Harris Teeter 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

in a rabbi trust for the purpose of funding distributions from the Deferral Plan. Does not include any

shares of restricted stock that were outstanding as of September 28, 2008 since these shares are already

outstanding and do not represent potential dilution. For more information on the Company’s restricted

stock and performance share grants, see the Note entitled “Stock Options and Stock Awards” of the Notes

to Consolidated Financial Statements in Item 8 hereof.

(2) The weighted average exercise price does not take into account performance share awards or restricted

stock units outstanding as of September 28, 2008.

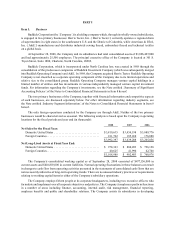

Comparison of Total Cumulative Shareholder Return for Five-Year Period Ending September 28, 2008

The following graph presents a comparison of the yearly percentage change in the Company’s cumulative

total shareholders’ return on Common Stock with the (i) Standard & Poor’s 500 Index, (ii) Standard & Poor’s

Midcap 400 Index, (iii) Standard & Poor’s Food Retail Index, and (iv) Standard & Poor’s Apparel, Accessories

& Luxury Goods Index for the five-year period ended September 28, 2008.

Comparison of Five-Year Cumulative Total Return*

Among Ruddick Corporation and Certain Indices**

$0

$50

$100

$150

$200

$250

9/03 9/04 9/05 9/06 9/07 9/08

Ruddick Corporation

S&P 500

S&P Midcap 400

S&P Food Retail

S&P Apparel, Accessories & Luxury Goods

Cumulative Total Return

9/30/03 9/30/04 9/30/05 9/30/06 9/30/07 9/30/08

Ruddick Corporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100.00 129.09 154.44 177.76 232.46 227.98

S&P 500 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100.00 113.87 127.82 141.62 164.90 128.66

S&P Midcap 400 ................................. 100.00 117.55 143.60 153.02 181.73 151.42

S&P Food Retail ................................. 100.00 93.74 117.59 122.06 138.83 104.53

S&P Apparel, Accessories & Luxury Goods ........... 100.00 121.41 145.13 163.99 187.50 128.57