortization of acquisition-related intangibles

resulted in a $482 million reduction to our overall gross margin dollars in 2011, compared to $65 million in 2010, primarily

due to the acquisitions in the first quarter of 2011.