Hamilton Beach 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

it is well-positioned to continue its leadership

position in the small appliance industry. Achieving

its $750 million sales objective will help move

the company toward achieving its near-term

financial objective of 8 percent operating profit

margin and its long-term financial objective of

a minimum 10 percent operating profit margin

in the years ahead. It also expects to continue to

be a substantial generator of cash flow before

financing activities, with a continued low level

of capital expenditures required.

Kitchen Collection

Kitchen Collection’s vision is to be a leading

specialty retailer of kitchenware in outlet malls

and to a lesser degree traditional malls through-

out the United States. Constrained discretionary

income, lower rates of household formation and

increased online shopping have resulted in fewer

visits to many of the malls and outlets where

Kitchen Collection has store locations. In this

environment, not all malls where Kitchen Collection

maintains stores have been adequately profitable.

Kitchen Collection closed nearly 100 stores during

2014 and 2015 due to a rigorous and strategic

review of the short-term and long-term prospects

of each location. As part of that process, Kitchen

Collection determined it was important to focus on

the Kitchen Collection brand, which resulted in the

closure of all remaining Le Gourmet Chef®stores.

As the business moves into 2016, Kitchen

Collection has a strong core in its Kitchen

Collection®store format in outlet malls. While

the company continues to optimize its store

portfolio with stores in high-traffic locations in

strong outlet malls, the focus is now shifting to

comparable store sales growth. Kitchen Collection

expects to accomplish this by increasing closure

rates through continued refinement of its format,

ongoing review of specific product offerings,

merchandise mix, store displays and appearance

and enhancing customers’ store experience

through improved customer interactions. A

particular focus will be on increasing sales of

higher-margin products. Nonetheless, at current

mall and store traffic levels, reaching the company’s

long-term 5 percent operating profit margin

target will be challenging.

Overall, Kitchen Collection is dealing with a

difficult environment and evolving aggressively

in a constructive manner. To achieve its vision,

Kitchen Collection must increase the number

of customers coming into its stores and its sale

closure rate with these customers. Kitchen

Collection believes its remaining stores are well-

positioned to allow the company to perform at

close to break-even in the current challenging

environment and to take advantage of any future

market rebound. The company will continue to

evaluate and, as lease contracts permit, terminate

or restructure leases for underperforming stores.

Capital expenditures are expected to be modest,

with generation of positive cash flow before

financing activities expected.

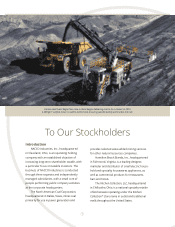

Conclusion and NACCO Outlook

NACCO is a strong, multi-industry company

with leading businesses in the mining and small

appliances industries. The Company continues to

believe HBB’s growth opportunities are significant.

NACCO is confident that HBB has the right strategic

initiatives in place to move it closer to achieving

its long-term growth and financial objectives.

While growth opportunities also are significant

at NACoal, they are largely based on growth at

existing and newer mines. Both HBB and NACoal

will be prudent in pursuing any new opportunities.

Kitchen Collection’s long-term prospects at this

time are uncertain, but its near-term prospects

are positive and should improve. NACCO is