Hasbro 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

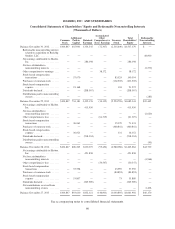

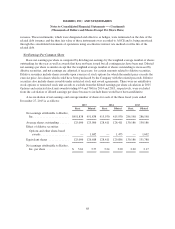

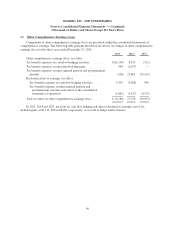

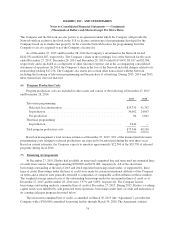

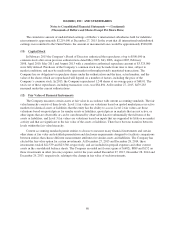

Changes in the components of accumulated other comprehensive earnings (loss), net of tax are as follows:

Pension and

Postretirement

Amounts

Gains

(Losses) on

Derivative

Instruments

Unrealized

Holding

Gains on

Available-

for-Sale

Securities

Foreign

Currency

Translation

Adjustments

Total

Accumulated

Other

Comprehensive

Earnings

(Loss)

2015

Balance at December 28,

2014 ................ $(113,092) 43,689 1,900 (27,951) (95,454)

Current period other

comprehensive earnings

(loss) ................ 6,892 86,155 (642) (95,694) (3,289)

Reclassifications from

AOCE to earnings ...... 3,269 (50,527) — — (47,258)

Balance at December 27,

2015 ................ $(102,931) 79,317 1,258 (123,645) (146,001)

2014

Balance at December 29,

2013 ................ $ (64,841) (7,313) — 38,019 (34,135)

Current period other

comprehensive earnings

(loss) ................ (51,206) 47,600 1,900 (65,970) (67,676)

Reclassifications from

AOCE to earnings ...... 2,955 3,402 — — 6,357

Balance at December 28,

2014 ................ $(113,092) 43,689 1,900 (27,951) (95,454)

2013

Balance at December 30,

2012 ................ $(120,422) (1,008) — 49,123 (72,307)

Current period other

comprehensive earnings

(loss) ................ 47,081 (3,075) — (11,104) 32,902

Reclassifications from

AOCE to earnings ...... 8,500 (3,230) — — 5,270

Balance at December 29,

2013 ................ $ (64,841) (7,313) — 38,019 (34,135)

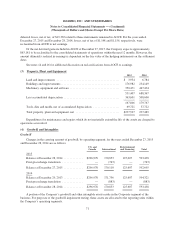

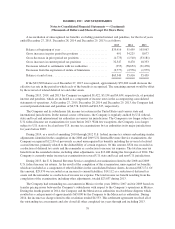

At December 27, 2015, the Company had remaining net deferred gains on foreign currency forward

contracts, net of tax, of $98,680 in AOCE. These instruments hedge payments related to inventory purchased in

the fourth quarter of 2015 or forecasted to be purchased from 2016 through 2020, intercompany expenses

expected to be paid or received during 2016 and 2017 and cash receipts for sales made at the end of 2015 or

forecasted to be made in 2016. These amounts will be reclassified into the consolidated statements of operations

upon the sale of the related inventory or recognition of the related sales, royalties or expenses.

In addition to foreign currency forward contracts, the Company entered into hedging contracts on future

interest payments related to the long-term notes due 2021 and 2044. At the date of debt issuance, these contracts

were terminated and the fair value on the date of settlement was deferred in AOCE and is being amortized to

interest expense over the life of the related notes using the effective interest rate method. At December 27, 2015,

70