Hertz 2009 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

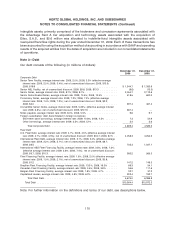

•a Third Amended and Restated Master Motor Vehicle Operating Lease and Servicing Agreement

between Hertz, as Lessee and Servicer, and HVF, as Lessor;

•a Third Amended and Restated Collateral Agency Agreement among HVF, as a Grantor, Hertz

General Interest LLC, as a Grantor, Hertz, as Servicer, The Bank of New York Mellon Trust

Company, N.A., as Collateral Agent, The Bank of New York Mellon Trust Company, N.A., as

Trustee and a Secured Party, and Hertz, as a Secured Party;

•a Second Amended and Restated Participation, Purchase and Sale Agreement by and between

Hertz General Interest LLC, HVF and Hertz, as Lessee and Servicer;

•a Second Amended and Restated Administration Agreement by and between Hertz, HVF and the

Trustee;

•a Second Amended and Restated Master Exchange Agreement among Hertz, HVF, Hertz General

Interest LLC, Hertz Car Exchange Inc., and DB Services Tennessee, Inc.; and

•a Second Amended and Restated Escrow Agreement among Hertz, HVF, Hertz General

Interest LLC, Hertz Car Exchange Inc., and J.P. Morgan Chase Bank, N.A.

Among other things, these amendments (i) give HVF the ability, subject to certain conditions, to issue

series of notes secured by segregated pools of collateral pledged to support only such series; (ii) modify

the conditions precedent to HVF issuing a new series of notes under the ABS Indenture; (iii) modify

certain conditions precedent to the amendment of the ABS Indenture, series supplements and certain of

the other U.S. Fleet Debt Program Documents; (iv) provide that if certain events of default with respect to

manufacturers of vehicles subject to repurchase programs (each, a ‘‘Manufacturer Event of Default’’) are

cured, the effects of such events of default on the U.S. Fleet Debt Program Documents generally cease;

(v) provide that if a Manufacturer Event of Default occurs, the related manufacturer does not cease to be

an eligible manufacturer, thereby allowing HVF to finance a greater proportion of vehicles manufactured

by such manufacturer during a Manufacturer Event of Default and (vi) give HVF the ability, subject to

certain conditions, to issue one or more series of notes that would be subordinated in rights to payment

of interest and principal to each other series of notes outstanding.

We expect to repay these notes as they mature in 2010 with a combination of revolver borrowings under

our new Series 2009-1 Notes, corporate liquidity or by issuing a new series of notes.

Series 2008-1 Notes. On September 12, 2008, HVF completed the closing of a variable funding note

facility referred to as the Series 2008-1 Notes. In September 2009, the series supplement and note

purchase agreement for the Series 2008-1 Notes were terminated.

Series 2009-1 Notes. In September 2009, HVF issued the Series 2009-1 Notes. The aggregate principal

amount of such facility is $2.1 billion and this facility is available to HVF on a revolving basis through the

expected final maturity date of January 2012 with a January 2013 legal final maturity. The Series 2009-1

Notes are expected to bear interest at variable rates based upon the weighted average of the

commercial paper rates paid by the bank conduits advancing funds to HVF plus a borrowing spread

which varies based on the rating of the Series 2009-1 Notes. The borrowing spread on the Series 2009-1

Notes is subject to increase if Moody’s Investors Service, or ‘‘Moody’s,’’ downgrades their rating of the

Series 2009-1 Notes below ‘‘Aa3.’’ The borrowing spread on the Series 2009-1 Notes is also subject to

increase during the continuance of an amortization event with respect to the Series 2009-1 Notes. The

Series 2009-1 Notes are currently rated ‘‘Aa1’’ by Moody’s. The Series 2009-1 Notes are subject to

events of default and amortization events that are customary in nature for U.S. rental car asset-backed

securitizations of this type, including non-payment of principal or interest, violation of covenants,

118