Hamilton Beach 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

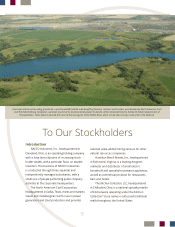

NACCO Industries, Inc. and its subsidiaries operate in the mining, small appliances and specialty retail

industries – all industries that experienced their own set of difficulties in 2014. While the overall economy improved

during 2014, the middle-market mass consumer, the target consumer for the Company’s Hamilton Beach Brands

(“HBB”) and Kitchen Collection businesses, continued to struggle with financial and economic concerns, leading

to weak retail market conditions for small appliances and other kitchen products. In addition, customer visits

to stores, particularly at traditional and outlet malls, continued to decline. North American Coal (“NACoal”)

performed as expected in 2014 with the exception of the Reed Minerals operations, where decreased demand

and depressed coal prices, particularly in the metallurgical coal market, caused significant losses. Given these

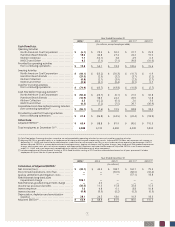

conditions, 2014 was a challenging year. Consolidated revenues decreased to $896.8 million in 2014 from $932.7

million in 2013 primarily due to reduced sales at Kitchen Collection from closing underperforming stores and

fewer customer visits at comparable stores, and lower royalty income and reduced deliveries at NACoal. However,

HBB’s revenues increased slightly as a result of an increase in sales of new products with higher price points.

The Company faces a very difficult situation with its Reed Minerals operation. When this business was

acquired in 2012, NACoal believed the metallurgical coal market was at a relative low point. However, that has

not proven to be the case as demand for metallurgical coal has fallen significantly and the price of metallurgical

coal has deteriorated far beyond the Company’s expectations. Since the acquisition in 2012, NACoal has made

significant investments to improve productivity and reduce operating costs at Reed Minerals.

In January 2015, Reed Minerals’ largest thermal coal customer clarified the plan it will adopt to comply with

the U.S. Environmental Protection Agency’s new Mercury and Air Toxics Standards (“MATS”) beginning in the

fourth quarter of 2015. This plan includes more stringent coal quality requirements than previously anticipated

and is expected to contribute to an overall increase in coal processing costs at Reed Minerals beginning in late

2015 without an increase in selling price. Revisions made early in 2015 to the Reed Minerals’ 2015 operating

plan and long-range outlook reflected this new information about MATS compliance, decreased demand and

depressed coal prices and the lack of any reliable indicators of a recovery in coal demand or price. As a result of

these factors, NACoal recorded a non-cash impairment charge of $105.1 million, or $66.4 million after tax, for 2014

related to the long-lived assets of its Reed Minerals mining operations. In 2013, NACoal determined that the $4.0

million, or $2.6 million after tax, of goodwill related to the 2012 acquisition of Reed Minerals was fully impaired.

Including these impairment charges, NACoal’s net loss was $51.0 million in 2014 compared with net income

of $31.9 million in 2013, while NACCO incurred a consolidated net loss of $38.1 million, or $5.02 per diluted share,

in 2014, compared with net income of $44.5 million, or $5.47 per diluted share, in 2013.

Excluding these impairments, NACoal reported adjusted income of $15.5 million in 2014 compared with

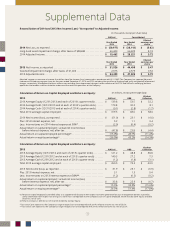

adjusted income of $34.5 million in 2013. “Adjusted income or loss” refers to net income or net loss results

that exclude long-lived asset and goodwill impairment charges. (For reconciliations from GAAP results to the

adjusted non-GAAP results, see page 14.) Improved results at the unconsolidated mining operations were

offset by a reduction in profitability at the consolidated mines and a significant reduction in royalty and other

income in 2014. Adjusted income for 2014 was negatively affected by the consolidated mines due to increased

operating costs at Reed Minerals and a reduction in lignite tons sold at Mississippi Lignite Mining Company as

a result of an increase in planned and unplanned outage days at the customer’s power plant during the year.

While HBB’s revenues and gross profit improved during 2014 from increased sales of new products with

higher price points and higher margins, net income declined to $23.1 million in 2014 from $25.1 million in 2013 as

selling, general and administrative expenses increased and foreign currency movements negatively affected results.

Finally, Kitchen Collection made significant improvements in its operations during 2014. Although revenues

decreased substantially from the closure of unprofitable stores, a reduction in operating expenses and a shift in

sales mix to higher-margin products helped Kitchen Collection achieve a lower net loss of $4.6 million in 2014

compared with a net loss of $6.9 million in 2013.

Consolidated adjusted income for the year ended December 31, 2014 was $28.3 million, or $3.72 per diluted

share, compared with adjusted income in 2013 of $47.0 million, or $5.79 per diluted share.

Additional discussion of these results, the Reed Minerals long-lived asset impairment and the 2015 outlook

for each of the Company’s businesses can be found starting on page 15 of this Annual Report on Form 10-K

or is available on the Company’s website.

Discussion of 2014 Results