Green Dot 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Green Dot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

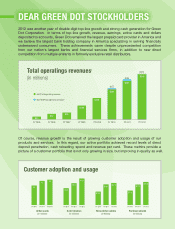

FY 2005

CY 2010 CY 2011 CY 2012 CY 2010 CY 2011 CY 2012 CY 2010 CY 2011 CY 2012 CY 2010 CY 2011 CY 2012

GAAP total operating revenues

Non-GAAP total operating revenues2

$34

3.4

26.5

34.3

41.8

$10.4

$16.1 $17.2

$7.8

$11.1

$12.6

4.2 4.4

$67 $84

$168

$259

$364

$467

$546

FY 2006 FY 2007 FY 2008 CY 2009 CY 2010

$377

$485

$555

CY 2011 CY 2012

Total operatings revenues1

(In millions)

Customer adoption and usage

Active cards

(In millions)

Cash transfers

(In millions)

Gross dollar volume

(In billions)

Purchase volume

(In billions)

• We successfully integrated the acquisition of Green Dot Bank, giving us the ability to more

effectively roll out new banking products, realize cost efciencies by not having to pay a

third party bank, generate new revenue streams in the form of interest income on

outstanding balances held at our bank and achieve a level of regulatory sustainability that

we believe is key to the long term success of any large-scale prepaid card provider.

• We successfully completed the integration of Loopt, delivering what we believe to be the

most advanced mobile banking technology capabilities of any bank in America. The recent

beta launch of GoBank is an example of that. We believe GoBank serves a new segment

of customers compared to those we have reached with our prepaid products, and it

provides us with an opportunity to develop new sales channels that would not have been

available to our prepaid products.

• We successfully renewed all retailer agreements that were set to expire in 2012 for

multi-year terms.

We have included in this letter “forward-looking statements,” which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of

1995. Words such as “will,” “expect,” “believe” and similar expressions are used to identify these forward-looking statements. For example, statements

regarding the key strategic benets that Green Dot expects from becoming a bank holding company are all forward-looking statements. These statements are

not guarantees of future performance and involve risks, uncertainties and assumptions that are difcult to predict. Forward-looking statements are based upon

assumptions as to future events that may not prove to be accurate. Actual outcomes and results may differ materially from what is expressed or forecast in these

forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not

limited to, the factors discussed in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available on Green Dot’s investor relations

website at ir.greendot.com and on the SEC website at www.sec.gov . All information provided in this letter speaks only as of the date of this, and Green Dot

assumes no obligation to update this information as a result of future events or developments.

DEAR GREEN DOT STOCKHOLDERS

While uncertainties and challenges still remain in the near term business outlook for Green Dot

as a result of the new competitive environment and the impact of new risk controls, Green Dot

not only experienced a solid 2012, but more importantly, succeeded in completing its strategic

goals for the year and established the opportunity for expanded growth heading into the future.

Here’s to a prosperous 2013,

Steven W. Streit

Chairman, President and Chief Executive Ofcer

2012 was another year of double-digit top-line growth and strong cash generation for Green

Dot Corporation. In terms of top-line growth, revenue, earnings, active cards and dollars

deposited to accounts, Green Dot remained the largest prepaid card provider in America and

we believe the largest bank holding company in America specializing in serving nancially

underserved consumers. These achievements came despite unprecedented competition

from our nation's largest banks and nancial services rms, in addition to new direct

competition from multiple entrants in formerly exclusive retail distributors.

Of course, revenue growth is the result of growing customer adoption and usage of our

products and services. In this regard, our active portfolio achieved record levels of direct

deposit penetration, cash reloading, spend and revenue per card. These metrics provide a

picture of a customer portfolio that is not only growing in size, but improving in quality as well.