Harris Teeter 2008 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2008 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of

Equity Securities

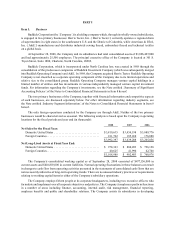

Information regarding the principal market for the Company’s common stock (the “Common Stock”),

number of shareholders of record, market price information per share of Common Stock and dividends declared

per share of Common Stock for each quarterly period in fiscal 2008 and 2007 is set forth below.

The Common Stock is listed on the New York Stock Exchange. As of November 14, 2008, there were

approximately 4,700 holders of record of Common Stock.

Quarterly Information

First

Quarter Second

Quarter Third

Quarter Fourth

Quarter

Fiscal 2008

Dividend Per Share ................................... $ 0.12 $ 0.12 $ 0.12 $ 0.12

Market Price Per Share

High ............................................ 38.03 36.99 39.79 38.98

Low............................................. 31.15 31.71 33.89 29.47

Fiscal 2007

Dividend Per Share ................................... $ 0.11 $ 0.11 $ 0.11 $ 0.11

Market Price Per Share

High ............................................ 28.91 30.50 32.39 37.28

Low............................................. 25.20 26.30 29.53 27.53

The Company expects to continue paying dividends on a quarterly basis which is at the discretion of the

Board of Directors and subject to legal and contractual requirements. Information regarding restrictions on the

ability of the Company to pay cash dividends is set forth in “Management’s Discussion and Analysis of Financial

Condition and Results of Operations - Capital Resources and Liquidity” in Item 7 hereof.

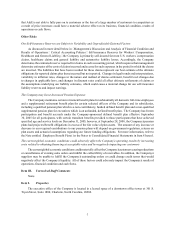

Equity Compensation Plan Information

The following table provides information as of September 28, 2008 regarding the number of shares of

Common Stock that may be issued under the Company’s equity compensation plans.

Number of

securities to be

issued upon exercise

of outstanding

options, warrants

and rights

Weighted-average

exercise price

of outstanding

options, warrants

and rights

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding securities

reflected in column (a))

Plan category (a) (1) (b) (2) (c)

Equity compensation plans

approved by security holders ......... 618,756 $16.40 1,679,200

Equity compensation plans not

approved by security holders ......... -0- -0- -0-

Total ............................ 618,756 $16.40 1,679,200

(1) Includes grants of 135,770 performance shares outstanding as of September 28, 2008. Excludes 99,294

shares of Common Stock that are deliverable in connection with the 99,294 stock units outstanding

under the Ruddick Corporation Director Deferral Plan (the “Deferral Plan”) that have been accumulated