Hasbro 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating expenses for 2015, 2014 and 2013 include benefits and expenses related to the following events:

• In August 2015, the Company finalized the sale of its manufacturing operations in East Longmeadow,

MA and Waterford, Ireland. This transaction resulted in a benefit to selling, distribution and

administration expenses of $3.1 million.

• In September 2014, the Company and Discovery amended their relationship with respect to Discovery

Family Channel (the “Network”). Prior to the amendment, the Company had a license agreement with the

Network that required payment of royalties by the Company to the Network based on a percentage of

revenue derived from products related to television shows broadcast on the Network. This agreement

included a minimum royalty guarantee of $125.0 million, which has been paid in full. As part of the

amended relationship, this earn-out period was extended to 2021 resulting in a benefit of $2.3 million to

royalties for the year ended December 28, 2014. Furthermore, this amended relationship resulted in an

amendment to the Company’s tax sharing agreement with Discovery which resulted in a net expense of

$0.9 million recorded to selling, distribution and administration expense for the year ended December 28,

2014.

• In February 2014, the Company settled outstanding disputes with an inventor related to the contractual

interpretation of which products were subject to payment of royalties under two license agreements

between the inventor and the Company relating to the Company’s NERF and SUPER SOAKER product

lines. As a result, the Company recorded a total charge of $61.1 million, of which $43.0 million and $3.1

million were recorded to royalties and selling, distribution and administration expense, respectively, for

the year ended December 29, 2013. A portion of this total charge was also recorded to interest expense

which is discussed below.

• During the fourth quarter of 2012, the Company announced a multi-year cost savings initiative. This

initiative included an approximate 10% workforce reduction, facility consolidations and process

improvements. The Company recognized charges totaling $5.2 million and $36.7 million for the years

ended December 28, 2014 and December 29, 2013, respectively, primarily related to employee severance

charges, which impacted cost of sales, product development and selling, distribution and administration

expenses. Furthermore, the Company also recognized pension curtailment and settlement charges in the

amount of $7.0 million in selling, distribution and administration expense during the year ended

December 29, 2013.

• During the fourth quarter of 2013, the Company decided to exit certain brands which were non-core to its

franchise brand strategy. Certain of these brands related to prior acquisitions and had intangible assets,

resulting in a write-off of these intangibles of $19.7 million, which were recorded to amortization of

intangibles for the year ended December 29, 2013.

• During the fourth quarter of 2013 the Company amended its license agreement with Zynga which resulted

in additional royalty expense of $20.9 million.

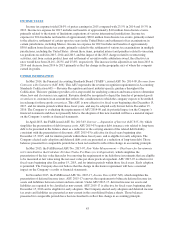

In total, these (benefits) expenses were recorded to the consolidated statements of operations as follows:

2015 2014 2013

Cost of sales .................................................... $ — — 10.2

Royalties ...................................................... (2.3) 63.8

Product development ............................................. — — 4.1

Amortization of intangibles ........................................ — — 19.7

Selling, distribution and administration .............................. (3.1) 6.1 32.5

Total .......................................................... $(3.1) 3.8 130.3

Cost of Sales

Cost of sales primarily consists of purchased materials, labor, manufacturing overheads and other inventory-

related costs such as obsolescence. Cost of sales decreased 1% to $1,677.0 million, or 37.7% of net revenues, for

39