Harris Teeter 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

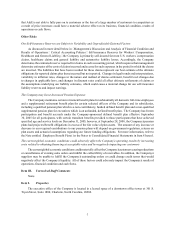

Fiscal 2008 Fiscal 2007 Fiscal 2006 % Inc. (Dec.)

% to

Sales % to

Sales % to

Sales 08 vs

07 07 vs

06

Net Sales

Harris Teeter....... $3,664,804 91.8 $3,299,377 90.7 $2,922,679 89.5 11.1 12.9

American & Efird... 327,593 8.2 339,831 9.3 343,177 10.5 (3.6) (1.0)

Total .......... $3,992,397 100.0 $3,639,208 100.0 $3,265,856 100.0 9.7 11.4

Gross Profit

Harris Teeter....... $1,138,857 28.53 $1,021,739 28.07 $ 897,637 27.49 11.5 13.8

American & Efird... 69,590 1.74 74,608 2.05 74,285 2.27 (6.7) 0.4

Total .......... 1,208,447 30.27 1,096,347 30.12 971,922 29.76 10.2 12.8

SG&A Expenses

Harris Teeter....... 961,092 24.08 867,656 23.84 770,000 23.58 10.8 12.7

American & Efird... 67,262 1.68 73,184 2.01 72,706 2.22 (8.1) 0.7

Corporate ......... 6,308 0.16 7,333 0.20 6,147 0.19 (14.0) 19.3

Total .......... 1,034,662 25.92 948,173 26.05 848,853 25.99 9.1 11.7

Operating Profit (Loss)

Harris Teeter....... 177,765 4.45 154,083 4.23 127,637 3.91 15.4 20.7

American & Efird... 2,328 0.06 1,424 0.04 1,579 0.05 63.6 (9.8)

Corporate ......... (6,308) (0.16) (7,333) (0.20) (6,147) (0.19) (14.0) 19.3

Total .......... 173,785 4.35 148,174 4.07 123,069 3.77 17.3 20.4

Other Expense, net..... 19,674 0.49 17,683 0.48 9,672 0.30 11.3 82.8

Income Tax Expense ... 57,359 1.44 49,803 1.37 41,061 1.26 15.2 21.3

Net Income........... $ 96,752 2.42 $ 80,688 2.22 $ 72,336 2.21 19.9 11.5

Consolidated net sales increased 9.7% in fiscal 2008 and 11.4% in fiscal 2007 when compared to prior

years as a result of strong sales gains at Harris Teeter. The fiscal 2008 and 2007 increases were partially offset by

sales declines at A&E. Over the past several years, A&E has pursued a global expansion strategy along with the

diversification of its product lines; however, the percentage of foreign sales to consolidated net sales has declined

during these periods as a result of the sales mix between the operating subsidiaries. Foreign sales for fiscal 2008

represented 4.6% of the consolidated sales of the Company, compared to 5.1% for fiscal 2007 and 5.4% for fiscal

2006. Refer to the discussion of segment operations under the captions “Harris Teeter, Retail Grocery Segment”

and “American & Efird, Industrial Thread Segment” for a further analysis of the segment operating results.

The gross profit margin increase for fiscal 2008 was driven by a gross profit margin improvement at

Harris Teeter that was offset, in part, by a gross profit margin decline at A&E from fiscal 2007 to fiscal 2008.

The increase in gross profit as a percent to sales for fiscal 2007 resulted primarily from improved gross profit

margins at Harris Teeter, although A&E also realized improved gross profit as a percent to its sales for fiscal

2007. Refer to the discussion of segment operations under the captions “Harris Teeter, Retail Grocery Segment”

and “American & Efird, Industrial Thread Segment” for a further analysis of the segment operating results.

Consolidated selling, general & administrative (“SG&A”) expenses, as a percent to consolidated net sales,

decreased in fiscal 2008 as a result of the leverage created through sales gains that apply against fixed costs

at Harris Teeter and lower SG&A expenses at A&E and Corporate. SG&A expenses, and its percent to sales,

increased in fiscal 2007 and fiscal 2006 as a result of increased operating costs at both subsidiaries. As previously

disclosed, Corporate SG&A expenses for fiscal 2006 included income of $2.2 million for life insurance proceeds