Hamilton Beach 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

To Our Stockholders

• NMHG Wholesale: Achieve a minimum operating profit margin of 9 percent

• NMHG Retail: Reach at least break-even financial performance while

building market position and transfer responsibility to independent dealers

when possible

• HBB: Achieve a minimum operating profit margin of 10 percent

• KC: Achieve a minimum operating profit margin of 5 percent

Subsidiary Financial Objectives:s

• NACoal: Earn a minimum return on capital employed of 13 percent and attain

positive Economic Value Income from all existing consolidated mining

operations and any new projects while maintaining or increasing the

profitability of all existing unconsolidated project mining operations

• All subsidiaries: Generate substantial cash flow before financing activities

Introduction

NACCO Industries, like many companies in the United

States and around the world, had a very challenging 2008.

While revenues increased slightly to $3.7 billion in 2008

compared with $3.6 billion in 2007, largely as a result of a

weak U.S. dollar, 2008 financial results were very disappointing

due to the effects of global economic conditions and the state

of current financial markets.

In last year’s annual report, we suggested that external

factors, including a slowing U.S. economy, were likely to affect

results significantly. The extent of the slowdown has been

significantly worse than expected, with the year ending amid

a deepening global recession which resulted in a decline in

the levels of our markets and in the volumes at each of our

subsidiaries. In addition, the year began with high material

cost inflation which was not able to be recovered adequately

through price increases. These factors, along with adverse

foreign currency movements, were key drivers of the significant

decrease in our financial results.

In addition, because the Company’s stock price at

December 31, 2008 was significantly below the Company’s

book value of tangible assets and book value of equity,

accounting rules required that the Company take a non-cash

write-off of goodwill and certain other intangible assets

totaling $435.7 million, or $431.6 million net of taxes of $4.1

million. The goodwill and intangibles were incurred largely as

a result of acquisitions in the late 1980s and early 1990s. The

Company recorded the pre-tax charges as follows: $351.1

million at NACCO Materials Handling Group (“NMHG”)

Wholesale, $80.7 million at Hamilton Beach and $3.9 million

at Kitchen Collection. The Company, however, believes that

current stock market valuations, which were the basis for

the impairment testing under existing accounting rules,

are generally reflective of broader global macro-economic

and stock market conditions rather than a reflection of the

operating fundamentals and the programs being implemented

at each of our subsidiaries.

Also during 2008, the Company recognized non-cash

charges of $29.8 million against the accumulated deferred tax

assets for the European and Australian operations and certain

U.S. state taxing jurisdictions of NMHG’s Wholesale and

Retail subsidiaries. While these deferred tax assets have been

charged against income, their benefit is still available to the

Company as income is generated in the future.

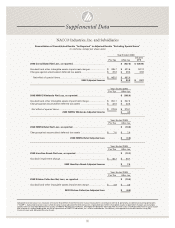

In the context of the 2008 market conditions and

including the goodwill and intangible assets impairment

charges and deferred tax asset charges, in 2008 the Company

incurred a consolidated net loss of $437.6 million, or $52.84

per share; NMHG Wholesale incurred a net loss of $365.6

million; NMHG Retail incurred a net loss of $10.4 million;

Hamilton Beach reported a net loss of $73.3 million; Kitchen

Collection reported a net loss of $10.0 million; and North

American Coal reported net income of $22.1 million.

Consolidated adjusted income for the year ended

December 31, 2008 was $23.8 million, or $2.87 per share. This

compares with net income in 2007 of $90.4 million, or $10.93

per diluted share.“Adjusted income or loss” in this letter refers

to net income or net loss results that exclude the goodwill and

intangible assets impairment charges as well as the charges

against the accumulated deferred tax assets. (For reconciliations

from GAAP results to the adjusted non-GAAP results, see

page 11.) The remaining discussion of 2008 results in this

letter relates only to adjusted income or adjusted loss unless

otherwise noted. Management believes a discussion of

adjusted income or adjusted loss is more reflective of NACCO’s

underlying business operations and assists investors and our

subsidiaries’ lenders, who often exclude non-cash charges

from their analyses, in better understanding the results of

operations of NACCO and its subsidiaries.