Hess 2000 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2000 Hess annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

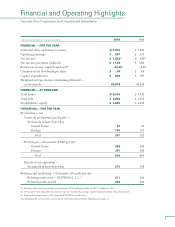

Financial and Operating Highlights

Amerada Hess Corporation and Consolidated Subsidiaries

Dollar amounts in millions, except per share data 2000 1999

FINANCIAL — FOR THE YEAR

Sales and other operating revenues $11,993 $ 7,039

Operating earnings $ 987 $ 307

Net income $ 1,023(a) $ 438(a)

Net income per share (diluted) $ 11.38 $ 4.85

Return on average capital employed(b) 20.4% 10.5%

Common stock dividends per share $ .60 $.60

Capital expenditures $ 938 $ 797

Weighted average shares outstanding (diluted)

—

in thousands 89,878 90,280

FINANCIAL —AT YEAR-END

Total assets $10,274 $ 7,728

Total debt $ 2,050 $ 2,310

Stockholders’ equity $ 3,883 $ 3,038

OPERATING —FOR THE YEAR

Production

—

net

Crude oil and natural gas liquids

—

thousands of barrels per day

United States 67 65

Foreign 194 167

Total 261 232

Natural gas

—

thousands of Mcf per day

United States 288 338

Foreign 391 305

Total 679 643

Barrels of oil equivalent

—

thousands of barrels per day 374 339

Refining and marketing

—

thousands of barrels per day

Refining crude runs

—

HOVENSA L.L.C.(c) 211 209

Refined products sold 366 344

(a) Includes after-tax income from special items of $36 million in 2000 and $131 million in 1999.

(b) Net income excluding after-tax interest expense divided by average capital employed (total debt plus equity).

(c) Reflects the Corporation’s 50% share of HOVENSA’s crude runs.

See Management’s Discussion and Analysis of Results of Operations beginning on page 19.