ICICI Bank 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

companies. Subsequent to the merger, ICICI Bank continues to nominate directors on the boards of

assisted companies. Apart from the Bank's employees, experienced professionals from the banking,

government and other sectors are appointed as nominee Directors. ICICI Bank has 112 nominee

Directors of whom 66 are employees of the Bank on the boards of 214 companies. ICICI Bank has a

Nominee Director Cell for maintaining records of nominee directorships.

ICICI Bank has established a tradition of best practices in corporate governance. The corporate

governance framework in ICICI Bank is based on an effective independent Board, the separation of the

Board's supervisory role from the executive management and the constitution of Board Committees,

generally comprising a majority of independent Directors and chaired by an independent Director, to

oversee critical areas.

ICICI Bank's corporate governance philosophy encompasses not only regulatory and legal

requirements, such as the terms of listing agreements with stock exchanges, but also several voluntary

practices aimed at a high level of business ethics, effective supervision and enhancement of value for

all stakeholders.

Whistle Blow er Policy

In line with the best international governance practices and the Sarbanes-Oxley Act, ICICI Bank has

formulated a Whistle Blower Policy for the ICICI group. In terms of this policy, employees of ICICI Bank

and its group companies are free to raise issues, if any, which they may have on the accounting policies

and procedures adopted for any area or item and report the same to the Audit Committee through

appropriate channels. The above mechanism has been communicated within the Bank across all levels

and has been posted on ICICI Bank's intranet.

Prevention of Insider Trading

ICICI Bank has instituted a comprehensive code of conduct for prevention of insider trading namely,

ICICI Bank Code of Conduct for Prevention of Insider Trading in accordance with the requirements of

SEBI (Prohibition of Insider Trading) Regulations, 1992.

Code of Business Conduct and Ethics

The Board of Directors has approved a Code of Business Conduct and Ethics for Directors and

employees of ICICI Bank.

ICICI Bank has a broad-based Board of Directors, constituted in compliance with the Banking

Regulation Act, 1949, Companies Act, 1956 and listing agreements entered into with stock exchanges

and in accordance with best practices in corporate governance. The Board functions either as a full

Board or through various committees constituted to oversee specific operational areas. The Board has

constituted 10 committees, namely, Agriculture & Small Enterprises Business Committee, Audit

Committee, Board Governance & Remuneration Committee, Business Strategy Committee, Credit

Committee, Fraud Monitoring Committee, Risk Committee, Share Transfer & Shareholders'/Investors'

Grievance Committee, Committee of Directors and Asset Liability Management Committee. A majority

CORPORATE GOVERNANCE

I. Philosophy of Corporate Governance

II. Board of Directors

15

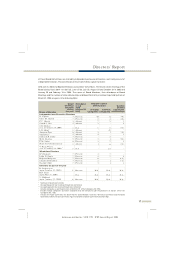

Directors’ Report

dickenson intellinetics 5690 2791 ICICI Annual Report 2004