Hamilton Beach 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

estimate consumer purchasing levels for 2009 or the timing of

a recovery. Consumer spending is expected to be significantly

reduced in 2009, particularly in the first half. As a result,

HBB expects revenues in 2009 to be lower than in 2008.

HBB offers high-quality, value-based products to

demanding end users. The company has an excellent pipeline

of innovative new products and has strong retail placements

at leading retailers. HBB is not significantly dependent on

higher-end segments of the market, which are currently

experiencing greater weakness.

Actions Being Taken to Move

Forward in 2009

A number of actions have

been taken at HBB to respond

to anticipated lower volumes.

Aggressive cost containment actions

taken to date include personnel

reductions, the suspension of

incentive compensation and

profit-sharing, benefit reductions,

wage freezes and spending and

travel restrictions, as well as other

cash and cost-saving initiatives. In

addition to these actions, HBB is

actively working to improve pricing

and product positioning and

reduce product costs in light of

softening commodity costs for

resins, copper, steel and aluminum, as well as reduced

transportation costs. HBB is also monitoring commodity

costs closely and is currently negotiating with suppliers and

retailers on costs, prices and product placement programs. All

of these actions are designed to bring product margins more

in line with those that prevailed in 2007 before commodity

cost increases pushed product costs up dramatically over the

course of 2008.

HBB entered the recession operationally strong with good

product placements. HBB’s targeted improvement programs,

which are now mature, are expected to be beneficial in these

challenging times. In addition, the company is reviewing

each area of the business to ensure continued focus on core

products and on strengthening its market position through

product innovation, promotions and branding programs.

HBB anticipates continued strong placements in 2009, with

increased placements and distribution at some retailers. The

company is also undertaking programs to enhance the market

position of its brands, which include the Hamilton Beach®

heritage brand and the quality, value-priced Proctor Silex®

brand. HBB’s approach is designed to improve competitiveness

during the recession so it can emerge from the downturn in

an enhanced market position.

Overall, 2009 net income and cash flow before financing

activities are currently expected to improve compared with

adjusted 2008 results because of HBB’s cost containment

actions and efforts to improve margins through reduced costs,

improved prices and new product

introductions and placements.

However, if markets deteriorate

further, revenues and earnings could

be adversely affected.

Longer-Term Perspective

Product quality, customer

service and fact-based professional

sales and marketing remain areas

of excellence for HBB. Important

promotional campaigns designed

to support HBB’s brands and new

products are expected to continue.

The company’s product and place-

ment track record is impressive due

to innovation processes centered on

understanding and meeting end-user

needs. New products introduced in 2008, as well as further

new product introductions in the pipeline for 2009 and future

years, are expected to improve revenues. However, the timing

of an upturn in U.S. consumer markets is very uncertain, which

makes overall revenues and margins very difficult to predict.

At HBB, an experienced team of professionals is

managing the challenges of the current economic environment

aggressively. The company will continue to work to improve

revenues and profitability by improving efficiencies, reducing

costs and pursuing strategic growth opportunities, including

those which may arise during the economic downturn. The

company is well positioned to continue its leadership position

in the small kitchen appliances industry and to attain its

longer-term financial objectives when increased consumer

spending returns.

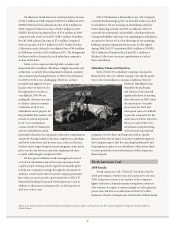

Above: Clockwise from top: Hamilton Beach Brands' newest products include: Hamilton Beach® Stay or Go™ 6 quart slow cooker with lid rest, Hamilton

Beach® Big Mouth® Deluxe food processor and Hamilton Beach® Set & Forget® Grill.