Hertz 2008 Annual Report Download - page 119

Download and view the complete annual report

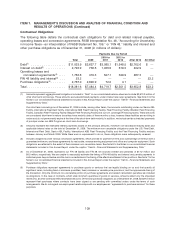

Please find page 119 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

rental car fleets in a number of European countries and Australia. Due to Spanish law considerations,

Fleetco (Espana), S.L. is an ‘‘orphan’’ entity which is an indirect subsidiary of a charitable trust. The

Senior Credit Facilities generally permit Hertz and its subsidiaries to guarantee obligations of one

another but not of unaffiliated entities, subject to certain exceptions.

On September 30, 2007, the Senior ABL Facility was amended to add Hertz Canada Equipment Rental

Partnership, an Ontario General Partnership, as an additional Canadian Borrower. Hertz Canada

Equipment Rental Partnership, whose partners are our wholly-owned subsidiary, Matthews and its

wholly-owned subsidiary, was formed in connection with a reorganization of Matthews and, as part of

that reorganization, received title to most of the assets of Matthews.

Senior Notes and Senior Subordinated Notes

In connection with the Acquisition, CCMG Acquisition Corporation issued the Senior Notes and the

Senior Subordinated Notes under separate indentures between CCMG Acquisition Corporation and

Wells Fargo Bank, National Association, as trustee. Hertz and the guarantors entered into supplemental

indentures, dated as of the Closing Date, pursuant to which Hertz assumed the obligations of CCMG

Acquisition Corporation under the Senior Notes, the Senior Subordinated Notes and the respective

indentures, and the guarantors issued the related guarantees. CCMG Acquisition Corporation

subsequently merged with and into Hertz, with Hertz as the surviving entity.

As of December 31, 2008, $2,113.6 million and $600.0 million in borrowings were outstanding under the

Senior Notes and Senior Subordinated Notes, respectively. Prior to October 1, 2006, our Senior Euro

Notes were not designated as a net investment hedge of our Euro-denominated net investments in our

international operations. For the nine months ended September 30, 2006, we incurred unrealized

exchange transaction losses of $19.2 million resulting from the translation of these Euro-denominated

notes into the U.S. dollar, which are recorded in our consolidated statement of operations in ‘‘Selling,

general and administrative’’ expenses. On October 1, 2006, we designated our Senior Euro Notes as an

effective net investment hedge of our Euro-denominated net investment in our international operations.

As a result of this net investment hedge designation, as of December 31, 2008, $15.7 million of losses,

which is net of tax of $12.6 million, attributable to the translation of our Senior Euro Notes into the U.S.

dollar, are recorded in our consolidated balance sheet in ‘‘Accumulated other comprehensive income

(loss).’’ The Senior Notes will mature in January 2014, and the Senior Subordinated Notes will mature in

January 2016. The Senior Dollar Notes bear interest at a rate per annum of 8.875%, the Senior Euro

Notes bear interest at a rate per annum of 7.875% and the Senior Subordinated Notes bear interest at a

rate per annum of 10.5%. Hertz’s obligations under the indentures are guaranteed by each of its direct

and indirect domestic subsidiaries that is a guarantor under the Senior Term Facility.

Both the indenture for the Senior Notes and the indenture for the Senior Subordinated Notes contain

covenants that, among other things, limit the ability of Hertz and its restricted subsidiaries, described in

the respective indentures, to incur more debt, pay dividends, redeem stock or make other distributions,

make investments, create liens, transfer or sell assets, merge or consolidate and enter into certain

transactions with Hertz’s affiliates. The indenture for the Senior Subordinated Notes also contains

subordination provisions and limitations on the types of senior subordinated debt that may be incurred.

The indentures also contain certain mandatory and optional prepayment or redemption provisions and

provide for customary events of default.

The restrictive covenants in the indentures governing the Senior Notes and the Senior Subordinated

Notes permit Hertz to make loans, advances, dividends or distributions to Hertz Holdings in an amount

99