Harris Teeter 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December of 2012 and the Company had previously repaid $20.0 million of the term loan prior to the closing of the amended

credit facility. The amended credit facility contains a revolving line of credit that provides for financing up to $350.0 million

through its termination date on January 30, 2017. In connection with the closing of the amended credit agreement, the Company

repaid the remaining $80.0 million term loan under the prior credit facility utilizing $40.0 million of cash and $40.0 million

of borrowings under the new revolver. The amended credit agreement provides for an optional increase of the revolving credit

facility by an additional amount of up to $100.0 million (if the existing or new lenders agree to assume the additional

commitments) and two one-year maturity extension options, both of which require consent of certain of the lenders. Outstanding

borrowings under the amended credit agreement bear interest at a variable rate, at the Company’s option at: (a) an alternate base

rate, based on a reference to: rates on federal funds transactions with members of the Federal Reserve System, the prime rate,

or the LIBOR Market Index Rate in effect on the interest determination date; (b) the LIBOR Market Index Rate; or (c) a LIBOR

Rate, each plus an applicable margin as determined by the administrative agent in accordance with the terms of the amended

credit agreement. The amount which may be borrowed from time to time and the applicable margin to the referenced interest

rate are each dependent on a leverage factor. The leverage factor is based on a ratio of rent-adjusted consolidated funded debt

divided by earnings before interest, taxes, depreciation, amortization and operating rents, as set forth in the amended credit

agreement. The more significant of the financial covenants that the Company must meet during the term of the amended credit

agreement include a maximum leverage ratio and a minimum fixed charge coverage ratio. The amended credit agreement

restricts the Company’s ability to pay dividends and make certain other restricted payments, as defined in the amended credit

agreement, if after giving effect to such restricted payment an event of default under the amended credit agreement would exist

or the Company would not be in compliance with certain specified financial covenants. However, management does not expect

these restrictions will affect the Company’s ability to pay dividends at the current level in the foreseeable future.

As of October 2, 2012, the Company was in compliance with all financial covenants of the amended credit facility. Issued

letters of credit reduced the amount available for borrowings under the amended credit facility and amounted to $26.2 million

as of October 2, 2012. In addition to the $323.8 million of borrowings available under the Company’s amended credit facility,

the Company has the capacity to borrow up to an aggregate amount of $29.1 million from two major U.S. life insurance

companies utilizing certain insurance assets as collateral. In the normal course of business, the Company will continue to

evaluate other financing opportunities based on the Company’s needs and market conditions.

Covenants in certain of the Company’s long-term debt agreements limit the total indebtedness that the Company may incur.

As of October 2, 2012, the amount of additional debt that could be incurred within the limitations of the most restrictive debt

covenants exceeded the additional borrowings available under the amended credit facility. As such, management believes that

the limit on indebtedness does not restrict the Company’s ability to meet future liquidity requirements through borrowings

available under the Company’s amended credit facility, including any liquidity requirements expected in connection with the

Company’s expansion plans for the foreseeable future.

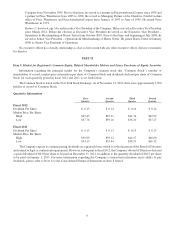

Contractual Obligations and Commercial Commitments

The Company has assumed various financial obligations and commitments in the normal course of its operations and

financing activities. Financial obligations are considered to represent known future cash payments that the Company is required

to make under existing contractual arrangements, such as debt and lease agreements. Management expects that cash provided

by operations and other sources of liquidity, such as the Company’s amended credit facility and new sources of financing

available to the Company, will be sufficient to meet these obligations on a short and long-term basis. The following table

represents the scheduled maturities of the Company’s contractual obligations as of October 2, 2012 (in thousands):

Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

Long-Term Debt

(1)

$ 139,242 $ 8,658 $ 16,279 $114,305 $ -

Operating Leases

(1) (2)

1,549,753 105,054 215,504 208,420 1,020,775

Capital Lease Obligations

(1) (2)

205,230 12,535 25,268 25,416 142,011

Purchase Obligations – Fixed Assets 65,453 65,453 - - -

Purchase Obligations – Service Contracts/Other 61,687 33,792 21,661 6,234 -

Unrecognized Tax Liability

(3)

481 165 316 - -

Other Long-Term Liabilities

(4)

10,396 1,509 2,710 1,974 4,203

Total Contractual Cash Obligations $2,032,242 $227,166 $281,738 $356,349 $1,166,989

14