Harris Teeter 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

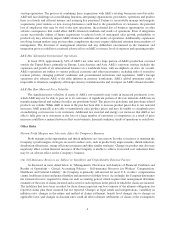

Consolidated Overview

The following table sets forth the operating profit components by each of the Company’s operating segments

and for the holding company (“Corporate”) for the 53 weeks ended October 3, 2010 (fiscal 2010), and the 52 weeks

ended September 27, 2009 (fiscal 2009) and September 28, 2008 (fiscal 2008). The table also sets forth each of

the segment’s net income components as a percent to total net sales and the percentage increase or decrease of such

components over the prior year (in thousands):

Fiscal 2010 Fiscal 2009 Fiscal 2008 % Inc. (Dec.)

%to

Sales %to

Sales %to

Sales 10 vs

09 09 vs

08

Net Sales

Harris Teeter ............... $4,099,353 93.2 $3,827,005 93.8 $3,664,804 91.8 7.1 4.4

A&E ..................... 301,097 6.8 250,817 6.2 327,593 8.2 20.0 (23.4)

Total ................... $4,400,450 100.0 $4,077,822 100.0 $3,992,397 100.0 7.9 2.1

Gross Profit

Harris Teeter ............... $1,227,446 27.89 $1,169,441 28.68 $1,138,857 28.53 5.0 2.7

A&E ..................... 72,412 1.65 47,916 1.17 69,590 1.74 51.1 (31.1)

Total ................... 1,299,858 29.54 1,217,357 29.85 1,208,447 30.27 6.8 0.7

SG&A Expenses

Harris Teeter ............... 1,045,860 23.77 993,850 24.37 961,092 24.08 5.2 3.4

A&E ..................... 52,907 1.20 52,646 1.29 67,262 1.68 0.5 (21.7)

Corporate .................. 3,120 0.07 6,119 0.15 6,308 0.16 (49.0) (3.0)

Total ................... 1,101,887 25.04 1,052,615 25.81 1,034,662 25.92 4.7 1.7

Impairment Charges – A&E

Goodwill .................. — — 7,654 0.19 — — n.m. n.m.

Long-Lived Assets .......... — — 2,237 0.05 — — n.m. n.m.

Total ................... — — 9,891 0.24 — — n.m. n.m.

Operating Profit (Loss)

Harris Teeter ............... 181,586 4.13 175,591 4.31 177,765 4.45 3.4 (1.2)

A&E ..................... 19,505 0.44 (14,621) (0.36) 2,328 0.06 n.m. n.m.

Corporate .................. (3,120) (0.07) (6,119) (0.15) (6,308) (0.16) (49.0) (3.0)

Total ................... 197,971 4.50 154,851 3.80 173,785 4.35 27.8 (10.9)

Other Expense, net ............ 19,566 0.45 16,068 0.40 19,190 0.48 21.8 (16.3)

Income Tax Expense .......... 65,297 1.48 52,225 1.28 57,359 1.44 25.0 (9.0)

Net Earnings ................. 113,108 2.57 86,558 2.12 97,236 2.43 30.7 (11.0)

Less: Net Earnings Attributable

to the Noncontrolling Interest . 1,067 0.02 594 0.01 484 0.01 79.8 22.7

Net Earnings Attributable to

Ruddick Corporation ........ $ 112,041 2.55 $ 85,964 2.11 $ 96,752 2.42 30.3 (11.1)

n.m. – not meaningful

15