Hamilton Beach 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

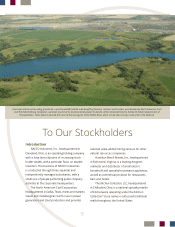

They care deeply about the land, water and

wildlife where they live and are excellent stewards.

As representative evidence of this corporate

and individual commitment to the environment,

MLMC received one of only three 2014 Excellence

in Surface Coal Mining Reclamation Awards from

the U.S. Department of the Interior’s Office of

Surface Mining and Reclamation.

Strategic Initiatives and Long-Term View

NACoal’s unconsolidated operations, which

constitute a large majority of its earnings and

cash flow capabilities, provide a strong core to

NACoal’s business model. NACoal has been very

fortunate to enter into six new agreements over

the last several years to develop new mines

or provide services to customers. Generally,

the power plants served by NACoal are among

the lower-cost producers of electricity on their

respective grids. NACoal expects to continue to

be a low-cost miner of coal at existing mines and

its mines in development, in support of customer

needs. Over the longer term, NACoal’s goal is to

increase earnings of its unconsolidated operations

by approximately 50 percent by 2017 over 2012

results through the development and maturation

of its new mines in development and normal

escalation of contractual compensation at its

existing unconsolidated mines. NACoal continues

to anticipate it will achieve this goal.

NACoal also has had a goal of at least doubling

the earnings contribution of its consolidated

mining operations by 2017 from 2012 levels due

to benefits from anticipated continued operational

improvements at MLMC’s customer’s power plant

and from the company’s execution of its long-term

plan at the Centennial operations. While NACoal

continues to expect meaningful improvements

of financial results at the MLMC mine compared

to 2012, the outlook at Centennial is poor at this

time due to low coal prices, low demand and

the aforementioned regulatory challenges. We

currently are not prepared to forecast significant

GAAP earnings at Centennial, and will not until

these price and demand conditions improve.

NACoal expects to continue its record of

operational excellence in safety, environmental

stewardship and production at each of its mining

operations and, over time, to deliver profitability

that exceeds its financial objectives, with the

exception of the Centennial operations.

Given the current unsupportive regulatory

environment for developing new traditional

coal-fired power plants, and based on lessons

learned at Centennial, NACoal is taking a very

disciplined approach with respect to growth.

Opportunities may exist, although limited, to

provide coal to customers for use other than as

a power-generation fuel, or to serve as a cost-plus

contract miner for non-coal operations, such as

aggregates or other minerals. Also, strategic

growth could possibly come from projects based

on new technologies that utilize coal, such as

integrated gasification combined-cycle power

generation, and production of alternative

fuels made from coal, as well as other clean

coal technologies and non-traditional products

derived from coal. NACoal is working with a

range of technical experts and potential partners

who could help develop projects based on these

advanced technologies. However, any significant

growth in domestic opportunities is largely

dependent on the United States adopting a

more balanced energy policy in which coal

continues to play a key role, including through

new coal technologies.

NACoal believes that a large majority of

consumers in the United States will benefit