Hamilton Beach 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

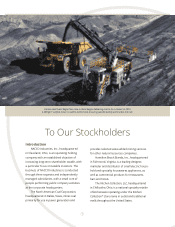

NACCO Industries, Inc. and its subsidiaries operate in the mining, small appliances and specialty

retail industries.

North American Coal (“NACoal”) performed as expected in 2015 with the exception of its Centennial

Natural Resources mining operation in Alabama. Revenues at NACoal were lower in 2015 because the

Centennial Natural Resources mining operation continued to be affected by decreased demand and

depressed coal prices, and the Company’s decision in mid-2015 to cease mining operations at Centennial.

NACoal’s consolidated mining operations, excluding Centennial, realized an increase in revenues mainly

as a result of an increase in tons sold at its Mississippi Lignite Mining Company (“MLMC”) operation.

NACoal reported net income of $5.6 million compared with a net loss of $51.0 million in 2014. The

decision to cease mining operations at Centennial came after incurring significant losses resulting from

worsening conditions in Alabama and global coal markets and the adverse effects of regulatory changes.

NACoal ceased coal production at Centennial in the fourth quarter of 2015.

Excluding Centennial, NACoal reported adjusted income of $27.3 million in 2015 compared with

adjusted income of $28.0 million in 2014. “Adjusted income” refers to net income or net loss adjusted

for the exclusion of Centennial, including the 2014 asset impairment charge. (For reconciliations from

GAAP results to the adjusted non-GAAP results, see page 14.) Improved results at MLMC from an increase

in tons sold were more than offset by a reduction in gains on sales of assets, a reduction in royalty and

other income and higher selling, general and administrative expenses in 2015 compared with 2014.

Hamilton Beach Brands (“HBB”) recorded increased revenues in 2015 primarily due to higher

volumes and the December 2014 acquisition of Weston Brands. While HBB’s revenues and gross profit

improved during 2015 primarily due to an increase in sales volumes and a full year of Weston results,

net income declined to $19.7 million in 2015 from $23.1 million in 2014 as unfavorable foreign currency

movements negatively affected results.

Kitchen Collection made significant improvements in 2015 as a result of realigning its business

around a smaller number of core Kitchen Collection®outlet stores. The realignment included closing

more than 100 unprofitable stores during 2014 and 2015 in light of changing consumer trends and

ongoing market weakness. Although Kitchen Collection revenues decreased substantially in 2015 from

the closure of these stores, Kitchen Collection achieved a substantially lower net loss of $0.4 million in

2015 compared to a net loss of $4.6 million in 2014 as a result of a $2.8 million pre-tax charge related

to the realignment and store closures recognized in 2014 as well as fewer promotional markdowns, a

shift in sales mix to higher-margin products and a reduction in store expenses in 2015.

Consolidated NACCO revenues increased from $896.8 million in 2014 to $915.9 million in 2015.

Consolidated net income was $22.0 million, or $3.13 per diluted share, in 2015, compared with a net

loss of $38.1 million, or $5.02 per diluted share, in 2014. Consolidated adjusted income for the year

ended December 31, 2015 was $43.7 million, or $6.22 per diluted share, compared with adjusted

income in 2014 of $40.8 million, or $5.37 per diluted share.

Discussion of 2015 Results