Hasbro 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Summary

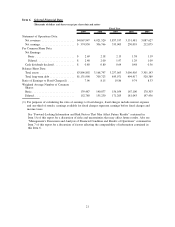

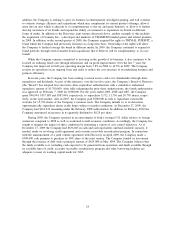

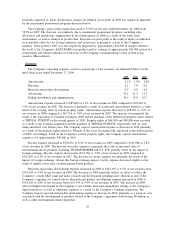

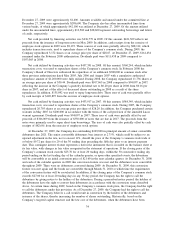

The components of the results of operations, stated as a percent of net revenues, are illustrated below for

each of the three fiscal years ended December 27, 2009.

2009 2008 2007

Net revenues .............................................. 100.0% 100.0% 100.0%

Cost of sales .............................................. 41.2 42.1 41.1

Gross profit ............................................... 58.8 57.9 58.9

Amortization .............................................. 2.1 1.9 1.8

Royalties ................................................. 8.1 7.8 8.2

Research and product development .............................. 4.5 4.8 4.4

Advertising ............................................... 10.1 11.3 11.3

Selling, distribution and administration ........................... 19.5 19.8 19.7

Operating profit ............................................ 14.5 12.3 13.5

Interest expense ............................................ 1.5 1.2 0.9

Interest income............................................. (0.1) (0.5) (0.8)

Other (income) expense, net ................................... 0.1 0.6 1.4

Earnings before income taxes .................................. 13.0 11.0 12.0

Income taxes .............................................. 3.8 3.4 3.3

Net earnings ............................................... 9.2% 7.6% 8.7%

Results of Operations

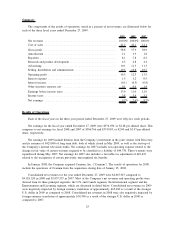

Each of the fiscal years in the three-year period ended December 27, 2009 were fifty-two week periods.

Net earnings for the fiscal year ended December 27, 2009 were $374,930, or $2.48 per diluted share. This

compares to net earnings for fiscal 2008 and 2007 of $306,766 and $333,003, or $2.00 and $1.97 per diluted

share, respectively.

Net earnings for 2009 include dilution from the Company’s investment in the joint venture with Discovery

and its issuance of $425,000 of long-term debt, both of which closed in May 2009, as well as the start-up of

the Company’s internal television studio. Net earnings for 2007 includes non-operating expense related to the

change in fair value of certain warrants required to be classified as a liability of $44,370. These warrants were

repurchased during May 2007. Net earnings for 2007 also includes a favorable tax adjustment of $29,619

related to the recognition of certain previously unrecognized tax benefits.

In January 2008, the Company acquired Cranium, Inc. (“Cranium”). The results of operations for 2008

include the operations of Cranium from the acquisition closing date of January 25, 2008.

Consolidated net revenues for the year ended December 27, 2009 were $4,067,947 compared to

$4,021,520 in 2008 and $3,837,557 in 2007. Most of the Company’s net revenues and operating profits were

derived from its three principal segments: the U.S. and Canada segment, the International segment and the

Entertainment and Licensing segment, which are discussed in detail below. Consolidated net revenues in 2009

were negatively impacted by foreign currency translation of approximately $65,200 as a result of the stronger

U.S. dollar in 2009 as compared to 2008. Consolidated net revenues in 2008 were also negatively impacted by

foreign currency translation of approximately $10,300 as a result of the stronger U.S. dollar in 2008 as

compared to 2007.

25