Hertz 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

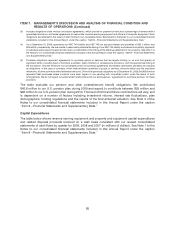

$366.2 million from December 31, 2008 to December 31, 2009, primarily related to the timing of

purchases and sales of revenue earning vehicles.

Our domestic and international operations are funded by cash provided by operating activities and by

extensive financing arrangements maintained by us in the United States, Europe, Puerto Rico, Australia,

New Zealand, Canada and Brazil. Net cash provided by operating activities during the year ended

December 31, 2009 was $1,775.0 million, a decrease of $769.2 million from the year ended

December 31, 2008. The decrease was primarily driven by a decrease in net income before

depreciation, amortization, non-cash impairment charges and other non-cash expenses as well as a

significant change in accounts payable driven by effective management of vendor terms taken in late

2008 and an increase in cash payments relating to the buydown of our rate on our interest rate swaps

and restructuring. Net cash provided by operating activities during the year ended December 31, 2008

was $2,544.2 million, a decrease of $260.5 million from the year ended December 31, 2007. The

decrease was primarily driven by a decrease in net income before depreciation, amortization, non-cash

impairment charges and other non-cash expenses.

Our primary use of cash in investing activities is for the acquisition of revenue earning equipment, which

consists of cars and equipment. Net cash used in investing activities during the year ended

December 31, 2009 was $1,289.7 million, a decrease of $618.5 million from the year ended

December 31, 2008. The decrease is primarily due to a reduction in revenue earning equipment

expenditures and the year-over-year change in restricted cash and cash equivalents, partly offset by a

decrease in proceeds from the disposal of revenue earning equipment. The year-over-year change in

restricted cash and cash equivalents was primarily related to the economic conditions which affected the

demand of revenue earning equipment and our LKE Program. Net cash used in investing activities

during the year ended December 31, 2008 was $1,908.3 million, a decrease of $150.5 million from the

year ended December 31, 2007. The decrease is primarily due to a reduction in revenue earning

equipment expenditures, partly offset by a decrease in proceeds from disposal of revenue earning

equipment.

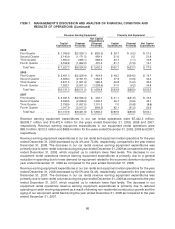

For the year ended December 31, 2009, our expenditures for revenue earning equipment were

$7,527.3 million and our proceeds from the disposal of such equipment were $6,024.9 million compared

to $10,151.0 million and $8,511.2 million, respectively, for the year ended December 31, 2008. For the

year ended December 31, 2009, our capital expenditures for property and non-revenue earning

equipment were $100.7 million and our proceeds from the disposal of such equipment were

$23.7 million compared to $193.8 million and $68.5 million, respectively, for the years ended

December 31, 2008.

For the year ended December 31, 2009, net expenditures for revenue earning equipment decreased as

compared to 2008. This decrease was due to a decrease in year-over-year expenditures for revenue

earning equipment, partly offset by a year-over-year decrease in disposal proceeds relating to revenue

earning equipment. For the year ended December 31, 2009, net expenditures for property and

equipment were lower than our net expenditures in 2008 relating to a decrease in year-over-year

expenditures, partly offset by a year-over-year decrease in disposal proceeds. For the full year 2010, we

expect the level of net expenditures for revenue earning equipment, property and non-revenue earning

equipment to be higher than the full year 2009. See ‘‘—Capital Expenditures’’ below.

Net cash used in financing activities during the year ended December 31, 2009 was $129.1 million, a

decrease of $566.3 million from the year ended December 31, 2008. The decrease is primarily due to

increases in proceeds from the issuance of long-term debt, sale of common stock and debt offering,

partly offset by increases in repayments under revolving lines of credit, net and repayment of long-term

78