HR Block 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

H&R BLOCK

2 0 0 7 A N N U A L R E P O R T

H&R BLOCK 2 0 0 7 A N N U A L R E P O R T

Table of contents

-

Page 1

H&R BLOCK 2007 ANNUAL REPORT H&R BLOCK 2007 ANNUAL REPORT -

Page 2

-

Page 3

... ofï¬ces, digital tax solutions through our TaxCut software and online programs, and, increasingly, blends of assisted tax preparation with do-it-yourself methods. We enhance tax client relationships for competitive advantage by offering investment services and advice plus our new capabilities in... -

Page 4

... per share Net income before discontinued operations and change in accounting principle Net income (loss) Other per share data Cash dividends declared Net book value Return on total revenues1 Return on stockholders' equity1 Return on average assets1 Working capital ratio Debt to total capital... -

Page 5

...for our core operations. A major step toward greater differentiation occurred in May 2006, when we opened H&R Block Bank. We began offering targeted consumer banking services to our tax clients to strengthen our unique market position and build client loyalty. During the past tax season, we restored... -

Page 6

...over the past few years to competitors selling highcost pre-season and early season loans to clients focused on getting cash fast. For tax season 2007, we combined the new Instant Money Advance Loan, or IMAL (originated by a third-party bank), with our own bank's H&R Block Emerald Prepaid MasterCard... -

Page 7

... OPERATIONS ONL CONSUMER FINANCIAL SERVICES BUSINESS SERVICES TAX SERVICES refund, thus avoiding checks and check-cashing fees. The Emerald Card establishes an account for them that offers simple and affordable year-round banking services, including direct deposit of payroll and other funds, ATM... -

Page 8

... first time for a better financial future. The bank had $1.5 billion in assets at fiscal year-end, including tax-client Emerald Card and savings account balances and funds held for clients of H&R Block Financial Advisors. Both businesses differentiate H&R Block from the tax services competition by... -

Page 9

... in client service, have built the industry-leading positions we enjoy. The focus and market leadership we have in our core tax and accounting businesses position us well for creating long-term value. H&R Block has the right businesses and strategies in place for the future, along with competitive... -

Page 10

Jack McCall TAX ADVISOR H&R BLOCK KANSAS CITY, MISSOURI 8 R OO SE V E LT KE LLY KANSAS C I T Y, M I SS O U R I :: Long-time tax client Roosevelt Kelly - one of 22.9 million clients served by H&R Block in ï¬scal 2007 - has a 40-year relationship with H&R Block and currently returns each season to... -

Page 11

... digital tax solutions. We're the best-known firm as well, with our H&R Block brand scoring 99 percent in consumer awareness in recent years. Talented and dedicated associates drive our success by focusing on delivery of high-quality services and products to clients as their tax and financial... -

Page 12

... 50 hours of education a year. On average, our clients are served by a professional with more than eight years of tax preparation experience. They their returns prepared during tax season 2007 - the H&R Block Easy IRASM and the H&R Block Easy SavingsSM account. Since the Bank began operations in... -

Page 13

... People advertising campaign that H&R Block launched in fall 2006 conveys expertise as a central element of our brand." Robert J. Bives IV MANAGING DIRECTOR OF INVESTMENTS LAKE AUSTIN INVESTMENT GROUP H&R BLOCK FINANCIAL ADVISORS AUSTIN, TEXAS Carol Mitchell, EA MASTER TAX ADVISOR H&R BLOCK AUSTIN... -

Page 14

... planning and services. During fiscal 2007, referrals from tax professionals to financial advisors generated 13,900 new accounts with $690 million in assets. More than 20 percent of H&R Block Financial Advisors' clients are also tax clients. The opportunity to build relationships and business... -

Page 15

... an easy and economical solution to tax preparation. They ï¬le throughout the course of the tax season. 13 early ï¬lers Early ï¬lers are often younger, lower-income, high school graduates who rent. Getting their refund fast is the number one objective, and many choose bank settlement products... -

Page 16

... to lead industry reform as an advocate for tax clients. We are committed to VICTOR SANCHEZ MIAMI, FLORIDA EARLY FILERS :: To avoid check-cashing costs and quickly receive funds for his tax overpayment, Victor Sanchez chose the new H&R Block Emerald Prepaid MasterCard® option offered by Irene... -

Page 17

... the financial mainstream, start saving for the future and enjoy low-cost banking services. Nearly 40 percent of account holders did not previously have The Emerald Card also made possible a breakthrough refund loan product we offered to tax clients during the 2007 season. Though a third-party bank... -

Page 18

...TaxCut online programs and software products, positioned as superior to the competition and yet lower priced. Many new tax filers each year are control-segment do-it-yourselfers who look for convenient access, broad capabilities and ease of use, all at low cost. We want to win their digital business... -

Page 19

... our segment share start with expanding market awareness of H&R Block's digital offerings. We're investing through advertising, search engine strategies, and other marketing and promotion initiatives. Two new TaxCut TV ads in January 2007 - both featuring our software and You Got People theme - took... -

Page 20

...clients used H&R Block's tax services last season than ever before. With solid execution, we are confident in our continued leadership of the tax preparation industry. H&R Block Online Office - Clients similarly enter information from the comfort of home; an H&R Block tax professional then prepares... -

Page 21

... Breault TAX PROFESSIONAL H&R BLOCK SAGINAW, MICHIGAN 19 J AYSON & J ODI MI KU LA & DAUG HTER, SAMMY S PARTA, MICHI G AN HY B RID :: Jayson and Jodi Mikula selected H&R Block Signature service, preparing their own tax return with TaxCut Online; then Laura Breault reviewed, edited, signed and... -

Page 22

... the market - middle-market companies on the move. We are the number one ï¬rm providing accounting, tax and business consulting services to clients in our target market segment. We are also the ï¬fth-largest U.S. accounting ï¬rm overall, with more than $1.3 billion in ï¬scal 2007 annual revenues... -

Page 23

... clients in the middle market, having annual revenues from $2.5 million to $1 billion. All but a few started small, grew and remain privately held. Our clients include top companies and organizations in manufacturing and distribution, construction and real estate, health care, ï¬nancial services... -

Page 24

DIRECTORS 1 :: MAR K A . ERNST Chairman, President and Chief Executive Officer H&R Block Inc. Kansas City, MO Committees 3, 4 2 :: THOMAS M . B LOCH Educator Kansas City, MO Committee 4 3 :: J ERRY D. CHOATE Retired Chairman of the Board and Chief Executive Officer The Allstate Corporation ... -

Page 25

..., Human Resources 6 :: TIMOTHY C . G O K EY Group President, Retail Tax 7 :: TOM ALLANSON Group President, Digital Tax 8 :: MARC W EST Group President, Commercial Tax 23 9 :: STEVEN TAIT President, RSM McGladrey Business Services Inc. 10 :: J OAN K . COHEN President, H&R Block Financial Advisors... -

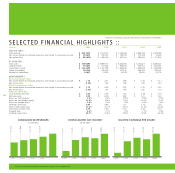

Page 26

FIVE YEARS IN REVIEW Amounts in thousands, except offices Year Ended April 30 2007 2006 2005 2004 2003 R etail tax preparation f ees United States Canada Australia C lients ser v ed United States Retail operations Digital tax solutions Canada Australia $ 1,782,933 80,120 33,216 $ 1,896,269 ... -

Page 27

...Address of principal executive offices, including zip code) (816) 854-3000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, without par value New York Stock... -

Page 28

...Procedures Other Information PART III Directors and Executive Officers of the Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions Principal Accounting Fees and Services PART IV... -

Page 29

... to tax return preparation to the general public in the United States, Canada and Australia. Our Business Services segment is a national accounting, tax and business consulting firm primarily serving mid-sized businesses under the RSM McGladrey name. Our Consumer Financial Services segment offers... -

Page 30

... clients a number of options for receiving their income tax refund, including a check directly from the Internal Revenue Service (IRS), an electronic deposit directly to their bank account, a refund anticipation check or a RAL. The following are some of the services we offer with our tax preparation... -

Page 31

... - The H&R Block Prepaid Emerald MasterCardË› allows a client to receive a tax refund from the IRS directly on a prepaid debit card, or to direct RAL or RAC proceeds to the card to avoid high-cost check-cashing fees. The card can be used for everyday purchases, bill payments, and ATM withdrawals... -

Page 32

... year 2007, the Canadian tax season ended April 30, 2007. COMPETITIVE CONDITIONS - The retail tax services business is highly competitive. There are a substantial number of tax return preparation firms and accounting firms offering tax return preparation services. Many tax return preparation firms... -

Page 33

..., Inc. (RSM), which provides accounting, tax, and business consulting services in 97 cities in 25 states and offers services in 18 of the top 25 U.S. markets. tax refund. Federal laws place restrictions on the fees an electronic filer may charge in connection with RALs. In addition, some states and... -

Page 34

... number of accounting firms offering similar services at the international, national, regional and local levels. As our focus is on middle-market businesses, our principal competition is with national and regional accounting firms. We believe we have a competitive CONSUMER FINANCIAL SERVICES GENERAL... -

Page 35

... the charter of HRB Bank. HRB Bank commenced operations on May 1, 2006 and offers traditional consumer banking services including checking and savings accounts, home equity lines of credit, individual retirement accounts, certificates of deposit and prepaid debit card accounts to clients in the... -

Page 36

... year 2007, we committed to a plan to sell and/or completed the wind-down of three smaller lines of business previously reported in our Business Services segment, as well as our tax operations in the United Kingdom previously reported in Tax Services. HRB Bank is subject to regulation, supervision... -

Page 37

..., credit history, employment history and personal information. We also originate stated income loans where income verification may not be obtained. We require a credit report on each applicant from an industry-recognized credit reporting company. In evaluating an applicant's credit history, we use... -

Page 38

... number of companies competing in the residential loan market, including mortgage banking companies, commercial banks, savings associations, credit unions and other financial institutions. During fiscal year 2007, the declining performance of non-prime originations, including early payment... -

Page 39

... for certain loans products. In September 2006, the federal financial regulatory agencies (The Board of Governors of the Federal Reserve System, the Office of Comptroller of the Currency, the OTS, the National Credit Union Administration, and the Federal Deposit Insurance Corporation) jointly issued... -

Page 40

... affect our access to these funds. To meet our future financing needs, we may issue additional debt or equity securities. LITIGATION - We are involved in lawsuits in the normal course of our business related to RALs, our POM guarantee program, electronic filing of tax returns, Express IRAs, losses... -

Page 41

... been a party to agreements with HSBC and its predecessors to participate in RALs provided by a lending bank to H&R Block tax clients. During fiscal year 2006, we signed a new agreement with HSBC under which HSBC and its designated bank will provide funding of all RALs offered through June 2011. We... -

Page 42

...in revenue from these accounts for fiscal year 2007. During the process of converting these accounts, we are exposed to risk in advisor and client retention, product pricing and related production revenues. REGULATORY ENVIRONMENT -BANKING - H&R Block, Inc., as a savings and loan holding company, and... -

Page 43

... than 5% of our loan balances. INTEGRATION INTO THE H&R BLOCK BRAND - We are working to foster an advice-based relationship with our tax clients through our retail tax office network. This advice-based relationship is key to the integration of Consumer Financial Services into the H&R Block brand and... -

Page 44

... properties. which is located in Kansas City, Missouri. Our former corporate headquarters building was sold during fiscal year 2007. Most of our tax offices, except those in shared locations, are operated under leases throughout the U.S. Our Canadian executive offices are H&R BLOCK 2007 Form 10K -

Page 45

...' claims consist of five counts relating to the Peace of Mind (POM) program under which the applicable tax return preparation subsidiary assumes liability for additional tax assessments attributable to tax return preparation error. The plaintiffs allege that the sale of POM guarantees constitutes... -

Page 46

...our consolidated financial statements. EXPRESS IRA LITIGATION - On March 15, 2006, the New York Attorney General filed a lawsuit in the Supreme Court of the State of New York, County of New York (Index No. 06/401110) entitled The People of New York v. H&R Block, Inc. and H&R Block Financial Advisors... -

Page 47

... investigations, claims and lawsuits pertain to RALs, the origination and servicing of mortgage loans, the electronic filing of customers' income tax returns, the POM guarantee program, and our Express IRA program and other investment products and RSM EquiCo, Inc. business valuation services. We... -

Page 48

... to ''Securities Authorized for Issuance under Equity Compensation Plans'' is reported in Item 8, note 13 to our consolidated financial statements. A summary of our purchases of H&R Block common stock during the fourth quarter of fiscal year 2007 is as follows: (shares in 000s) Total Number of... -

Page 49

... tax preparation solutions, combined with personalized financial During fiscal year 2007, we committed to a plan to sell and/or advice concerning retirement savings, home ownership and other completed the wind-down of three smaller lines of business previously opportunities to help clients build... -

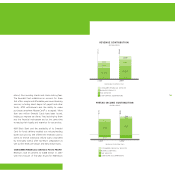

Page 50

Consolidated Results of Operations Year ended April 30, REVENUES - Tax Services Business Services Consumer Financial Services Corporate and eliminations 2007 $ 2,685,858 932,361 388,090 14,965 $ 4,021,274 (in 000s, except per share amounts) 2006 $ 2,449,751 828,133 287,955 8,914 $ 3,574,... -

Page 51

... Year Ended April 30, CLIENTS SERVED - United States: Company-owned operations Franchise operations IMAL only (2) Digital tax solutions International (4) (3) Tax Services :: Financial Results Year Ended April 30, Service revenues: Tax preparation fees Other services Other revenues: Royalties Loan... -

Page 52

... clients served in company-owned offices. The decrease in clients served was partially due to a number of technology problems that severely hurt the start of our filing season, coupled with increased competition due to competitors' refund lending products. Our international operations contributed... -

Page 53

... recorded a $19.5 million pretax charge related to this settlement in the third quarter of fiscal year 2006. We are named as a defendant in one other class-action lawsuit and one state attorney general lawsuit alleging that we engaged in wrongdoing with respect to the RAL program. We believe we have... -

Page 54

...wealth management and capital market services. The following discussion excludes the results of the three businesses reported in discontinued operations for all periods presented. Business Service :: Operating Statistics Year Ended April 30, ACCOUNTING, TAX AND BUSINESS CONSULTING - Chargeable hours... -

Page 55

... Services' revenues, net of interest expense and provision for loan losses, for fiscal year 2007 increased $58.3 million, or 20.7%, over the prior year, primarily as a result of HRB Bank, which commenced operations May 1, 2006. Financial advisor production revenue, which consists primarily of fees... -

Page 56

Other service revenues increased $36.4 million, due to revenues earned from our new H&R Block Prepaid Emerald MasterCardË› program, coupled with positive sweep account rate variances and higher underwriting fees. Net interest income on banking activities totaled $24.0 million for fiscal year 2007. ... -

Page 57

... (2) Other revenues Other cost of origination Net margin (loss) Total cost of origination (3) Total cost of origination and acquisition LOAN DELIVERY - Loan sales: Third-party buyers HRB Bank Execution price (4) (dollars in 000s) Discontinued Operations :: Operating Results Year Ended April 30... -

Page 58

.... Interest income decreased $78.7 million from the prior year. This decrease is primarily due to higher levels of non-performing loans, lower accretion resulting from the sale of previously securitized residual interests and lower write-ups to residual interest balances. H&R BLOCK 2007 Form 10K -

Page 59

... related to our loan servicing business: (dollars in 000s) Year Ended April 30, Average servicing portfolio: With related MSRs Without related MSRs Ending servicing portfolio: With related MSRs Without related MSRs Number of loans serviced Average delinquency rate Weighted average FICO score WAC... -

Page 60

....6 million restructuring charge associated with the closing of some of our branch offices. Compensation and benefits increased $53.8 million primarily due to an increase in the average number of sales associates during the year to support higher loan volumes and the resulting increase in origination... -

Page 61

... impairment analysis is based on a discounted cash flow approach and market comparables, when available. This analysis, at the reporting unit level, requires significant management judgment with respect to revenue and expense forecasts, anticipated changes in working capital, and the selection and... -

Page 62

...we sell loans to third parties with the servicing of those loans retained. At the time of the loan sale, we determine and record on our balance sheet the allocated historical cost of the MSRs attributable to loans sold, as illustrated above. These MSRs are amortized over the H&R BLOCK 2007 Form 10K -

Page 63

... funds fees, collection fees and interest earning funds held in deposit. These fees could be impacted by state legislation efforts, customer behavior, fee waiver policies and industry trends. During the period from May 1, 2005 to April 30, 2007, assumptions used in valuing MSRs were updated... -

Page 64

... fiscal year 2007, we also updated our assumption related to the average number of days of interest collected on funds received as a result of prepayments (Ancillary fees on the table above). We decreased the average number of days of interest collected following a review of the servicing portfolio... -

Page 65

...at the end of fiscal year 2007. We purchase shares on the open market in accordance with existing authorizations, subject to various factors including the price of the stock, our ability to maintain liquidity and financial flexibility, securities laws restrictions, internally and regulatory targeted... -

Page 66

...- In fiscal year 2007, Consumer Financial Services used $1.0 billion in investing activities primarily due to the purchase of mortgage loans from OOMC. Cash provided by financing activities of $1.3 billion is due to customer deposits. To manage short-term liquidity, Block Financial Corporation (BFC... -

Page 67

... a portion may also be used to sell servicing advances and finance residual interests. Additionally, these arrangements free up cash and short-term borrowing capacity, improve liquidity and flexibility, and reduce balance sheet risk, while providing stability and access to liquidity in the secondary... -

Page 68

... the NIM bonds issued to the third-party investors are paid in full. At the settlement of each NIM transaction, we remove the trading residual interests sold from our consolidated balance sheet and record the cash received and the new residual interest retained. These new H&R BLOCK 2007 Form 10K -

Page 69

... the consolidated financial statements for additional information. We entered into a $3.0 billion line of credit agreement with HSBC Finance Corporation effective January 2, 2007 for use as a funding source for the purchase of RAL participations. This line was secured by our RAL participations. All... -

Page 70

... is as follows: (in 000s) Total Commercial paper and other short-term borrowings Customer deposits Debt Media advertising purchase obligation Acquisition payments Retirement obligation assumed Capital lease obligation Operating leases Total contractual cash obligations $ 1,567,082 1,129,263 502,236... -

Page 71

... federal savings bank charter of HRB Bank. HRB Bank commenced operations on May 1, 2006, at which time H&R Block, Inc. became a savings and loan holding company. As a savings and loan holding company, H&R Block, Inc. is subject to regulation by the OTS. Federal savings banks are subject to extensive... -

Page 72

... our consolidated financial statements. (dollars in 000s) Average Balance Interest-earning assets: Loans, net Available-for-sa le investment securities Federal funds sold FHLB stock Noninterest-earning assets Total HRB Bank assets Interest-bearing liabilities: Customer deposits FHLB borrowing Non... -

Page 73

... Recoveries Charge-offs Balance at end of period Ratio of net charge-offs to average loans outstanding during the year $ - 3,622 - (174) 3,448 0.02% Average Balance Money market and savings Interest-bearing checking accounts IRAs Certificates of deposit Noninterest-bearing deposits $ $ 509... -

Page 74

....0 million drawn on a new credit facility and $75.0 million in FHLB advances. For fiscal year 2007, the average issuance term of our commercial paper was 45 days and the average outstanding balance was $1.0 billion. As commercial paper and bank borrowings are generally seasonal, interest rate risk... -

Page 75

... stock. See table below for sensitivity analysis of our mortgage-backed securities. HRB Bank's liabilities consist primarily of transactional deposit relationships, such as prepaid debit card accounts and checking accounts. Other liabilities include money market accounts, certificates of deposit... -

Page 76

... the fixed-rate mortgage loans is closed approximately 10-15 days prior to standard Public Securities Association (PSA) settlement dates. At April 30, 2007 we recorded an asset of $0.1 million related to these instruments. To finance our prime originations, we use a warehouse facility with capacity... -

Page 77

... scope and results of their audits, including internal control, audit and financial matters. KPMG LLP audited our consolidated financial statements. Their audits were conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States). H&R BLOCK 2007 Form 10K -

Page 78

... of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated June 29, 2007 expressed an unqualified opinion on management's assessment of, and the effective operation of, internal control over financial reporting. Kansas City, Missouri June 29, 2007 H&R BLOCK 2007 Form 10K -

Page 79

... income, stockholders' equity, and cash flows for each of the years in the three-year period ended April 30, 2007, and our report dated June 29, 2007 expressed an unqualified opinion on those consolidated financial statements. 51 m Kansas City, Missouri June 29, 2007 H&R BLOCK 2007 Form 10K -

Page 80

... M E AND COMPREHENSIVE INCOME Year Ended April 30, REVENUES - Service revenues Other revenues: Product and other revenues Interest income OPERATING EXPENSES - Cost of services Cost of other revenues Selling, general and administrative Operating income Non-operating interest expense Other income, net... -

Page 81

...operations, held for sale Total assets LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES - Commercial paper and other short-term borrowings Customer banking deposits Accounts payable to customers, brokers and dealers Accounts... notes to consolidated financial statements. H&R BLOCK 2007 Form 10K -

Page 82

... wages and payroll taxes Accrued income taxes Other noncurrent liabilities Other, net Net cash provided by (used in) operating activities CASH FLOWS FROM INVESTING ACTIVITIES - Available-for-sale securities: Purchases of available-for-sale securities Sales of and payments received on other available... -

Page 83

...available-for-sale securities Stock-based compensation Shares issued for: Option exercises Nonvested shares ESPP Acquisitions Acquisition of treasury shares Cash dividends paid - $0.53 per share Balances at April 30, 2007... notes to consolidated financial statements. H&R BLOCK 2007 Form 10K -

Page 84

..., we offer tax return preparation; accounting, tax and consulting services to business clients; investment services through a registered broker-dealer; traditional consumer banking services; tax preparation and related software; and refund anticipation loans offered by a third-party lending... -

Page 85

... the balance sheet date. Securities borrowed and securities loaned transactions are generally reported as collateralized financings. These transactions require deposits of cash and/or collateral with the lender. Securities loaned consist of securities owned by customers that were purchased on margin... -

Page 86

... with software developed or purchased for internal use. These costs are typically amortized over 36 months using the straight-line method. We capitalized interest costs during construction of our new corporate headquarters facility for qualified expenditures based upon interest rates in place during... -

Page 87

... Service revenues consist of mortgage loan servicing fees and are recorded in the period in which the service is performed. DERIVATIVE ACTIVITIES. We use forward loan sale commitments, interest rate swaps and other financial instruments to manage our interest rate risk related to commitments to fund... -

Page 88

... origination fees and costs and purchase discounts and premiums, which are amortized to income over the life of the loan using the interest method. Product and other revenues include royalties, refund anticipation loan (RAL) participation revenues and sales of software products. Franchise royalties... -

Page 89

... of mortgage loans held for investment, note 9 for the fair value of time deposits and note 10 for fair value of long-term debt. NEW ACCOUNTING STANDARDS - In February 2007, Statement of Financial Accounting Standards No. 159, ''The Fair Value Option for Financial Assets and Financial Liabilities... -

Page 90

... impact of new accounting standards not yet adopted reflects current views. There may be material differences between these estimates and the actual impact of these standards. Year Ended April 30, Net income Add: Stock-based compensation expense included in reported net income, net of taxes Deduct... -

Page 91

... Noncompete agreements Weighted average life $ 10 years 15 years 10 years $ 2,497 9,666 7,730 100 19,993 During fiscal year 2007 we acquired TaxWorks LLC, a provider of commercial tax preparation software targeting the independent tax preparer market. The initial cash purchase price was... -

Page 92

... year 2007. As a result, we adjusted deferred tax balances initially recorded in connection with this acquisition resulting in an increase of $16.6 million to goodwill and received cash of $10.1 million, which was recorded as a reduction of goodwill. During fiscal year 2005, our Business Services... -

Page 93

... $8.2 million. HRB Bank had no commitments to purchase mortgage loans from third-party lenders at April 30, 2007. Activity in the allowance for loan losses for the year ended April 30, 2007 is as follows: (in 000s) Balance, beginning of period Provision for loan losses Charge-offs Recoveries... -

Page 94

... related to the sale or wind-down of our discontinued operations. The purchase price for our acquisition of AmexTBS was subject to certain contractual post-closing adjustments, which were finalized during fiscal year 2007. As a result, we adjusted deferred tax balances initially recorded in... -

Page 95

... $3.0 billion line of credit agreement with HSBC and various financial activities. The components of short-term Finance Corporation effective January 2, 2007 through the earlier of borrowings as of April 30, 2007 are as follows: June 30, 2007 or the date of repayment, for use as a funding source for... -

Page 96

... of customer banking deposits at April 30, 2007 are as follows: (in 000s) Outstanding Balance Demand deposits: Money-market deposits Savings deposits Checking deposits: Interest-bearing Noninterest-bearing IRAs and other time deposits: Due in 2008 Due in 2009 Due in 2010 Due in 2011 Due in 2012... -

Page 97

... the fair value of nonvested shares and performance nonvested share units based on the closing price of our common stock on the grant date. Generally, we expense the grant-date fair value, net of estimated forfeitures, over the vesting period on a straight-line basis. Upon H&R BLOCK 2007 Form 10K -

Page 98

... price equal to the fair market value of our common stock on the grant date and have a contractual term of ten years. Our 1999 Stock Option Plan for Seasonal Employees provides for awards of nonqualified options to certain employees. These awards are granted to seasonal employees in our Tax Services... -

Page 99

... following assumptions were used to value options during the periods: Year Ended April 30, Options - management and director: Expected volatility Expected term Dividend yield Risk-free interest rate Weighted average fair value Options - seasonal: Expected volatility Expected term Dividend yield Risk... -

Page 100

...of the surviving or purchasing company having a market value equal to twice the exercise price of the Right. After an Unapproved Stock Acquisition, but before any person or group of persons acquires 50% or more of the outstanding shares of our Common Stock, the Board of Directors may exchange all or... -

Page 101

... of such earnings. Moreover, due to the availability of foreign income tax credits, management believes the amount of federal income taxes would be immaterial in the event foreign earnings were repatriated. The loss from discontinued operations for fiscal year 2007 of $808.0 million is net of... -

Page 102

... charter-approval order through fiscal year 2009. This condition was extended through fiscal year 2012 as a result of a Supervisory Directive issued on May 29, 2007. See further discussion of the Supervisory Directive below. As of April 30, 2007, our fiscal year end, HRB Bank's leverage ratio was 11... -

Page 103

... to tax return preparation error for which we are responsible. We defer all revenues than projected in the preliminary revised capital plan for the period May 2007 through April 2009; (3) institutes reporting requirements to the OTS quarterly and monthly by the Board of Directors and management... -

Page 104

..., 2007 there were no balances outstanding on these letters of credit. During fiscal year 2006, we entered into a transaction with the City of Kansas City, Missouri, to provide us with sales and property tax savings on the furniture, fixtures and equipment for our new corporate headquarters facility... -

Page 105

... class. The plaintiff is seeking further review by the appellate court. The People of California v. H&R Block, Inc., H&R Block Services, Inc., H&R Block Enterprises, Inc., H&R Block Tax Services, Inc., Block Financial Corporation, HRB Royalty, Inc., and Does 1 through 50, 77 m H&R BLOCK 2007 Form... -

Page 106

... consolidated financial statements. EXPRESS IRA LITIGATION - On March 15, 2006, the New York Attorney General filed a lawsuit in the Supreme Court of the State of New York, County of New York (Index No. 06/401110) entitled The People of New York v. H&R Block, Inc. and H&R Block Financial Advisors... -

Page 107

...of business previously reported in our Business Services segment, as well as our tax operations attorneys general, other state regulators, individual plaintiffs, and cases in which plaintiffs seek to represent a class of similarly situated customers. The amounts claimed in these claims and lawsuits... -

Page 108

... of the transaction. The financial results included in discontinued operations are as follows: (in 000s) Year Ended April 30, Revenue: Gains on sales of mortgage assets, net Interest income Loan servicing revenue Other Income (loss) from operations before income tax (benefit) Impairment of assets... -

Page 109

...34,107) (1,583) (38,300) $ 159,058 Year Ended April 30, Residual interests mark-to-market Additions to AFS residual interests $ 2007 13,832 127,580 $ 2006 35,274 61,651 Prime mortgage loans are sold in loan sales, servicing released, to third-party buyers. We sold $27.5 billion and $40.3 billion... -

Page 110

... residual interests are as follows: 2007 Estimated credit losses Discount rate Variable returns to third-party beneficial interest holders 5.09% 24.79% 2006 2.55% 25.00% 2005 2.72% 25.00% LIBOR forward curve at closing date The key assumptions we used to estimate the cash flows and values of our... -

Page 111

... to fund fixed-rate prime loans. The position on certain or all of the fixed-rate mortgage loans is closed approximately 10-15 days prior to standard Public Securities Association (PSA) settlement dates. None of our derivative instruments qualify for hedge accounting treatment as of April 30, 2007... -

Page 112

...liabilities held for sale in the consolidated balance sheets. Under the warehouse agreements, we may be required to provide funds in the event of declining loan values, but only to the extent of the 10% guaranteed amount. Funds provided as a result of declining loan values at April 30, 2007 and 2006... -

Page 113

... to fund loans using its off-balance sheet financing facilities. At our current origination levels, we estimate we would only need waivers for between $3.0 billion and $4.0 billion of available capacity at any given time. However, the sale of OOMC is subject to various closing conditions, including... -

Page 114

... planning and related financial advice through HRBFA and full-service banking through HRB Bank. HRB Bank offers traditional banking services, including checking and savings accounts, home equity lines of credit, individual retirement accounts, certificates of deposit and prepaid debit card accounts... -

Page 115

(in 000s) (in 000s) Year Ended April 30, REVENUES - Tax Services Business Services Consumer Financial Services Corporate INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE TAXES - Tax Services Business Services Consumer Financial Services Corporate 2007 $ 2,685,858 932,361 388,090 14,965 $ 4,021,274... -

Page 116

... using the equity method of accounting. Income of subsidiaries is, therefore, reflected in our investment in subsidiaries account. The elimination entries eliminate investments in subsidiaries, related stockholder's equity and other intercompany balances and transactions. H&R BLOCK 2007 Form 10K -

Page 117

...S (in 000s) Year Ended April 30, 2007 Revenues Expenses: Cost of service revenues Cost of other revenues Selling, general and administrative Operating income Interest expense Other income, net Income from continuing operations before taxes Income taxes Net income from continuing operations Net loss... -

Page 118

... Total assets Commercial paper and other, short-term borrowings Customer deposits Accounts payable to customers, brokers and dealers Long-term debt Liabilities held for sale Other liabilities Net intercompany advances Stockholders' equity Total liabilities and stockholders' equity H&R Block, Inc... -

Page 119

... from other short-term borrowings Customer banking deposits Repayments of Senior Notes Dividends paid Acquisition of treasury shares Proceeds from issuance of common stock Excess tax benefits on stock-based compensation Net intercompany advances Financing cash flows of discontinued operations Other... -

Page 120

... business acquisitions Net intercompany advances Investing cash flows of discontinued operations Other, net Net cash provided by (used in) investing activities Cash flows from financing activities: Repayments of short-term debt Proceeds from issuance of short-term debt Repayments of lines of credit... -

Page 121

... registered public accounting firm, have issued an audit report on our assessment of the Company's internal control over financial reporting. This report appears near the beginning of Item 8. (c) CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING - During the quarter ended April 30, 2007, there... -

Page 122

... conduct that applies to our directors, officers and employees, including our chief executive officer, chief financial officer, principal accounting officer and persons performing similar functions. A copy of the code of business ethics and conduct is available on our website at www.hrblock.com. We... -

Page 123

...between HRB Management, Inc. and Carol Graebner. Bridge Credit and Guarantee Agreement dated as of April 16, 2007 among Block Financial Corporation, H&R Block, Inc., the lenders party thereto, and HSBC Bank USA National Association. Supplemental Indenture Number One dated as of April 27, 2007 to the... -

Page 124

.... 32.2 Certification by Chief Financial Officer pursuant to 18 U.S.C. 1350, as adopted by Section 906 of the Sarbanes-Oxley Act of 2002. The exhibits will be filed with the SEC but will not be included in the printed version of the Annual Report to Shareholders. 10.78 m 96 H&R BLOCK 2007 Form 10K -

Page 125

... Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated on June 29, 2007. Mark A. Ernst Chairman of the Board, President, Chief Executive Officer and Director (principal executive officer) Roger W. Hale... -

Page 126

.... 10.8* Form of 1989 Stock Option Plan for Outside Directors Stock Option Agreement, filed as Exhibit 10.9 to the Company's annual report on Form 10-K for the year ended April 30, 2005, file number 1-6089, is incorporated by reference. 10.9* The H&R Block Stock Plan for Non-Employee Directors, as... -

Page 127

....28 HSBC Digital Settlement Products Distribution Agreement dated as of September 23, 2005, among HSBC Bank USA, National Association, HSBC Taxpayer Financial Services Inc., H&R Block Digital Tax Solutions, LLC, and H&R Block Services, Inc., filed as Exhibit 10.15 to the quarterly report on Form 10... -

Page 128

...10.42 Stock Purchase Agreement by and between H&R Block, Inc., Block Financial Corporation and OOMC Acquisition Corp., filed as Exhibit 10.1 to the Company's current report on Form 8-K dated April 19, 2007, file number 1-6089, is incorporated by reference. 10.43 Sale and Servicing Agreement dated as... -

Page 129

..., National Association, filed as Exhibit 10.40 to the Company's annual report on Form 10-K for the year ended April 30, 2005, file number 1-6089, is incorporated by reference. 10.60 Amendment No. 1 to Second Amended and Restated Sale and Servicing Agreement dated March 8, 2005 among Option One Owner... -

Page 130

..., Option One Owner Trust 2002-3 and UBS Real Estate Securities Inc., filed as Exhibit 10.7 to the Company's quarterly report on Form 10-Q for the quarter ended January 31, 2007, file number, 1-6089, is incorporated by reference. 10.77 Second Amended and Restated Sale and Servicing Agreement dated as... -

Page 131

...Note Purchase Agreement dated as of January 1, 2007, among Option One Loan Warehouse Corporation, Option One Owner Trust 2007-5A and Citigroup Global Markets Realty Corp., filed as Exhibit 10.23 to the Company's quarterly report on Form 10-Q for the quarter ended January 31, 2007, file number 1-6089... -

Page 132

... charge to our shareholders a copy of our 2007 Form 10-K as ï¬led with the Securities and Exchange Commission. Requests should be directed by telephone to Investor Relations, 1-800-869-9220, option 8, or by mail to One H&R Block Way, Kansas City, Missouri 64105. For more information about H&R Block... -

Page 133

H&R BLOCK H&R Block Inc. One H&R Block Way Kansas City, MO 64105 816.854.3000 www.hrblock.com