Hamilton Beach 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

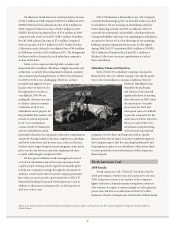

Above: A Le Tourneau front-end loader loads mined lignite coal into a Kress coal haul truck at The Coteau Properties Company’s Freedom Mine in

North Dakota.

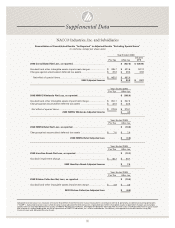

On this basis, North American Coal reported net income

of $22.1 million in 2008 compared with $31.0 million in 2007.

NMHG Wholesale had adjusted income of $4.5 million in

2008 compared with net income of $48.2 million in 2007.

NMHG Retail had an adjusted loss of $3.4 million in 2008

compared with a net loss in 2007 of $8.9 million. Hamilton

Beach’s 2008 adjusted income of $7.4 million compared

with net income of $19.5 million in 2007. Finally, Kitchen

Collection’s results declined to an adjusted loss of $6.4 million

in 2008 from a net loss of $0.9 million in 2007. The background

for these results is discussed in each subsidiary company’s

section of this letter.

Today we face unprecedented global economic and

financial market conditions. The future is highly uncertain and,

at this time, accurately forecasting market demand, customer

and consumer purchasing behavior or NACCO performance

for 2009 or 2010 is very challenging. Therefore, we have

promptly and aggressively put

in place what we believe to be

the right plans to weather a

very difficult 2009. We are

making the decisions necessary

to address current economic

conditions at all of our

subsidiaries and to prepare for

the possibility that markets will

remain at current depressed

levels. Cost containment

actions at NACCO Industries

and our subsidiaries include

personnel reductions, the suspension of incentive compensation

and profit-sharing, benefit reductions, wage freezes, spending

and travel restrictions, and, in some cases, salary reductions.

Further, many targeted improvement programs, some put in

place over the last few years and some implemented more

recently, will be largely complete in 2009.

We have great confidence in the management teams at

each of our subsidiaries and in the many experienced and

capable people working closely together around the globe

to help our companies manage through the downturn. In

addition, several senior NACCO parent company personnel

have taken on more specific operational roles at NACCO

Materials Handling Group and North American Coal, in

addition to their parent company roles, to add expertise as

well as to reduce costs.

NACCO Industries is financially secure. The Company

currently has financing in place on favorable terms at each of

its subsidiaries. We are focusing on maximizing cash flow

before financing activities in 2009. In addition, NACCO

currently has substantial cash available, which provides the

Company flexibility with respect to capitalizing its subsidiaries,

an option we believe to be a key advantage of our operating

holding company organizational structure. In this regard,

during 2008, NACCO contributed $68.3 million to NMHG,

$29.0 million to Hamilton Beach and $25.3 million to

Kitchen Collection to increase capitalization at each of

these subsidiaries.

Subsidiary Financial Objectives

Each of NACCO’s subsidiary companies has specific

financial objectives (see sidebar on page 3 for specific goals).

Due to the extraordinary economic conditions, NACCO

Materials Handling Group,

Hamilton Beach Brands

and Kitchen Collection fell

significantly short of meeting

their objectives in 2008. Given

the uncertainty of market

projections for 2009 and

subsequent years, it is difficult

to provide a timetable for the

achievement of these objectives.

However, each of NACCO’s

subsidiaries is implementing

well-structured operational

programs over the short and long term with its specific

financial objectives in mind. As market conditions improve,

the Company expects that the operating fundamentals and

the programs in place at our subsidiaries will position them

to move positively toward achievement of their long-term

financial goals.

North American Coal

2008 Results

North American Coal (“NACoal”) has had relatively

stable performance over the years and continued to do so in

2008. Long-term contracts are in place at the company’s

lignite coal mines, demand remains strong from customers

who continue to require a constant supply of coal to generate

power and cash flow is steadier than in NACCO’s other

businesses. Positive developments at NACoal in 2008 included