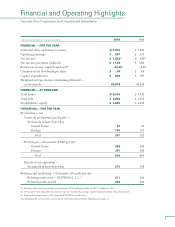

Hess 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 Hess annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

The year 2000 was an extraordinary year for Amerada Hess.

• We achieved record after-tax earnings of $1.023 billion ($11.38 per

share), a 20% return on average capital employed.

• We increased production to 374,000 barrels of oil equivalent per day

from 339,000 barrels per day in 1999, a 10% increase.

• We began construction of the coking unit at our HOVENSA joint venture

Virgin Islands refinery.

• We significantly expanded our retail marketing network.

• We repurchased 3,444,000 shares of Common Stock for $220 million.

We enter 2001 confident that we will have another year of strong earnings and

production growth. We have a strong balance sheet and are poised to take steps

for further growth and profitability. We continue to strive for excellence in our

environmental, health and safety performance.

EXPLORATION AND PRODUCTION

In 2000, we achieved a 29% return on capital employed in exploration and

production. Exploration and production will continue to be the primary

vehicle for future income and growth. We will balance our efforts among

exploration drilling, reserve development opportunities and acquisitions. We

believe that increasing our international portfolio of lower-cost, long-life

reserves and our exposure to natural gas in the United States is the best way

to create value in our upstream business.

Major milestones in 2000 included the successful development of the

Conger and Northwestern Fields in the Gulf of Mexico, which will add about

16,000 barrels of oil equivalent per day to our United States production, the

acquisition of the Gassi El Agreb redevelopment project in Algeria, which

will add current net production of about 14,000 barrels of oil per day, and the

acquisition of an additional interest in the Azeri, Chirag and Guneshli Fields

in Azerbaijan, which offer lower-cost, long-life reserves. Early this year, the

Atora Field in Gabon came onstream.

We recently reached agreement to purchase natural gas properties onshore

and offshore Louisiana for approximately $750 million. Net production from

these properties will average about 200,000 Mcf of natural gas equivalent per

day in 2001 and peak at about 250,000 Mcf per day in 2003. Early in 2001, we

also acquired Gulf of Mexico properties that will have net production of about

To Our Stockholders