Hamilton Beach 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Conclusion and NACCO Outlook

NACCO is a strong, multi-industry company

with leading businesses in the mining and small

appliances industries. The Company continues to

believe HBB’s growth opportunities are significant.

While growth opportunities also are significant

at NACoal, they are largely based on growth at

existing mines and those in development. Both

HBB and NACoal will be prudent in pursuing

any new opportunities. NACCO is confident that

NACoal and HBB have the right strategic initiatives

in place to move them closer to achieving their

long-term growth and financial objectives. Kitchen

Collection’s long-term prospects at this time are

uncertain, but its near-term prospects are positive

and should improve significantly. NACCO is well

positioned to support its individual businesses

in the years ahead. Each subsidiary is benefitting

from programs previously put in place which,

when combined with the initiatives now being

implemented, should improve income and return

on total capital employed at each business over

the next few years. In addition, the Company

expects each business to generate significant

cash flow before financing over time, which it

expects to use mainly to pay dividends, repurchase

stock when that is an attractive investment for

its stockholders, and reduce debt.

As of December 31, 2014, NACCO had

repurchased 680,013 shares of its Class A common

stock for an aggregate purchase price of $36.0

million, including $35.1 million of stock purchased

during 2014. These purchases were made under

the stock repurchase program the Company

announced in November 2013, which permits the

repurchase of up to $60 million of the Company’s

outstanding Class A common stock. Under a

previous stock repurchase program which ran

from November 2011 to November 2013, the

Company repurchased approximately 624,000

shares of Class A common stock for an aggregate

purchase price of $35.6 million.

n n n

We would like to recognize Jack Turben, who

chose to retire from the NACCO and subsidiary

Boards this past May, after serving for 17 years.

He also served as chair of our Finance Committee.

Jack brought unique and valuable perspectives

to the Board from his experiences as a real

pioneer and leader in the private equity arena.

We appreciate his many contributions and wish

him well in retirement.

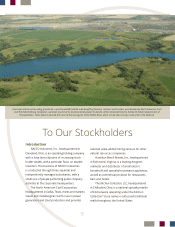

In closing, we would like to thank all of our

subsidiaries’ customers, retailers and suppliers,

and all of NACCO’s stockholders, for their

continued support. Most importantly, we would

also like to thank all employees of NACCO and its

subsidiary companies for their continued hard

work. We continue to have great confidence

in the management teams leading each of our

subsidiaries and the parent company, and we

are confident these teams can successfully

implement their respective strategic initiatives

to enhance the Company’s sales and profits over

the next few years.

Gregory H. Trepp

President and Chief Executive Officer

Hamilton Beach Brands, Inc.

Chief Executive Officer

The Kitchen Collection, LLC

Robert L. Benson

President and Chief Executive Officer

The North American Coal Corporation

Alfred M. Rankin, Jr.

Chairman, President and Chief Executive Officer

NACCO Industries, Inc.