Green Dot 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Green Dot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our consolidated nancial statements are prepared in accordance with accounting principles generally

accepted in the United States of America (GAAP). To supplement these nancial statements, we use measures

of operating results that are adjusted to exclude, among other things, stock-based retailer incentive

compensation expense. The letter to stockholders contained in this annual report (the stockholder letter)

includes non-GAAP total operating revenues. This non-GAAP nancial measure is not calculated or presented

in accordance with, and is not an alternative or substitute for, a nancial measure prepared in accordance with

GAAP, and should be read only in conjunction with our nancial measure prepared in accordance with GAAP.

Our non-GAAP nancial measures may be different from similarly-titled non-GAAP nancial measures used by

other companies.

We believe that the presentation of non-GAAP nancial measures provide useful information to management

and investors regarding underlying trends in our consolidated nancial condition and results of operations. We

also believe that the non-GAAP nancial measure contained in the stockholder letter is useful to investors in

evaluating our operating performance for the following reason:

• Stock-based retailer incentive compensation is a non-cash GAAP accounting charge that is an offset to our

actual revenues from operations as we have historically calculated them. This charge results from the

monthly lapsing of our right to repurchase a portion of the 2,208,552 shares we issued to our largest retail

distributor, Walmart, in May 2010. By adding back this charge to our GAAP 2010 and future total operating

revenues, investors can make direct comparisons of our revenues from operations prior to and after May

2010 and thus more easily perceive trends in our core operations. Further, because the monthly charge is

based on the then-current fair market value of the shares as to which our repurchase right lapses, adding

back this charge eliminates uctuations in our operating revenues caused by variations in our month-end

stock prices and thus provides insight on the operating revenues directly associated with those core

operations.

Our management regularly uses this supplemental non-GAAP nancial measure internally to understand,

manage and evaluate our business and make operating decisions. For additional information regarding our use

of non-GAAP nancial measures and the items excluded by us from one or more of our non-GAAP nancial

measures, investors are encouraged to review the reconciliations of our non-GAAP nancial measures to the

comparable GAAP nancial measures, which can be found by clicking on "Financial Information" in the Investor

Relations section of our website at ir.greendot.com.

(Unaudited)

$ 546,285

8,251

$ 554,536

$ 467,398

17,3 37

$ 484,735

$ 363,888

13,369

$ 377,257

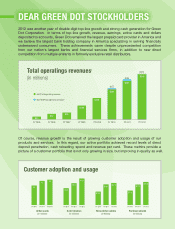

Total operating revenues

Stock-based retailer incentive compensation *

Non-GAAP total operating revenues

* We do not include any income tax impact of the associated non-GAAP adjustment to non-GAAP total operating revenues because this non-GAAP nancial

measure is provided before income tax expense.

(In thousands)